Citibank 2008 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

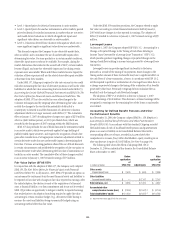

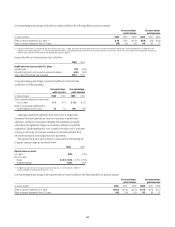

7. PRINCIPAL TRANSACTIONS

Principal transactions revenue consists of realized and unrealized gains and

losses from trading activities. Not included in the table below is the impact of

net interest revenue related to trading activities, which is an integral part of

trading activities’ profitability. The following table presents principal

transactions revenue for the years ended December 31:

In millions of dollars 2008 2007 2006 (1)

Institutional Clients Group

Fixed income (2) $ (6,455) $ 4,053 $5,593

Credit products (3) (21,614) (21,805) (744)

Equities (4) (394) 682 866

Foreign exchange (5) 2,316 1,222 693

Commodities (6) 667 686 487

Total ICG $(25,480) $(15,162) $6,895

Consumer Banking/Global Cards (7) 1,616 1,364 504

Global Wealth Management (7) 836 1,315 680

Corporate/Other 840 397 (89)

Total principal transactions revenue $(22,188) $(12,086) $7,990

(1) Reclassified to conform to the current period’s presentation.

(2) Includes revenues from government securities and corporate debt, municipal securities, preferred

stock, mortgage securities, and other debt instruments. Also includes spot and forward trading of

currencies and exchange-traded and over-the-counter (OTC) currency options, options on fixed income

securities, interest rate swaps, currency swaps, swap options, caps and floors, financial futures, OTC

options, and forward contracts on fixed income securities. Losses in 2008 reflect the volatility and

dislocation in the credit and trading markets.

(3) Includes revenues from structured credit products such as North America and Europe collateralized

debt obligations. In 2007 and 2008, losses recorded were related to subprime-related exposures in

ICG’s lending and structuring business and exposures to super senior CDOs.

(4) Includes revenues from common, preferred and convertible preferred stock, convertible corporate

debt, equity-linked notes, and exchange-traded and OTC equity options and warrants.

(5) Includes revenues from foreign exchange spot, forward, option and swap contracts, as well as

translation gains and losses.

(6) Primarily includes the results of Phibro LLC, which trades crude oil, refined oil products, natural gas,

and other commodities.

(7) Includes revenues from various fixed income, equities and foreign exchange transactions.

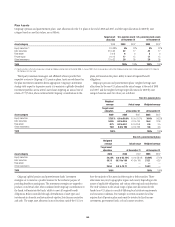

8. INCENTIVE PLANS

The Company has adopted a number of equity compensation plans under

which it administers stock options, restricted or deferred stock and stock

purchase programs. The award programs are used to attract, retain and

motivate officers, employees and non-employee directors, to compensate

them for their contributions to the Company, and to encourage employee

stock ownership. The plans are administered by the Personnel and

Compensation Committee of the Citigroup Board of Directors, which is

composed entirely of independent non-employee directors. At December 31,

2008, approximately 142 million shares were authorized and available for

grant under Citigroup’s stock incentive and stock purchase plans. In

accordance with Citigroup practice, shares would be issued out of Treasury

stock upon exercise or vesting.

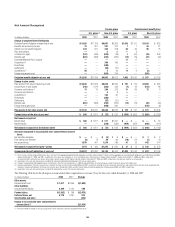

The following table shows components of compensation expense relating

to the Company’s stock-based compensation programs as recorded during

2008, 2007 and 2006:

In millions of dollars 2008 2007 2006

SFAS 123(R) charges for January 2006 awards to

retirement-eligible employees $— $ — $ 648

SFAS 123(R) charges for estimated awards to

retirement-eligible employees 110 467 824

Option expense 29 86 129

Amortization of MC LTIP awards (1) 18 18 —

Amortization of restricted and deferred stock awards

(excluding MC LTIP) (2) 3,133 2,728 1,565

Total $3,290 $3,299 $3,166

(1) Management Committee Long-Term Incentive Plan (MC LTIP) was created in 2007.

(2) Represents amortization of expense over the remaining life of all unvested restricted and deferred

stock awards granted to all employees prior to 2006. The 2008, 2007 and 2006 periods also include

amortization expense for all unvested awards to non-retirement-eligible employees on or after

January 1, 2006. Amortization includes estimated forfeitures of awards.

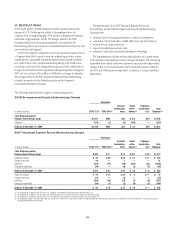

STOCK AWARD PROGRAMS

The Company, primarily through its Capital Accumulation Program (CAP),

issues shares of Citigroup common stock in the form of restricted or deferred

stock to participating officers and employees. For all stock award programs,

during the applicable vesting period, the shares awarded cannot be sold or

transferred by the participant, and some or all of the shares awarded are

subject to cancellation if the participant’s employment is terminated. After

the award vests, the shares become freely transferable (subject to the stock

ownership commitment of senior executives). From the date of the award,

the recipient of a restricted stock award can direct the vote of the shares and

receive dividend equivalents. Recipients of deferred stock awards receive

dividend equivalents, but cannot vote shares until they have vested.

Stock awards granted in January 2008, 2007, 2006 and 2005 generally

vest 25% per year over four years, except for awards to certain employees at

Smith Barney that vest after two years and July 2007 Management

Committee Long-Term Incentive Plan awards (further described below) that

vest in January 2010. Stock awards granted in 2003 and 2004 generally

vested after a two- or three-year vesting period. CAP participants in 2008,

2007, 2006 and 2005 could elect to receive all or part of their award in stock

options. The figures presented in the stock option program tables include

options granted under CAP. Unearned compensation expense associated with

the stock awards represents the market value of Citigroup common stock at

the date of grant and is recognized as a charge to income ratably over the

full vesting period, except for those awards granted to retirement-eligible

140