Citibank 2008 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

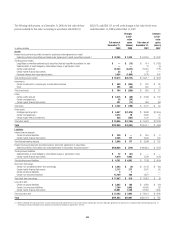

The Company has elected the fair-value option where the interest-rate risk of

such liabilities is economically hedged with derivative contracts or the

proceeds are used to purchase financial assets that will also be accounted for

at fair value through earnings. The election has been made to mitigate

accounting mismatches and to achieve operational simplifications. These

positions are reported in Short-term borrowings and Long-term debt on the

Company’s Consolidated Balance Sheet.

The majority of these non-structured liabilities are a result of the

Company’s election of the fair-value option for liabilities associated with the

Citi-advised Structured Investment Vehicles (SIVs), which were consolidated

during the fourth quarter of 2007. The change in fair values of the SIVs’

liabilities reported in earnings was $2.6 billion for the year ended

December 31, 2008. For these non-structured liabilities the aggregate fair

value is $263 million lower than the aggregate unpaid principal balance as

of December 31, 2008.

For all other non-structured liabilities classified as Long-term debt for

which the fair-value option has been elected, the aggregate unpaid principal

balance exceeds the aggregate fair value of such instruments by $97 million

as of December 31, 2008 while the aggregate fair value exceeded the

aggregate unpaid principal by $112 million as of December 31, 2007. The

change in fair value of these non-structured liabilities reported a gain of $1.2

billion for the year ended December 31, 2008.

The change in fair value for these non-structured liabilities is reported in

Principal transactions in the Company’s Consolidated Statement of

Income.

Related interest expense continues to be measured based on the contractual

interest rates and reported as such in the Consolidated Income Statement.

Certain mortgage loans

Citigroup has elected the fair-value option for certain purchased and originated

prime fixed-rate and conforming adjustable-rate first mortgage loans held-for-

sale. These loans are intended for sale or securitization and are hedged with

derivative instruments. The Company has elected the fair-value option to

mitigate accounting mismatches in cases where hedge accounting is complex

and to achieve operational simplifications. The fair-value option was not

elected for loans held-for-investment, as those loans are not hedged with

derivative instruments. This election was effective for applicable instruments

originated or purchased on or after September 1, 2007.

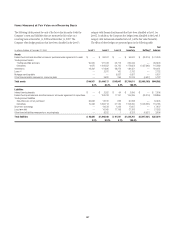

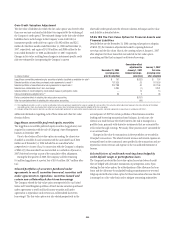

The following table provides information about certain mortgage loans

carried at fair value:

In millions of dollars

December 31,

2008

December 31,

2007

Carrying amount reported on the Consolidated

Balance Sheet $4,273 $6,392

Aggregate fair value in excess of unpaid principal

balance $ 138 $ 136

Balance on non-accrual loans or loans more than

90 days past due $9 $17

Aggregate unpaid principal balance in excess of fair

value for non-accrual loans or loans more than

90 days past due $2 $—

The changes in fair values of these mortgage loans is reported in Other

revenue in the Company’s Consolidated Statement of Income. The changes

in fair value during the year ended December 31, 2008 due to instrument-

specific credit risk resulted in a $32 million loss. The change in fair value

during 2007 due to instrument-specific credit risk was immaterial. Related

interest income continues to be measured based on the contractual interest

rates and reported as such in the Consolidated Income Statement.

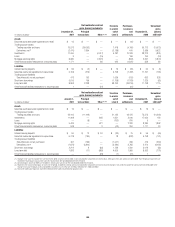

Items selected for fair-value accounting in accordance

with SFAS 155 and SFAS 156

Certain hybrid financial instruments

The Company has elected to apply fair-value accounting under SFAS 155 for

certain hybrid financial assets and liabilities whose performance is linked to

risks other than interest rate, foreign exchange or inflation (e.g., equity,

credit or commodity risks). In addition, the Company has elected fair-value

accounting under SFAS 155 for residual interests retained from securitizing

certain financial assets.

The Company has elected fair-value accounting for these instruments

because these exposures are considered to be trading-related positions and,

therefore, are managed on a fair-value basis. In addition, the accounting for

these instruments is simplified under a fair-value approach as it eliminates

the complicated operational requirements of bifurcating the embedded

derivatives from the host contracts and accounting for each separately. The

hybrid financial instruments are classified as Trading account assets,

Loans,Deposits,Trading account liabilities (for prepaid derivatives),

Short-term borrowings or Long-Term Debt on the Company’s Consolidated

Balance Sheet according to their legal form, while residual interests in

certain securitizations are classified as Trading account assets.

For hybrid financial instruments for which fair-value accounting has

been elected under SFAS 155 and that are classified as Long-term debt, the

aggregate unpaid principal exceeds the aggregate fair value by $1.9 billion

as of December 31, 2008, while the aggregate fair value exceeds the

aggregate unpaid principal balance by $460 million as of December 31,

2007. The difference for those instruments classified as Loans is immaterial.

Changes in fair value for hybrid financial instruments, which in most

cases includes a component for accrued interest, are recorded in Principal

transactions in the Company’s Consolidated Statement of Income. Interest

accruals for certain hybrid instruments classified as trading assets are

recorded separately from the change in fair value as Interest revenue in the

Company’s Consolidated Statement of Income.

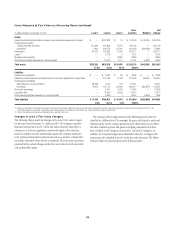

Mortgage servicing rights

The Company accounts for mortgage servicing rights (MSRs) at fair value in

accordance with SFAS 156. Fair value for MSRs is determined using an

option-adjusted spread valuation approach. This approach consists of

projecting servicing cash flows under multiple interest-rate scenarios and

discounting these cash flows using risk-adjusted rates. The model

assumptions used in the valuation of MSRs include mortgage prepayment

speeds and discount rates. The fair value of MSRs is primarily affected by

changes in prepayments that result from shifts in mortgage interest rates. In

managing this risk, the Company hedges a significant portion of the values

of its MSRs through the use of interest-rate derivative contracts, forward-

purchase commitments of mortgage-backed securities, and purchased

securities classified as trading. See Note 23 on page 175 for further

discussions regarding the accounting and reporting of MSRs.

These MSRs, which totaled $5.7 billion and $8.4 billion as of

December 31, 2008 and December 31, 2007, respectively, are classified as

Mortgage servicing rights on Citigroup’s Consolidated Balance Sheet.

Changes in fair value of MSRs are recorded in Commissions and fees in the

Company’s Consolidated Statement of Income.

206