Citibank 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

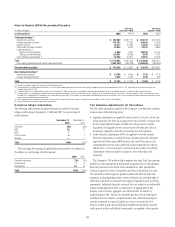

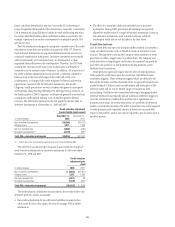

Loans Reclassified to Held for Investment

FASB Statement No. 65, Accounting for Certain Mortgage Banking

Activities (SFAS 65), and AICPA Statement of Position 01-6, “Accounting by

Certain Entities (Including Entities with Trade Receivables) That Lend to or

Finance the Activities of Others” (SOP 01-6), require that the accounting for

a loan be based upon the Company’s intent and ability to hold the loan for

the foreseeable future or until maturity. Loans that the Company has the

intent and ability to hold for the foreseeable future, or until maturity or

payoff, should be classified as held for investment (HFI) and reported in the

balance sheet at the amortized cost of the loan, adjusted by the allowance for

loan losses. Loans that the Company intends to sell should be classified as

held for sale (HFS) and reported at the lower of cost or fair value.

During the fourth quarter of 2008, Citigroup made a number of transfers

from the HFS category to the HFI category to better reflect prevailing

intentions of the Company. Reclassifications of loans were made at fair value

on the date of transfer. The impact of the transfers executed during the

fourth quarter of 2008 is detailed in the following table, summarized by type

of loan:

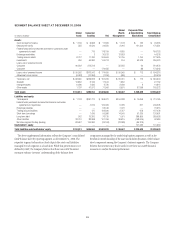

Fair value

at date

of transfer

Carrying value at

December 31, 2008

Fair value at

December 31, 2008

Loans reclassified to held for investment

Highly leveraged loans $ 3,318 $ 3,350 $ 1,650

Commercial real estate loans 7,150 7,049 7,110

Other loans 5,241 5,492 5,523

Total loans $15,709 $15,891 $14,283

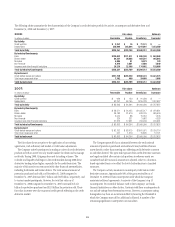

Loan balances reclassified relate to funded positions that were originated

as part of a strategy to distribute. Prior to the recent dislocation in the credit

markets, Citigroup managed the risk associated with these loans by seeking

to sell a majority of its exposure to the market prior to, or shortly after,

funding. For the reasons discussed under “Debt Securities Reclassified to

Available-for-Sale and Held-to-Maturity” on page 87, the Company believes

that the best value can now be obtained through a hold strategy. It is now the

Company’s intention to hold these positions for the foreseeable future, which

is considered to be such time as the loan period expires, or sufficient liquidity

returns to the market place, such that the loans can be sold for a value which

the Company believes is representative of the implicit credit risk of the

position. Due to the severity and duration of current unfavorable market

conditions, the Company does not anticipate such liquidity returning in the

foreseeable future, which for these loans the Company generally defines to be

within the next year. The loans reclassified to HFI are assessed for intention

to hold on an individual loan basis. After transfer, HFI loans are now subject

to the Company’s allowance for loan loss review process.

89