Citibank 2008 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

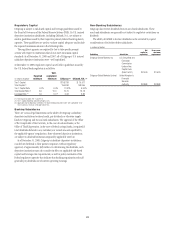

CGMHI also has substantial borrowing arrangements consisting of

facilities that CGMHI has been advised are available, but where no

contractual lending obligation exists. These arrangements are reviewed on

an ongoing basis to ensure flexibility in meeting CGMHI’s short-term

requirements.

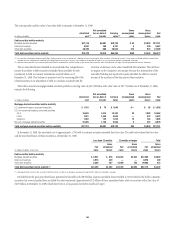

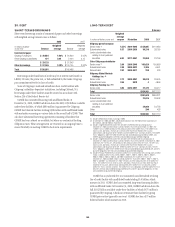

The Company issues both fixed and variable rate debt in a range of

currencies. It uses derivative contracts, primarily interest rate swaps, to

effectively convert a portion of its fixed rate debt to variable rate debt and

variable rate debt to fixed rate debt. The maturity structure of the derivatives

generally corresponds to the maturity structure of the debt being hedged. In

addition, the Company uses other derivative contracts to manage the

foreign exchange impact of certain debt issuances. At December 31, 2008,

the Company’s overall weighted average interest rate for long-term debt was

3.83% on a contractual basis and 4.19% including the effects of derivative

contracts.

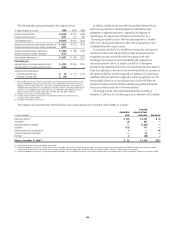

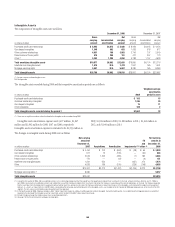

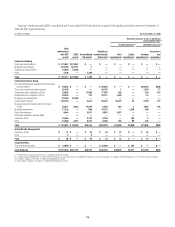

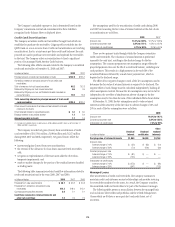

Aggregate annual maturities of long-term debt obligations (based on final maturity dates) including trust preferred securities are as follows:

In millions of dollars 2009 2010 2011 2012 2013 Thereafter

Citigroup parent company $13,463 $17,500 $19,864 $21,135 $17,525 $102,794

Other Citigroup subsidiaries 55,853 16,198 18,607 2,718 4,248 11,691

Citigroup Global Markets Holdings Inc. 1,524 2,352 1,487 2,893 392 11,975

Citigroup Funding Inc. 17,632 5,381 2,154 1,253 3,790 7,164

Total $88,472 $41,431 $42,112 $27,999 $25,955 $133,624

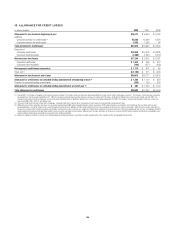

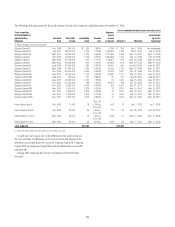

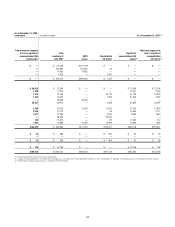

Long-term debt at December 31, 2008 and December 31, 2007 includes

$24,060 million and $23,756 million, respectively, of junior subordinated

debt. The Company formed statutory business trusts under the laws of the

state of Delaware. The trusts exist for the exclusive purposes of (i) issuing

Trust Securities representing undivided beneficial interests in the assets of the

Trust; (ii) investing the gross proceeds of the Trust Securities in junior

subordinated deferrable interest debentures (subordinated debentures) of its

parent; and (iii) engaging in only those activities necessary or incidental

thereto. Upon approval from the Federal Reserve, Citigroup has the right to

redeem these securities.

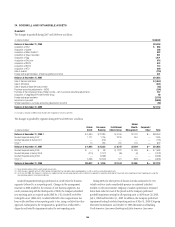

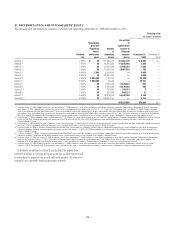

Citigroup has contractually agreed not to redeem or purchase (i) the

6.50% Enhanced Trust Preferred Securities of Citigroup Capital XV before

September 15, 2056, (ii) the 6.45% Enhanced Trust Preferred Securities of

Citigroup Capital XVI before December 31, 2046, (iii) the 6.35% Enhanced

Trust Preferred Securities of Citigroup Capital XVII before March 15, 2057,

(iv) the 6.829% Fixed Rate/Floating Rate Enhanced Trust Preferred

Securities of Citigroup Capital XVIII before June 28, 2047, (v) the 7.250%

Enhanced Trust Preferred Securities of Citigroup Capital XIX before

August 15, 2047, (vi) the 7.875% Enhanced Trust Preferred Securities of

Citigroup Capital XX before December 15, 2067, and (vii) the 8.300% Fixed

Rate/Floating Rate Enhanced Trust Preferred Securities of Citigroup Capital

XXI before December 21, 2067 unless certain conditions, described in

Exhibit 4.03 to Citigroup’s Current Report on Form 8-K filed on

September 18, 2006, in Exhibit 4.02 to Citigroup’s Current Report on

Form 8-K filed on November 28, 2006, in Exhibit 4.02 to Citigroup’s Current

Report on Form 8-K filed on March 8, 2007, in Exhibit 4.02 to Citigroup’s

Current Report on Form 8-K filed on July 2, 2007, in Exhibit 4.02 to

Citigroup’s Current Report on Form 8-K filed on August 17, 2007, in

Exhibit 4.2 to Citigroup’s Current Report on Form 8-K filed on November 27,

2007, and in Exhibit 4.2 to Citigroup’s Current Report on Form 8-K filed on

December 21, 2007, respectively, are met. These agreements are for the

benefit of the holders of Citigroup’s 6.00% Junior Subordinated Deferrable

Interest Debentures due 2034.

Citigroup owns all of the voting securities of these subsidiary trusts. These

subsidiary trusts have no assets, operations, revenues or cash flows other

than those related to the issuance, administration and repayment of the

subsidiary trusts and the subsidiary trusts’ common securities. These

subsidiary trusts’ obligations are fully and unconditionally guaranteed by

Citigroup.

170