Citibank 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sources of Liquidity

Primary sources of liquidity for Citigroup and its principal subsidiaries

include:

• deposits;

• collateralized financing transactions;

• senior and subordinated debt;

• commercial paper;

• trust preferred and preferred securities; and

• purchased/wholesale funds.

Citigroup’s funding sources are diversified across funding types and

geography, a benefit of its global franchise. Funding for Citigroup and its

major operating subsidiaries includes a geographically diverse retail and

corporate deposit base of $774.2 billion. These deposits are diversified across

products and regions, with approximately two-thirds of them outside of the

U.S. This diversification provides the Company with an important, stable and

low-cost source of funding. A significant portion of these deposits has been,

and is expected to be, long-term and stable, and are considered to be core.

There are qualitative as well as quantitative assessments that determine the

Company’s calculation of core deposits. The first step in this process is a

qualitative assessment of the deposits. For example, as a result of the Company’s

qualitative analysis certain deposits with wholesale funding characteristics are

excluded from consideration as core. Deposits that qualify under the Company’s

qualitative assessments are then subjected to quantitative analysis.

Excluding the impact of changes in foreign exchange rates and the sale

of our retail banking operations in Germany during the year ending

December 31, 2008, the Company’s deposit base remained stable. On a

volume basis, deposit increases were noted in Transaction Services, U.S.

Retail Banking and Smith Barney. This was partially offset by the Company’s

decision to reduce deposits considered wholesale funding, consistent with the

Company’s de-leveraging efforts, and declines in International Consumer

Banking and the Private Bank.

Citigroup and its subsidiaries have historically had a significant presence

in the global capital markets. The Company’s capital markets funding

activities have been primarily undertaken by two legal entities: (i) Citigroup

Inc., which issues long-term debt, medium-term notes, trust preferred

securities, and preferred and common stock; and (ii) Citigroup Funding Inc.

(CFI), a first-tier subsidiary of Citigroup, which issues commercial paper,

medium-term notes and structured equity-linked and credit-linked notes, all

of which are guaranteed by Citigroup. Other significant elements of long-

term debt on the Consolidated Balance Sheet include collateralized advances

from the Federal Home Loan Bank system, long-term debt related to the

consolidation of ICG’s Structured Investment Vehicles, asset-backed

outstandings, and certain borrowings of foreign subsidiaries.

Each of Citigroup’s major operating subsidiaries finances its operations

on a basis consistent with its capitalization, regulatory structure and the

environment in which it operates. Particular attention is paid to those

businesses that for tax, sovereign risk, or regulatory reasons cannot be freely

and readily funded in the international markets.

Citigroup’s borrowings have historically been diversified by geography,

investor, instrument and currency. Decisions regarding the ultimate

currency and interest rate profile of liquidity generated through these

borrowings can be separated from the actual issuance through the use of

derivative instruments.

Citigroup is a provider of liquidity facilities to the commercial paper

programs of the two primary Credit Card securitization trusts with which it

transacts. Citigroup may also provide other types of support to the trusts. As a

result of the recent economic downturn, its impact on the cashflows of the

trusts, and in response to credit rating agency reviews of the trusts, the

Company increased the credit enhancement in the Omni Trust, and plans to

provide additional enhancement to the Master Trust (see Note 23 to

Consolidated Financial Statements on page 175 for a further discussion).

This support preserves investor sponsorship of our card securitization

franchise, an important source of liquidity.

Banking Subsidiaries

There are various legal limitations on the ability of Citigroup’s subsidiary

depository institutions to extend credit, pay dividends or otherwise supply

funds to Citigroup and its non-bank subsidiaries. The approval of the Office

of the Comptroller of the Currency, in the case of national banks, or the

Office of Thrift Supervision, in the case of federal savings banks, is required if

total dividends declared in any calendar year exceed amounts specified by

the applicable agency’s regulations. State-chartered depository institutions

are subject to dividend limitations imposed by applicable state law.

In determining the declaration of dividends, each depository institution

must also consider its effect on applicable risk-based capital and leverage

ratio requirements, as well as policy statements of the federal regulatory

agencies that indicate that banking organizations should generally pay

dividends out of current operating earnings.

Non-Banking Subsidiaries

Citigroup also receives dividends from its non-bank subsidiaries. These

non-bank subsidiaries are generally not subject to regulatory restrictions on

dividends. However, as discussed in “Capital Resources and Liquidity” on

page 94, the ability of CGMHI to declare dividends can be restricted by capital

considerations of its broker-dealer subsidiaries.

CGMHI’s consolidated balance sheet is liquid, with the vast majority of its

assets consisting of marketable securities and collateralized short-term

financing agreements arising from securities transactions. CGMHI monitors

and evaluates the adequacy of its capital and borrowing base on a daily basis

to maintain liquidity and to ensure that its capital base supports the

regulatory capital requirements of its subsidiaries.

Some of Citigroup’s non-bank subsidiaries, including CGMHI, have credit

facilities with Citigroup’s subsidiary depository institutions, including Citibank,

N.A. Borrowings under these facilities must be secured in accordance with

Section 23A of the Federal Reserve Act. There are various legal restrictions on

the extent to which a bank holding company and certain of its non-bank

subsidiaries can borrow or obtain credit from Citigroup’s subsidiary depository

institutions or engage in certain other transactions with them. In general, these

restrictions require that transactions be on arm’s length terms and be secured

by designated amounts of specified collateral. See Note 20 to the Consolidated

Financial Statements on page 169.

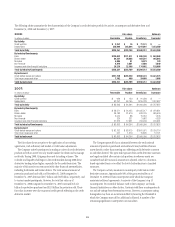

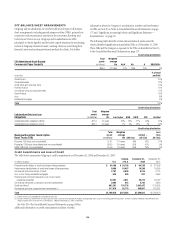

At December 31, 2008, long-term debt and commercial paper outstanding

for Citigroup, CGMHI, CFI and Citigroup’s subsidiaries were as follows:

In billions of dollars

Citigroup

parent

company CGMHI (2)

Citigroup

Funding

Inc. (2)

Other

Citigroup

subsidiaries

Long-term debt $192.3 $20.6 $37.4 $109.3 (1)

Commercial paper $ — $ — $28.6 $ 0.5

(1) At December 31, 2008, approximately $67.4 billion relates to collateralized advances from the Federal

Home Loan Bank.

(2) Citigroup Inc. guarantees all of CFI’s debt and CGMHI’s publicly issued securities.

99