Citibank 2008 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The FRB may also expect the Company to commit resources to its

subsidiary banks in certain circumstances. However, the FRB may not

compel a bank holding company to remove capital from its regulated

securities and insurance subsidiaries for this purpose.

A U.S. bank is not required to repay a deposit at a branch outside the U.S.

if the branch cannot repay the deposit due to an act of war, civil strife, or

action taken by the government in the host country.

Privacy and Data Security

Under U.S. federal law, the Company must disclose its privacy policy to

consumers, permit consumers to “opt out” of having non-public customer

information disclosed to third parties, and allow customers to opt out of

receiving marketing solicitations based on information about the customer

received from another subsidiary. States may adopt more extensive privacy

protections.

The Company is similarly required to have an information security

program to safeguard the confidentiality and security of customer

information and to ensure its proper disposal and to notify customers of

unauthorized disclosure, consistent with applicable law or regulation.

Non-U.S. Regulation

A substantial portion of the Company’s revenues is derived from its

operations outside the U.S., which are subject to the local laws and

regulations of the host country. Those requirements affect how the local

activities are organized and the manner in which they are conducted. The

Company’s foreign activities are thus subject to both U.S. and foreign legal

and regulatory requirements and supervision, including U.S. laws

prohibiting companies from doing business in certain countries.

SECURITIES REGULATION

Certain of Citigroup’s subsidiaries are subject to various securities and

commodities regulations and capital adequacy requirements of the

regulatory and exchange authorities of the jurisdictions in which they

operate.

Subsidiaries’ registrations include as broker-dealer and investment

adviser with the SEC and as futures commission merchant and commodity

pool operator with the Commodity Futures Trading Commission (CFTC).

Subsidiaries’ memberships include the New York Stock Exchange, Inc.

(NYSE) and other principal United States securities exchanges, as well as the

Financial Industry Regulatory Authority (FINRA) and the National Futures

Association (NFA).

Citigroup’s primary U.S. broker-dealer subsidiary, Citigroup Global

Markets Inc. (CGMI), is registered as a broker-dealer in all 50 states, the

District of Columbia, Puerto Rico, Taiwan and Guam. CGMI is also a

primary dealer in U.S. Treasury securities and a member of the principal

United States futures exchanges. CGMI is subject to extensive regulation,

including minimum capital requirements, which are issued and enforced by,

among others, the SEC, the CFTC, the NFA, FINRA, the NYSE, various other

self-regulatory organizations of which CGMI is a member and the securities

administrators of the 50 states, the District of Columbia, Puerto Rico and

Guam. The SEC and the CFTC also require certain registered broker-dealers

(including CGMI) to maintain records concerning certain financial and

securities activities of affiliated companies that may be material to the

broker-dealer, and to file certain financial and other information regarding

such affiliated companies.

Citigroup’s securities operations abroad are conducted through various

subsidiaries and affiliates, principally Citigroup Global Markets Limited in

London and Nikko Citigroup Limited (a joint venture between CGMHI and

Nikko Cordial) and Nikko Cordial in Tokyo. Its securities activities in the

United Kingdom, which include investment banking, trading, and brokerage

services, are subject to the Financial Services and Markets Act of 2000, which

regulates organizations that conduct investment businesses in the United

Kingdom including capital and liquidity requirements, and to the rules of

the Financial Services Authority. Nikko Citigroup Limited and Nikko Cordial

are registered securities companies in Japan, and as such their activities in

Japan are regulated principally by the Financial Services Agency of Japan.

These and other subsidiaries of Citigroup are also members of various

securities and commodities exchanges and are subject to the rules and

regulations of those exchanges. Citigroup’s other offices abroad are also

subject to the jurisdiction of foreign financial services regulatory authorities.

CGMI is a member of the Securities Investor Protection Corporation

(SIPC), which, in the event of the liquidation of a broker-dealer, provides

protection for customers’ securities accounts held by the firm of up to

$500,000 for each eligible customer, subject to a limitation of $100,000 for

claims for cash balances. To supplement the SIPC coverage, CGMI has

purchased for the benefit of its customers additional protection, subject to an

aggregate loss limit of $600 million and a per client cash loss limit of up to

$1.9 million.

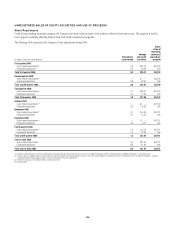

Unresolved SEC Staff Comments

The Company is in discussion with the SEC in response to comment letters

received from the SEC Division of Corporate Finance primarily regarding

Goodwill.

CAPITAL REQUIREMENTS

As a registered broker-dealer, CGMI is subject to the SEC’s Net Capital Rule.

CGMI computes net capital under the alternative method of the Net Capital

Rule, which requires the maintenance of minimum net capital equal to 2%

of aggregate debit items (as defined). A member of the NYSE may be required

to reduce its business if its net capital is less than 4% of aggregate debit

balances (as defined) and may also be prohibited from expanding its

business or paying cash dividends if resulting net capital would be less than

5% of aggregate debit balances. Furthermore, the Net Capital Rule does not

permit withdrawal of equity or subordinated capital if the resulting net

capital would be less than 5% of such aggregate debit balances.

The Net Capital Rule also limits the ability of broker-dealers to transfer

large amounts of capital to parent companies and other affiliates. Under the

Net Capital Rule, equity capital cannot be withdrawn from a broker-dealer

without the prior approval of that broker-dealer’s designated examining

authority (in the case of CGMI, the NYSE) in certain circumstances,

including when net capital after the withdrawal would be less than (i) 120%

of the minimum net capital required by the Net Capital Rule, or (ii) 25% of

the broker-dealer’s securities position “haircuts.” “Haircuts” is the term used

for deductions from capital of certain specified percentages of the market

value of securities to reflect the possibility of a market decline prior to

disposition. In addition, the Net Capital Rule requires broker-dealers to notify

the SEC and the appropriate self-regulatory organization two business days

before any withdrawals of excess net capital if the withdrawals (in the

aggregate over any 30-day period) would exceed the greater of $500,000 or

30% of the broker-dealer’s excess net capital, and two business days after any

228