Citibank 2008 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Banking). The results of the first step of the impairment test showed no

indication of impairment in any of the reporting units at any of the periods

except December 31, 2008 and, accordingly, the Company did not perform

the second step of the impairment test, except for the test performed as of

December 31, 2008. As of December 31, 2008, there was an indication of

impairment in the North America Consumer Banking,Latin America

Consumer Banking and EMEA Consumer Banking reporting units and,

accordingly, the second step of testing was performed on these reporting

units.

Based on the results of the second step of testing, the Company recorded a

$9.6 billion pretax ($8.7 billion after tax) goodwill impairment charge in the

fourth quarter of 2008, representing the entire amount of goodwill allocated

to these reporting units. The primary cause for the goodwill impairment in

the above reporting units was the rapid deterioration in the financial

markets, as well as in the global economic outlook particularly during the

period beginning mid-November through year end 2008. This deterioration

further weakened the near-term prospects for the financial services industry.

These and other factors, including the increased possibility of further

government intervention, also resulted in the decline in the Company’s

market capitalization from approximately $90 billion at July 1, 2008 and

approximately $74 billion at October 31, 2008 to approximately $36 billion

at December 31, 2008.

The more significant fair-value adjustments in the pro forma purchase

price allocation in the second step of testing were to fair-value loans and debt

and were made to identify and value identifiable intangibles. The

adjustments to measure the assets, liabilities and intangibles were for the

purpose of measuring the implied fair value of goodwill and such

adjustments are not reflected in the Consolidated Balance Sheet.

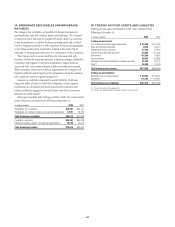

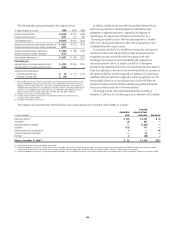

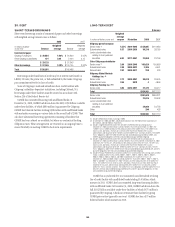

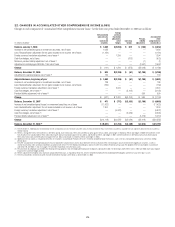

The following table shows reporting units with goodwill balances and the

excess of fair value of allocated book value as of December 31, 2008.

Reporting Unit

($ in millions)

Fair Value as a % of

Allocated Book Value

Goodwill

(post-impairment)

North America Cards 139% 6,765

International Cards 218% 4,066

Asia Consumer Banking 293% 3,106

Securities & Banking 109% 9,774

Global Transaction Services 994% 1,570

North America GWM 386% 1,259

International GWM 171% 592

While no impairment was noted in step one of our Securities and

Banking reporting unit impairment test at October 31, 2008 and

December 31, 2008, goodwill present in that reporting unit may be

particularly sensitive to further deterioration in economic conditions. Under

the market approach for valuing this reporting unit, the earnings multiples

and transaction multiples were selected from multiples obtained using data

from guideline companies and acquisitions. The selection of the actual

multiple considers operating performance and financial condition such as

return on equity and net income growth of Securities and Banking as

compared to the guideline companies and acquisitions. For the valuation

under the income approach, the Company utilized a discount rate which it

believes reflects the risk and uncertainty related to the projected cash flows,

and selected 2013 as the terminal year. In 2013, the value was derived

assuming a return to historical levels of core-business profitability for the

reporting unit, despite the significant losses experienced in 2008. This

assumption is based on management’s view that this recovery will occur

based upon various macro- economic factors such as the recent U.S.

government stimulus actions, restoring marketplace confidence and

improved risk-management practices on an industry-wide basis.

Furthermore, Company-specific actions such as its recently announced

realignment of its businesses to optimize its global businesses for future

profitable growth, will also be a factor in returning the Company’s core

Securities and Banking business to historical levels.

Small deterioration in the assumptions used in the valuations, in

particular the discount rate and growth rate assumptions used in the net

income projections, could significantly affect the Company’s impairment

evaluation and, hence, results. If the future were to differ adversely from

management’s best estimate of key economic assumptions and associated

cash flows were to decrease by a small margin, the Company could

potentially experience future material impairment charges with respect to

the goodwill remaining in our Securities and Banking reporting unit. Any

such charges by themselves would not negatively affect the Company’s Tier 1

and Total Regulatory Capital Ratios, Tangible Capital or the Company’s

liquidity position.

167