Citibank 2008 Annual Report Download - page 190

Download and view the complete annual report

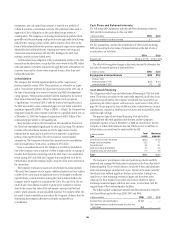

Please find page 190 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Finally, the Company is one of several named dealers in the commercial

paper issued by the conduits and earns a market-based fee for providing such

services. Along with third-party dealers, the Company makes a market in the

commercial paper and may from time to time fund commercial paper

pending sale to a third party. On specific dates with less liquidity in the

market, the Company may hold in inventory commercial paper issued by

conduits administered by the Company, as well as conduits administered by

third parties. The amount of commercial paper issued by its administered

conduits held in inventory fluctuates based on market conditions and

activity. As of December 31, 2008, the Company owned $57 million of

commercial paper issued by its administered conduits.

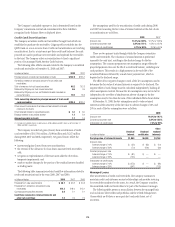

FIN 46(R) requires that the Company quantitatively analyze the expected

variability of the conduit to determine whether the Company is the primary

beneficiary of the conduit. The Company performs this analysis on a

quarterly basis and has concluded that the Company is not the primary

beneficiary of the conduits as defined in FIN 46(R) and, therefore, does not

consolidate the conduits it administers. In conducting this analysis, the

Company considers three primary sources of variability in the conduit: credit

risk, interest-rate risk and fee variability.

The Company models the credit risk of the conduit’s assets using a Credit

Value at Risk (C-VaR) model. The C-VaR model considers changes in credit

spreads (both within a rating class as well as due to rating upgrades and

downgrades), name-specific changes in credit spreads, credit defaults and

recovery rates and diversification effects of pools of financial assets. The

model incorporates data from independent rating agencies as well as the

Company’s own proprietary information regarding spread changes, ratings

transitions and losses given default. Using this credit data, a Monte Carlo

simulation is performed to develop a distribution of credit risk for the

portfolio of assets owned by each conduit, which is then applied on a

probability-weighted basis to determine expected losses due to credit risk. In

addition, the Company continuously monitors the specific credit

characteristics of the conduit’s assets and the current credit environment to

confirm that the C-VaR model used continues to incorporate the Company’s

best information regarding the expected credit risk of the conduit’s assets.

The Company also analyzes the variability in the fees that it earns from

the conduit using monthly actual historical cash flow data to determine

average fee and standard deviation measures for each conduit. Because any

unhedged interest rate and foreign-currency risk not contractually passed on

to customers is absorbed by the fees earned by the Company, the fee

variability analysis incorporates those risks.

The fee variability and credit risk variability are then combined into a

single distribution of the conduit’s overall returns. This return distribution is

updated and analyzed on at least a quarterly basis to ensure that the amount

of the Subordinate Loss Notes issued to third parties is sufficient to absorb

greater than 50% of the total expected variability in the conduit’s returns.

The expected variability absorbed by the Subordinate Loss Note investors is

therefore measured to be greater than the expected variability absorbed by

the Company through its liquidity arrangements and other fees earned, and

the investors in commercial paper and medium-term notes. While the

notional amounts of the Subordinate Loss Notes are quantitatively small

compared to the size of the conduits, this is reflective of the fact that most of

the substantive risks of the conduits are absorbed by the enhancements

provided by the sellers and other third parties that provide transaction-level

credit enhancement. Because FIN 46(R) requires these risks and related

enhancements to be excluded from the analysis, the remaining risks and

expected variability are quantitatively small. The calculation of variability

under FIN 46(R) focuses primarily on expected variability, rather than the

risks associated with extreme outcomes (for example, large levels of default)

that are expected to occur very infrequently. So while the Subordinate Loss

Notes are sized appropriately compared to expected losses as measured in FIN

46(R), they do not provide significant protection against extreme or unusual

credit losses.

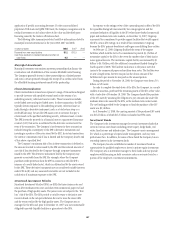

Third-Party Commercial Paper Conduits

The Company also provides liquidity facilities to single- and multi-seller

conduits sponsored by third parties. These conduits are independently owned

and managed and invest in a variety of asset classes, depending on the

nature of the conduit. The facilities provided by the Company typically

represent a small portion of the total liquidity facilities obtained by each

conduit, and are collateralized by the assets of each conduit. The notional

amount of these facilities is approximately $1.4 billion as of December 31,

2008. $2 million was funded under these facilities as of December 31, 2008.

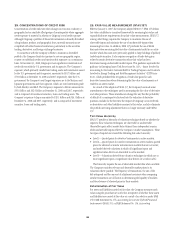

Collateralized Debt and Loan Obligations

A collateralized debt obligation (CDO) is an SPE that purchases a pool of

assets consisting of asset-backed securities and synthetic exposures through

derivatives on asset-backed securities and issues multiple tranches of equity

and notes to investors. A third-party manager is typically retained by the CDO

to select the pool of assets and manage those assets over the term of the CDO.

The Company earns fees for warehousing assets prior to the creation of a

CDO, structuring CDOs and placing debt securities with investors. In

addition, the Company has retained interests in many of the CDOs it has

structured and makes a market in those issued notes.

A cash CDO, or arbitrage CDO, is a CDO designed to take advantage of the

difference between the yield on a portfolio of selected assets, typically

residential mortgage-backed securities, and the cost of funding the CDO

through the sale of notes to investors. “Cash flow” CDOs are vehicles in

which the CDO passes on cash flows from a pool of assets, while “market

value” CDOs pay to investors the market value of the pool of assets owned by

the CDO at maturity. Both types of CDOs are typically managed by a third-

party asset manager. In these transactions, all of the equity and notes issued

by the CDO are funded, as the cash is needed to purchase the debt securities.

In a typical cash CDO, a third-party investment manager selects a portfolio

of assets, which the Company funds through a warehouse financing

arrangement prior to the creation of the CDO. The Company then sells the

debt securities to the CDO in exchange for cash raised through the issuance

of notes. The Company’s continuing involvement in cash CDOs is typically

limited to investing in a portion of the notes or loans issued by the CDO and

making a market in those securities, and acting as derivative counterparty

for interest rate or foreign currency swaps used in the structuring of the CDO.

A synthetic CDO is similar to a cash CDO, except that the CDO obtains

exposure to all or a portion of the referenced assets synthetically through

derivative instruments, such as credit default swaps. Because the CDO does

not need to raise cash sufficient to purchase the entire referenced portfolio, a

substantial portion of the senior tranches of risk is typically passed on to CDO

investors in the form of unfunded liabilities or derivative instruments. Thus,

the CDO writes credit protection on select referenced debt securities to the

Company or third parties and the risk is then passed on to the CDO investors

in the form of funded notes or purchased credit protection through derivative

184