Citibank 2008 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

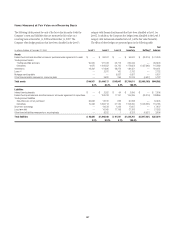

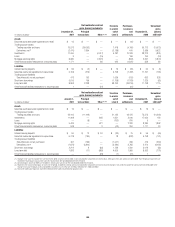

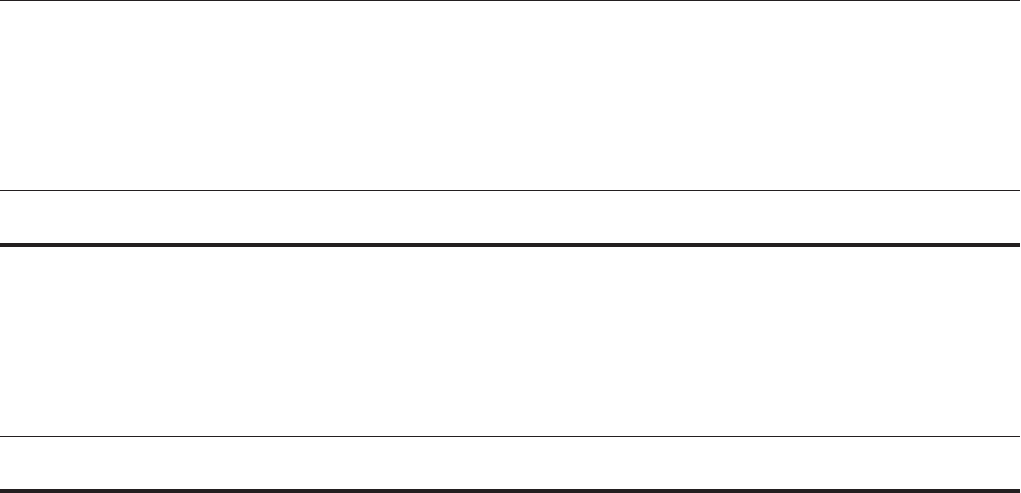

Items Measured at Fair Value on a Recurring Basis (continued)

In millions of dollars at December 31, 2007 Level 1 Level 2 Level 3

Gross

inventory Netting(1)

Net

balance

Assets

Federal funds sold and securities borrowed or purchased under agreements to resell $ — $132,383 $ 16 $ 132,399 $ (48,094) $ 84,305

Trading account assets

Trading securities and loans 151,684 234,846 75,573 462,103 — 462,103

Derivatives 7,204 428,779 31,226 467,209 (390,328) 76,881

Investments 64,375 125,282 17,060 206,717 — 206,717

Loans (2) — 3,718 9 3,727 — 3,727

Mortgage servicing rights — — 8,380 8,380 — 8,380

Other financial assets measured on a recurring basis — 13,570 1,171 14,741 (4,939) 9,802

Total assets $223,263 $938,578 $133,435 $1,295,276 $(443,361) $851,915

17.2% 72.5% 10.3% 100.0%

Liabilities

Interest-bearing deposits $ — $ 3,542 $ 56 $ 3,598 $ — $ 3,598

Federal funds purchased and securities loaned or sold under agreements to repurchase — 241,790 6,158 247,948 (48,094) 199,854

Trading account liabilities

Securities sold, not yet purchased 68,928 9,140 473 78,541 — 78,541

Derivatives 8,602 447,119 33,696 489,417 (385,876) 103,541

Short-term borrowings — 8,471 5,016 13,487 — 13,487

Long-term debt — 70,359 8,953 79,312 — 79,312

Other financial liabilities measured on a recurring basis — 6,506 1 6,507 (4,939) 1,568

Total liabilities $ 77,530 $786,927 $ 54,353 $ 918,810 $(438,909) $479,901

8.4% 85.7% 5.9% 100.0%

(1) Represents netting of: (i) the amounts due under securities purchased under agreements to resell and the amounts owed under securities sold under agreements to repurchase in accordance with FIN 41, and

(ii) derivative exposures covered by a qualifying master netting agreement in accordance with FIN 39, cash collateral and the market value adjustment.

(2) There is no allowance for loan losses recorded for loans reported at fair value.

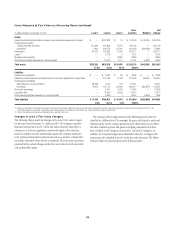

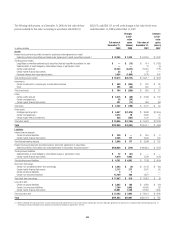

Changes in Level 3 Fair-Value Category

The following tables present the changes in the Level 3 fair-value category

for the years ended December 31, 2008 and 2007. The Company classifies

financial instruments in Level 3 of the fair-value hierarchy when there is

reliance on at least one significant unobservable input to the valuation

model. In addition to these unobservable inputs, the valuation models for

Level 3 financial instruments typically also rely on a number of inputs that

are readily observable either directly or indirectly. Thus, the gains and losses

presented below include changes in the fair value related to both observable

and unobservable inputs.

The Company often hedges positions with offsetting positions that are

classified in a different level. For example, the gains and losses for assets and

liabilities in the Level 3 category presented in the tables below do not reflect

the effect of offsetting losses and gains on hedging instruments that have

been classified by the Company in the Level 1 and Level 2 categories. In

addition, the Company hedges items classified in the Level 3 category with

instruments also classified in Level 3 of the fair-value hierarchy. The effects

of these hedges are presented gross in the following tables.

198