Citibank 2008 Annual Report Download - page 85

Download and view the complete annual report

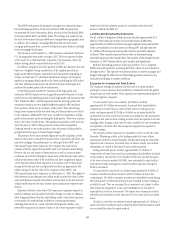

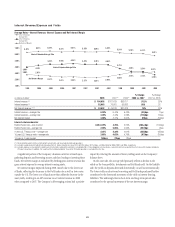

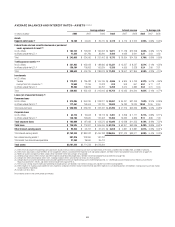

Please find page 85 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• $12 billion, or 38%, increase in U.S. Treasury and federal agency

securities;

• $5 billion, or 10%, increase in foreign government securities; and

• $13 billion, or 85%, net increase in other trading securities.

Total average trading account assets were $381 billion in 2008, compared

to $441 billion in 2007, yielding average rates of 4.6% and 4.2%, respectively.

During 2008 trading account liabilities decreased by $15 billion, or 8%,

due to:

• $13 billion, or 13%, increase in revaluation losses primarily consisting of

increases from interest rates, foreign exchange and credit derivative

contracts, offset by an increase in netting permitted under master netting

agreements; and

• $28 billion, or 35%, decrease in securities sold, not yet purchased,

comprising a $28 billion decrease in debt securities, while U.S. Treasury

securities remained flat.

In 2008, average trading account liabilities were $76 billion, yielding an

average rate of 1.7%, compared to $105 billion and 1.4% in the prior year.

For further discussion regarding trading account assets and liabilities, see

Note 15 to the Consolidated Financial Statements on page 157.

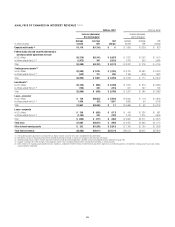

Federal Funds Sold (Purchased) and Securities Borrowed

(Loaned) or Purchased (Sold) Under Agreements to

Resell (Repurchase)

Federal funds sold and federal funds purchased consist of unsecured

advances of excess balances in reserve accounts held at Federal Reserve

banks. When the Company advances federal funds to a third party, it is

selling its excess reserves. Similarly, when the Company receives federal

funds, the Company is purchasing reserves from a third party. These interest-

bearing transactions typically have an original maturity of one business day.

Securities borrowed and securities loaned are recorded at the amount of

cash advanced or received, with a minimal amount adjusted for fair value in

accordance with SFAS 159. With respect to securities borrowed, the Company

pays cash collateral in an amount in excess of the market value of securities

borrowed, and receives excess in the case of securities loaned. The Company

monitors the market value of securities borrowed and loaned on a daily basis

with additional collateral advanced or obtained as necessary. Interest

received or paid for these transactions is recorded in interest income or

interest expense.

Securities purchased under agreements to resell and securities sold under

agreements to repurchase are treated as collateralized financing transactions

and are primarily carried at fair value in accordance with SFAS 159 since

January 1, 2007. In prior periods, these agreements were carried at cost. The

Company’s policy is to take possession of securities purchased under

agreements to resell. The market value of securities to be repurchased and

resold is monitored, and additional collateral is obtained where appropriate

to protect against credit exposure.

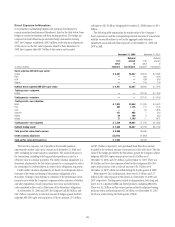

During 2008 the decrease of $90 billion, or 33%, in federal funds sold and

securities borrowed or purchased under agreements to resell, and the

decrease of $99 billion, or 33%, in federal funds purchased and securities

loaned or sold under agreements to repurchase were primarily driven by

balance sheet management.

For further information regarding these balance sheet categories, see

Note 13 to the Consolidated Financial Statements on page 156.

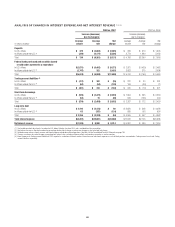

Investments

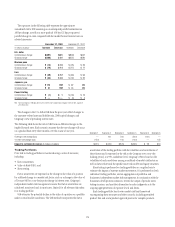

Investments consist of debt and equity securities that are available-for-sale,

debt securities that are held-to-maturity, non-marketable equity securities

that are carried at fair value, and non-marketable equity securities carried at

cost. Debt securities include bonds, notes and redeemable preferred stock, as

well as loan-backed securities (such as mortgage-backed securities) and

other structured notes. Marketable and non-marketable equity securities

carried at fair value include common and nonredeemable preferred stocks.

These instruments provide the Company with long-term investment

opportunities while in most cases remaining relatively liquid.

Non-marketable equity securities carried at cost primarily include equity

shares issued by the Federal Reserve Bank and the Federal Home Loan Bank

that the Company is required to hold.

Investment securities classified as available-for-sale are primarily carried

at fair value with the changes in fair value generally recognized in

stockholders’ equity (accumulated other comprehensive income). Declines

in fair value that are deemed other-than-temporary, as well as gains and

losses from the sale of these investment securities, are recognized in current

earnings. Certain investments in non-marketable equity securities and

certain investments that would otherwise be accounted for using the equity

method are carried at fair value in accordance with SFAS 159. Changes in

fair value of such investments are recorded in earnings. Debt securities

classified as held-to-maturity are carried at cost unless a decline in fair value

below cost is deemed other-than-temporary, in which case such a decline is

recorded in current earnings.

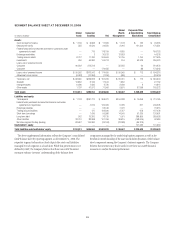

During 2008, investments increased by $41 billion, or 19%, principally

due to the transfer of debt securities from Trading assets to Investments as

discussed in the section “Reclassification of Financial Assets” on page 87.

For further information regarding investments, see Note 16 to the

Consolidated Financial Statements on page 158.

Other Assets

Other assets are composed of cash and due from banks, deposits with banks,

brokerage receivables, goodwill, intangibles, and various other assets.

During 2008, other assets increased $58 billion, or 15%, due to the $101

billion increase in deposits with banks and the $31 billion increase in the

deferred tax asset. These increases were offset by the following decreases:

• $41 billion related to loans held-for-sale as they were reclassed to loans

held-for-investment (for further discussion, see “Reclassification of

Financial Assets” on page 87);

• $17 billion in goodwill and intangibles, driven by the impairment of

goodwill and intangibles, foreign exchange translation and the decrease

in the fair value of the MSR;

• $13 billion in brokerage receivables; and

• $3 billion in various other assets.

For further information regarding goodwill and intangibles, see Note 19

to the Consolidated Financial Statements on page 166. For further discussion

on brokerage receivables, see Note 14 to the Consolidated Financial

Statements on page 157.

Deposits

Deposits represent customer funds that are payable on demand or upon

maturity. The majority of deposits are carried at cost, with a minimal

amount recorded at fair value in accordance with SFAS 155 and SFAS 159.

79