Citibank 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

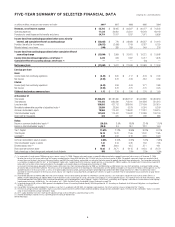

2008 IN SUMMARY

Citigroup reported a $32.1 billion loss from continuing operations ($6.42 per

share) for 2008. The results were impacted by continued losses related to the

disruption in the fixed income markets, higher consumer credit costs, and a

deepening of the global economic slowdown.

The net loss of $27.7 billion ($5.59 per share) in 2008 includes the results

and sales of the Company’s German retail banking operations and

CitiCapital (which were reflected as discontinued operations), as well as a

$9.568 billion Goodwill impairment charge based on the results of its fourth

quarter of 2008 goodwill impairment testing. The goodwill impairment

charge was recorded in North America Consumer Banking, Latin America

Consumer Banking and EMEA Consumer Banking.

During 2008, the Company benefited from substantial U.S. government

financial involvement, including (i) raising an aggregate $45 billion in

capital through the sale of Citigroup non-voting perpetual, cumulative

preferred stock and warrants to purchase common stock to the U.S.

Department of the Treasury (UST), (ii) entering into a loss-sharing

agreement with various U.S. government entities covering $301 billion of

Company assets, and (iii) issuing $5.75 billion of senior unsecured debt

guaranteed by the Federal Deposit Insurance Corporation (FDIC) (in

addition to $26.0 billion of commercial paper and interbank deposits of

Citigroup’s subsidiaries guaranteed by the FDIC outstanding as of

December 31, 2008). In connection with these programs and agreements,

Citigroup is required to pay consideration to the U.S. government, including

in the form of dividends on the preferred stock and other fees. In addition,

Citigroup has agreed not to pay common stock dividends in excess of $0.01

per share per quarter for three years (beginning in 2009) or to repurchase its

common stock without the consent of U.S. government entities. For

additional information on the above, see “TARP and Other Regulatory

Programs” on page 44.

In addition to the equity issuances to the UST under TARP, Citigroup

raised $32 billion of capital in private and public offerings during 2008.

In addition, on January 16, 2009, the Company announced a

realignment, for management and reporting purposes, into two businesses:

Citicorp, primarily comprised of the Company’s Global Institutional Bank

and the Company’s regional consumer banks; and Citi Holdings, primarily

comprised of the Company’s brokerage and asset management business,

local consumer finance business, and a special asset pool. Citigroup believes

that the realignment will optimize the Company’s global businesses for

future profitable growth and opportunities and will assist in the Company’s

ongoing efforts to reduce its balance sheet and simplify its organization. See

“Outlook for 2009” on page 7.

On February 27, 2009, the Company announced an exchange offer of its

common stock for up to $27.5 billion of its existing preferred securities and

trust preferred securities at a conversion price of $3.25 per share. The U.S.

government will match this exchange up to a maximum of $25 billion of its

preferred stock at the same conversion price. These transactions are intended

to increase the Company’s tangible common equity (TCE) and will require

no additional U.S. government investment in Citigroup. See “Outlook for

2009” on page 7.

During 2008, the Company also completed 19 strategic divestitures which

were designed to strengthen our franchises.

Revenues of $52.8 billion decreased 33% from 2007, primarily driven by

significantly lower revenues in ICG due to write-downs related to subprime

CDOs and leveraged lending and other fixed income exposures. Revenues

outside of ICG declined 6%. The Company’s revenues outside North America

declined 4% from 2007.

Net interest revenue grew 18% from 2007, reflecting the lower cost of funds,

as well as lower rates outside the U.S. The lower cost of funds more than offset

the decrease in the asset yields during the year. Net interest margin in 2008 was

3.06%, up 65 basis points from 2007 (see the discussion of net interest margin

on page 82). Non-interest revenue decreased $34 billion from 2007, primarily

reflecting subprime and fixed income write-downs.

Although the Company made significant progress in reducing its expense

base during the year, operating expenses increased 19% from the previous

year with lower operating expenses being offset by a $9.568 billion goodwill

impairment charge, higher restructuring/ repositioning charges and the

impact of acquisitions. Excluding the goodwill impairment charge, expenses

have declined for four consecutive quarters, due to lower incentive

compensation accruals and continued benefits from re-engineering efforts.

Headcount was down 52,000 from December 31, 2007.

The Company’s equity capital base and trust preferred securities were $165.5

billion at December 31, 2008. Stockholders’ equity increased by $28.2 billion

during 2008 to $141.6 billion, which was affected by capital issuances discussed

above, and the distribution of $7.6 billion in dividends to common and

preferred shareholders. Citigroup maintained its “well-capitalized” position

with a Tier 1 Capital Ratio of 11.92% at December 31, 2008.

Total credit costs of $33.3 billion included NCLs of $19.0 billion, up from

$9.9 billion in 2007, and a net build of $14.3 billion to credit reserves. The

build consisted of $10.8 billion in Consumer ($8.2 billion in North America

and $2.6 billion in regions outside North America), $3.3 billion in ICG and

$249 million in GWM (see “Credit Reserves” on page 11 for further

discussion). The Consumer loan loss rate was 3.75%, a 149 basis-point

increase from the fourth quarter of 2007. Corporate cash-basis loans were

$9.6 billion at December 31, 2008, an increase of $7.8 billion from year-ago

levels. This increase is primarily attributable to the transfer of non-accrual

loans from the held-for-sale portfolio to the held-for-investment portfolio

during the fourth quarter of 2008. The allowance for loan losses totaled

$29.6 billion at December 31, 2008, a coverage ratio of 4.27% of total loans.

The effective tax rate (benefit) of (39)% in 2008 primarily resulted from

the pretax losses in the Company’s Securities and Banking business taxed in

the U.S. (the U.S. is a higher tax-rate jurisdiction). In addition, the tax

benefits of permanent differences, including the tax benefit for not providing

U.S. income taxes on the earnings of certain foreign subsidiaries that are

indefinitely invested, favorably affected the Company’s effective tax rate.

At December 31, 2008, the Company had increased its structural liquidity

(equity, long-term debt and deposits) as a percentage of assets from 62% at

December 31, 2007 to approximately 66% at December 31, 2008. Citigroup

has continued its deleveraging, reducing total assets from $2,187 billion at

December 31, 2007 to $1,938 billion at December 31, 2008.

At December 31, 2008, the maturity profile of Citigroup’s senior long-term

unsecured borrowings had a weighted average maturity of seven years.

Citigroup also reduced its commercial paper program from $35 billion at

December 31, 2007 to $29 billion at December 31, 2008.

Recently, Robert Rubin, Sir Win Bischoff and Roberto Hernández

Ramirez announced they would not stand for re-election at Citigroup’s 2009

Annual Meeting of Stockholders. On February 23, 2009, Richard Parsons

became the Chairman of the Company.

6