Citibank 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.EVENTS IN 2008

Certain significant events during 2008 had, or could have, an effect on

Citigroup’s current and future financial condition, results of operations,

liquidity and capital resources. These events are summarized below and

discussed in more detail throughout this MD&A.

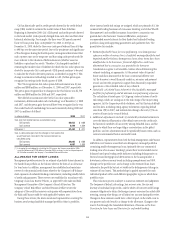

TARP AND OTHER REGULATORY PROGRAMS

Issuance of $25 Billion of Perpetual Preferred Stock and a

Warrant to Purchase Common Stock under TARP

On October 28, 2008, Citigroup raised $25 billion through the sale of

non-voting perpetual, cumulative preferred stock and a warrant to purchase

common stock to the UST as part of the UST Troubled Asset Relief Program

(TARP) Capital Purchase Program. All of the proceeds were treated as Tier 1

Capital for regulatory purposes.

Additional Issuance of $20 Billion of Perpetual Preferred

Stock and a Warrant to Purchase Common Stock under

TARP

On December 31, 2008, related to the U.S. Government Loss-Sharing

Agreement described below, Citigroup raised an additional $20 billion

through the sale of non-voting perpetual, cumulative preferred stock and a

warrant to purchase common stock to the UST as part of TARP. All of the

proceeds were treated as Tier 1 Capital for regulatory purposes.

U.S. Government Loss-Sharing Agreement

On January 15, 2009, Citigroup entered into a definitive agreement providing

for loss sharing by the UST, FDIC and the Federal Reserve Bank of New York

on a $301 billion portfolio of Citigroup assets (valued as of November 21,

2008). In consideration for this loss-sharing agreement, Citigroup issued

$7.3 billion of non-voting perpetual, cumulative preferred stock and a

warrant to purchase common stock to the UST and the FDIC. Of the

issuance, $3.5 billion will be treated as Tier 1 Capital for regulatory purposes.

Use of TARP Proceeds

Citigroup has established a formal process for its use of the TARP proceeds

which is directed by senior executives and emphasizes expanding the flow of

credit and strengthening the financial system in the United States, consistent

with the objectives of TARP. Citigroup’s first quarterly progress report

regarding its implementation and management of TARP was issued on

February 3, 2009. See “TARP and Other Regulatory Programs” on page 44.

FDIC’s Temporary Liquidity Guarantee Program

Under the terms of the FDIC’s guarantee program, the FDIC will guarantee,

until the earlier of its maturity or June 30, 2012, certain qualifying senior

unsecured debt issued by certain Citigroup entities between October 14, 2008

and June 30, 2009 (proposed to be extended to October 30, 2009), in

amounts up to 125% of the qualifying debt for each qualifying entity. The

FDIC will charge Citigroup a fee ranging from 50 to 100 basis points in

accordance with a prescribed fee schedule for any new qualifying debt issued

with the FDIC guarantee. At December 31, 2008, Citigroup had issued $5.75

billion of long-term debt that is covered under the FDIC guarantee, with

$1.25 billion maturing in 2010 and $4.5 billion maturing in 2011. In

January and February 2009, Citigroup and its affiliates issued an additional

$14.9 billion in senior unsecured debt under this program.

In addition, Citigroup, through its subsidiaries, also had $26.0 billion in

commercial paper and interbank deposits backed by the FDIC outstanding as

of December 31, 2008. FDIC guarantees of commercial paper (and interbank

deposits) cease to be available after June 30, 2009 (proposed to be extended

to October 30, 2009), and the FDIC charges a fee ranging from 50 to 100

basis points in connection with the issuance of those instruments.

Lowering of Quarterly Dividend to $0.01 Per Share

In accordance with various TARP programs, commencing in 2009, Citigroup

has agreed not to pay common stock dividends in excess of $0.01 per share

per quarter for three years without the consent of the UST, FDIC and the

Federal Reserve Bank of New York.

On January 20, 2009, Citigroup declared a $0.01 quarterly dividend on the

Company’s common stock. This dividend was paid on February 22, 2009 to

stockholders of record on February 2, 2009.

For additional details on each of these programs, see “TARP and Other

Regulatory Programs” beginning on page 44 for further discussion.

PRIVATE AND PUBLIC ISSUANCES OF PREFERRED

AND COMMON STOCK

During the first quarter of 2008, Citigroup issued $12.5 billion of 7%

convertible preferred stock in a private offering, $3.2 billion of 6.5%

convertible preferred stock in public offerings, and $3.715 billion of 8.125%

non-convertible preferred stock in public offerings.

In the second quarter of 2008, Citigroup raised $8.0 billion of capital

through public offerings of non-convertible preferred stock and issued

approximately $4.9 billion of common stock.

In total, the Company raised $32.3 billion in capital in private and public

offerings during 2008, excluding issuances to the UST under TARP. See Note

21 on page 172 for further information.

9