Citibank 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PUTTING TARP FUNDS TO WORK

We take very seriously the responsibility to put TARP funds to work to help our customers and their

communities through this difficult period. We are using the capital we received through the TARP to

increase lending to borrowers in need. We are committed to generating an exceptional return on all

stakeholders’ capital and we have reported and will continue to report on our activities quarterly.

We are also keenly aware of our responsibility to do all we can to rekindle the economy and renew

productive activity. And we are working with individual customers to help relieve some of the

pressure they’re experiencing.

By using our databases and customer insight, we have been able to identify customers at risk of

delinquency and reach out to them to restructure their loans before they slip into default. Our Citi

Homeownership Assistance Program (CHAP) is a proactive program that helps avoid the loss of

homes and protects credit scores and future borrowing potential. Through new assistance

programs, we have helped about 440,000 homeowners weather the downturn. We are also pleased

to support the Administration’s approach to mortgage loan modifications.

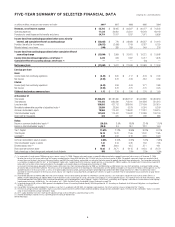

2008 FINANCIAL RESULTS

We reported a loss of $27.7 billion in 2008. This unacceptable result reflects the impact of a weak

economy and a lack of market liquidity on various assets we carried into this downturn. As

previously disclosed, our results included $32 billion of revenue mark-to-market losses on assets in

our Securities and Banking business. In addition, like all major banks, we are experiencing elevated

credit losses as our customers struggle to repay loans. As credit quality deteriorated, we added to

loan loss reserves. Our 2008 results reflect a net build of $14.7 billion to our loan loss reserves. We

ended the year with total loan loss reserves of $30 billion.

Our financial results this year were very disappointing. However, away from these losses, our core

franchises are performing well and our customers remain active and engaged with Citi around the

world. We will build on this to achieve our highest priority

—

returning Citi to profitability.

THREE-STAGE PLAN FOR RESTORING STRENGTH

After being appointed CEO of Citi in December 2007, my management team and I conducted a

comprehensive review of Citi’s operations. We found an incredible global franchise with material

competitive advantages in many businesses. We discovered some of the most talented professionals

in the industry. And we identified numerous opportunities for growth.

However, we also inherited many high-risk assets that were not essential to our core business. We

found that some of Citi’s resources were allocated to activities that did not create enough value for

our clients and did not earn adequate risk-adjusted returns for shareholders. At the same time, we

uncovered an outsized cost structure and inefficient information technology systems that in many

cases could not connect to one another.

We devised a plan to attack all of these issues and in May 2008 we outlined our multiyear plan to

restore strength and position the company for future growth in three stages: Get Fit, Restructure

Citi, and Maximize Citi.

Throughout 2008, in the midst of a global economic downturn and global financial crisis, we

remained focused on Getting Fit. We have made and continue to make significant progress in

strengthening Citi’s capital and structural liquidity; reducing the balance sheet, expenses and

headcount; and decreasing risk across the organization.

• We raised significant capital from private investors as well as through the TARP. We increased

our Tier 1 capital ratio to approximately 11.9 percent at year end, making Citi’s Tier 1 among the

highest in the industry.

• We increased our structural liquidity to 66 percent of total assets in the final quarter of 2008.

• We reduced our assets from a peak of almost $2.4 trillion down to about $1.9 trillion and

completed 19 divestitures.

• In the fourth quarter of 2008, we reduced our “business-as-usual” expenses by 16 percent from

the fourth quarter of 2007 to $12.8 billion.