Citibank 2008 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

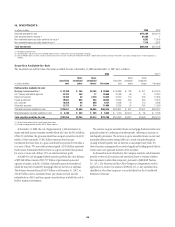

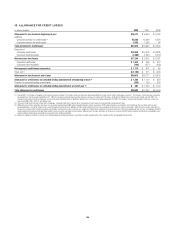

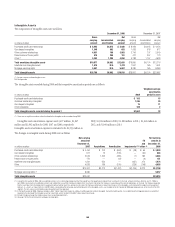

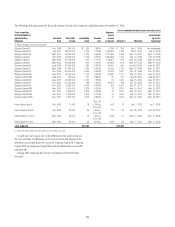

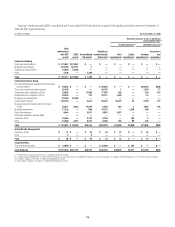

Intangible Assets

The components of intangible assets were as follows:

December 31, 2008 December 31, 2007

In millions of dollars

Gross

carrying

amount

Accumulated

amortization

Net

carrying

amount

Gross

carrying

amount

Accumulated

amortization

Net

carrying

amount

Purchased credit card relationships $ 8,443 $4,513 $ 3,930 $ 8,499 $4,045 $ 4,454

Core deposit intangibles 1,345 662 683 1,435 518 917

Other customer relationships 4,031 168 3,863 2,746 197 2,549

Present value of future profits 415 264 151 427 257 170

Other (1) 5,343 1,285 4,058 5,783 1,157 4,626

Total amortizing intangible assets $19,577 $6,892 $12,685 $18,890 $6,174 $12,716

Indefinite-lived intangible assets 1,474 N/A 1,474 1,591 N/A 1,591

Mortgage servicing rights 5,657 N/A 5,657 8,380 N/A 8,380

Total intangible assets $26,708 $6,892 $19,816 $28,861 $6,174 $22,687

(1) Includes contract-related intangible assets.

N/A Not Applicable.

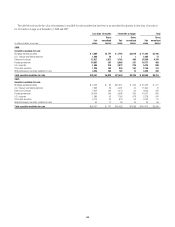

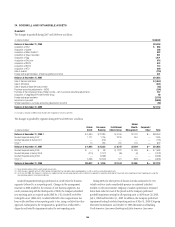

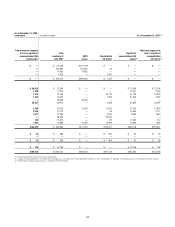

The intangible assets recorded during 2008 and their respective amortization periods are as follows:

In millions of dollars 2008

Weighted-average

amortization

period in years

Purchased credit card relationships $ 103 15

Customer relationship intangibles 1,355 25

Core deposit intangibles 15 11

Other intangibles 189 2

Total intangible assets recorded during the period (1) $1,662 22

(1) There was no significant residual value estimated for the intangible assets recorded during 2007.

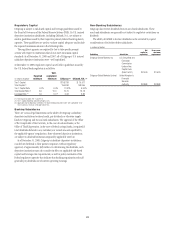

Intangible assets amortization expense was $1,427 million, $1,267

million and $1,842 million for 2008, 2007 and 2006, respectively.

Intangible assets amortization expense is estimated to be $1,253 million in

2009, $1,224 million in 2010, $1,188 million in 2011, $1,162 million in

2012, and $1,044 million in 2013.

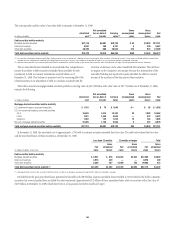

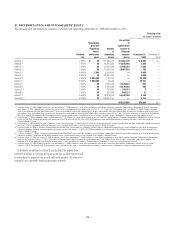

The changes in intangible assets during 2008 were as follows:

In millions of dollars

Net carrying

amount at

December 31,

2007 Acquisitions Amortization Impairments (1)(2)

FX

and

other (3)

Net carrying

amount at

December 31,

2008

Purchased credit card relationships $ 4,454 $ 103 $ (664) $ (28) $ 65 $ 3,930

Core deposit intangibles 917 15 (155) — (94) 683

Other customer relationships 2,549 1,355 (225) (1) 185 3,863

Present value of future profits 170 — (13) — (6) 151

Indefinite-lived intangible assets 1,591 550 — (937) 270 1,474

Other 4,626 189 (370) (239) (148) 4,058

$14,307 $2,212 $(1,427) $(1,205) $ 272 $14,159

Mortgage servicing rights (4) 8,380 5,657

Total intangible assets $22,687 $19,816

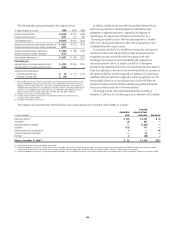

(1) During the first quarter of 2008, Old Lane notified investors in its multistrategy hedge fund that they would have the opportunity to redeem their investments in the fund, without restriction, effective July 31, 2008. In

April 2008, substantially all unaffiliated investors had notified Old Lane of their intention to redeem their investments. Based on the Company’s expectation of the level of redemptions in the fund, the Company expected

that the cash flows from the hedge fund management contract will be lower than previously estimated. The Company performed an impairment analysis of the intangible asset relating to the hedge fund management

contract. As a result, an impairment loss of $202 million, representing the remaining unamortized balance of the intangible assets, was recorded in the first quarter of 2008 operating expenses in the results of the ICG

segment. The fair value was estimated using a discounted cash flow approach.

(2) In the fourth quarter of 2008, Citigroup recorded a $937 million impairment charge on a Nikko Asset Management contract intangible. During the fourth quarter, it was determined that triggering events occurred that

required further testing of the intangible assets for impairment, which resulted in the $937 million impairment charge.

(3) Includes foreign exchange translation and purchase accounting adjustments.

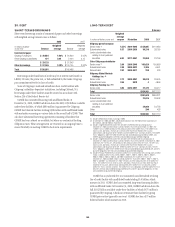

(4) See page 182 for the roll-forward of mortgage servicing rights.

168