Citibank 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Latin America

Acquisition of Grupo Financiero Uno

In 2007, Citigroup completed its acquisition of Grupo Financiero Uno

(GFU), the largest credit card issuer in Central America, and its affiliates,

with $2.2 billion in assets. The results for GFU are included in Citigroup’s

Global Cards and Latin America Consumer Banking businesses from

March 5, 2007 forward.

Acquisition of Grupo Cuscatlán

In 2007, Citigroup completed the acquisition of the subsidiaries of Grupo

Cuscatlán for $1.51 billion ($755 million in cash and 14.2 million shares of

Citigroup common stock) from Corporacion UBC Internacional S.A. Grupo.

The results of Grupo Cuscatlán are included from May 11, 2007 forward and

are recorded in Latin America Consumer Banking.

Asia

Acquisition of Bank of Overseas Chinese

In 2007, Citigroup completed its acquisition of Bank of Overseas Chinese

(BOOC) in Taiwan for approximately $427 million. Results for BOOC are

included in Citigroup’s Asia Consumer Banking, Global Cards and

Securities and Banking businesses from December 1, 2007 forward.

EMEA

Acquisition of Quilter

In 2007, the Company completed the acquisition of Quilter, a U.K. wealth

advisory firm, from Morgan Stanley. Quilter’s results are included in

Citigroup’s Smith Barney business from March 1, 2007 forward. Quilter is

being disposed of as part of the sale of Smith Barney to Morgan Stanley

described in Subsequent Events.

Acquisition of Egg

In 2007, Citigroup completed its acquisition of Egg Banking plc (Egg), a

U.K. online financial services provider, from Prudential PLC for

approximately $1.39 billion. Results for Egg are included in Citigroup’s

Global Cards and EMEA Consumer Banking businesses from May 1, 2007

forward.

Purchase of 20% Equity Interest in Akbank

In 2007, Citigroup completed its purchase of a 20% equity interest in Akbank,

the second-largest privately owned bank by assets in Turkey for

approximately $3.1 billion. This investment is accounted for using the equity

method of accounting.

Sabanci Holding, a 34% owner of Akbank shares, and its subsidiaries have

granted Citigroup a right of first refusal or first offer over the sale of any of

their Akbank shares in the future. Subject to certain exceptions, including

purchases from Sabanci Holding and its subsidiaries, Citigroup has otherwise

agreed not to increase its percentage ownership in Akbank.

OTHER ITEMS

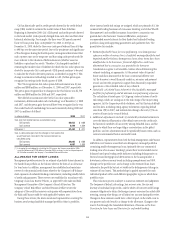

Sale of MasterCard Shares

In 2007, the Company recorded a $367 million after-tax gain ($581 million

pretax) on the sale of approximately 4.9 million MasterCard Class B shares

that had been received by Citigroup as a part of the MasterCard initial public

offering completed in June 2006. The gain was recorded in the following

businesses:

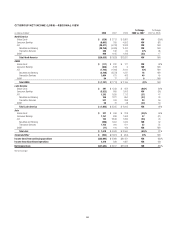

In millions of dollars

2007

Pretax

total

2007

After-tax

total

2006

Pretax

total

2006

After-tax

total

Global Cards $466 $296 $ 94 $59

Consumer Banking 96 59 27 18

ICG 19 12 2 1

Total $581 $367 $123 $78

Redecard IPO

In 2007, Citigroup (a 31.9% shareholder in Redecard S.A., the only merchant

acquiring company for MasterCard in Brazil) sold approximately

48.8 million Redecard shares in connection with Redecard’s initial public

offering in Brazil. Following the sale of these shares, Citigroup retained

approximately 23.9% ownership in Redecard. An after-tax gain of

approximately $469 million ($729 million pretax) was recorded in

Citigroup’s 2007 financial results in the Global Cards business.

Visa Restructuring and Litigation Matters

In 2007, Visa USA, Visa International and Visa Canada were merged into Visa

Inc. (Visa). As a result of that reorganization, Citigroup recorded a $534

million (pretax) gain on its holdings of Visa International shares primarily

recognized in the Consumer Banking business. The shares were then

carried on Citigroup’s balance sheet at the new cost basis. In addition,

Citigroup recorded a $306 million (pretax) charge related to certain of Visa

USA’s litigation matters primarily recognized in the North America

Consumer Banking business.

16