Citibank 2008 Annual Report Download - page 181

Download and view the complete annual report

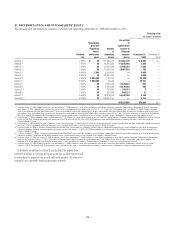

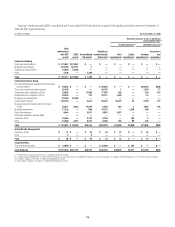

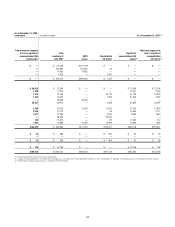

Please find page 181 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23. SECURITIZATIONS AND VARIABLE INTEREST

ENTITIES

Overview

Citigroup and its subsidiaries are involved with several types of off-balance

sheet arrangements, including special purpose entities (SPEs). See Note 1 on

page 122 for a discussion of proposed accounting changes to SFAS 140,

Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities (SFAS 140), and FASB Interpretation No. 46,

“Consolidation of Variable Interest Entities (revised December 2003)

(FIN 46 (R)).”

Uses of SPEs

An SPE is an entity designed to fulfill a specific limited need of the company

that organized it.

The principal uses of SPEs are to obtain liquidity and favorable capital

treatment by securitizing certain of Citigroup’s financial assets, to assist

clients in securitizing their financial assets, and to create investment

products for clients. SPEs may be organized in many legal forms including

trusts, partnerships, or corporations. In a securitization, the company

transferring assets to an SPE converts those assets into cash before they

would have been realized in the normal course of business, through the

SPE’s issuance of debt and equity instruments, certificates, commercial

paper, and other notes of indebtedness, which are recorded on the balance

sheet of the SPE and not reflected on the transferring company’s balance

sheet, assuming applicable accounting requirements are satisfied. Investors

usually have recourse to the assets in the SPE and often benefit from other

credit enhancements, such as a collateral account or overcollateralization in

the form of excess assets in the SPE, or from a liquidity facility, such as a line

of credit, liquidity put option or asset purchase agreement. The SPE can

typically obtain a more favorable credit rating from rating agencies than the

transferor could obtain for its own debt issuances, resulting in less expensive

financing costs. The SPE may also enter into derivative contracts in order to

convert the yield or currency of the underlying assets to match the needs of

the SPE investors, or to limit or change the credit risk of the SPE. Citigroup

may be the provider of certain credit enhancements as well as the

counterparty to any related derivative contracts.

SPEs may be Qualifying SPEs (QSPEs) or Variable Interest Entities (VIEs)

or neither.

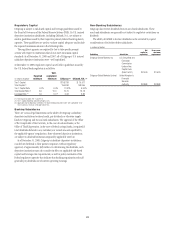

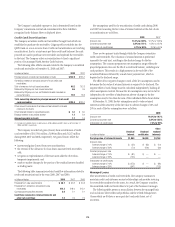

Qualifying SPEs

QSPEs are a special class of SPEs defined in (SFAS 140). QSPEs have

significant limitations on the types of assets and derivative instruments they

may own or enter into and the types and extent of activities and decision-

making they may engage in. Generally, QSPEs are passive entities designed

to purchase assets and pass through the cash flows from those assets to the

investors in the QSPE. QSPEs may not actively manage their assets through

discretionary sales and are generally limited to making decisions inherent in

servicing activities and issuance of liabilities. QSPEs are generally exempt

from consolidation by the transferor of assets to the QSPE and any investor

or counterparty.

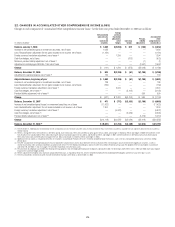

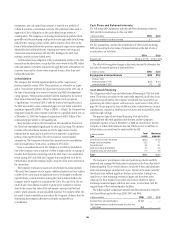

Variable Interest Entities

VIEs are entities defined in (FIN 46(R)), as entities that have either a total

equity investment that is insufficient to permit the entity to finance its

activities without additional subordinated financial support or whose equity

investors lack the characteristics of a controlling financial interest (i.e.,

ability to make significant decisions through voting rights, right to receive

the expected residual returns of the entity and obligation to absorb the

expected losses of the entity). Investors that finance the VIE through debt or

equity interests or other counterparties that provide other forms of support,

such as guarantees, subordinated fee arrangements, or certain types of

derivative contracts, are variable interest holders in the entity. The variable

interest holder, if any, that will absorb a majority of the entity’s expected

losses, receive a majority of the entity’s expected residual returns, or both, is

deemed to be the primary beneficiary and must consolidate the VIE.

Consolidation under FIN 46(R) is based on expected losses and residual

returns, which consider various scenarios on a probability-weighted basis.

Consolidation of a VIE is, therefore, determined based primarily on

variability generated in scenarios that are considered most likely to occur,

rather than based on scenarios that are considered more remote. Certain

variable interests may absorb significant amounts of losses or residual

returns contractually, but if those scenarios are considered very unlikely to

occur, they may not lead to consolidation of the VIE.

All of these facts and circumstances are taken into consideration when

determining whether the Company has variable interests that would deem it

the primary beneficiary and, therefore, require consolidation of the related

VIE or otherwise rise to the level where disclosure would provide useful

information to the users of the Company’s financial statements. In some

cases, it is qualitatively clear based on the extent of the Company’s

involvement or the seniority of its investments that the Company is not the

primary beneficiary of the VIE. In other cases, a more detailed and

quantitative analysis is required to make such a determination.

The Company generally considers the following types of involvement to be

significant:

• assisting in the structuring of a transaction and retaining any amount of

debt financing (e.g., loans, notes, bonds or other debt instruments) or an

equity investment (e.g., common shares, partnership interests or

warrants);

• writing a “liquidity put” or other liquidity facility to support the issuance

of short-term notes;

• writing credit protection (e.g., guarantees, letters of credit, credit default

swaps or total return swaps where the Company receives the total return

or risk on the assets held by the VIE); or

• certain transactions where the Company is the investment manager and

receives variable fees for services.

In various other transactions, the Company may act as a derivative

counterparty (for example, interest rate swap, cross-currency swap, or

purchaser of credit protection under a credit default swap or total return

swap where the Company pays the total return on certain assets to the SPE);

may act as underwriter or placement agent; may provide administrative,

trustee, or other services; or may make a market in debt securities or other

instruments issued by VIEs. The Company generally considers such

involvement, by itself, “not significant” under FIN 46(R).

175