Citibank 2008 Annual Report Download - page 129

Download and view the complete annual report

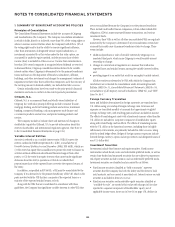

Please find page 129 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fair value that are determined to be other than temporary are recorded in

earnings immediately. Realized gains and losses on sales are included in

income primarily on a specific identification cost basis, and interest and

dividend income on such securities is included in Interest revenue.

• Venture capital investments held by Citigroup’s private equity subsidiaries

that are considered investment companies are carried at fair value with

changes in fair value reported in Other revenue. These subsidiaries

include entities registered as Small Business Investment Companies and

engage exclusively in venture capital activities.

• Certain investments in non-marketable equity securities and certain

investments that would otherwise have been accounted for using the

equity method are carried at fair value, since the Company has elected to

apply fair value accounting in accordance with SFAS 159, The Fair Value

Option for Financial Assets and Financial Liabilities (SFAS 159).

Changes in fair value of such investments are recorded in earnings.

• Certain non-marketable equity securities are carried at cost and

periodically assessed for other-than-temporary impairment, as set out in

Note 16 on page 158.

For investments in fixed-income securities classified as held-to-maturity

or available-for-sale, accrual of interest income is suspended for investments

that are in default or on which it is likely that future interest payments will

not be made as scheduled.

The Company uses a number of valuation techniques for investments

carried at fair value, which are described in Note 27 on page 202.

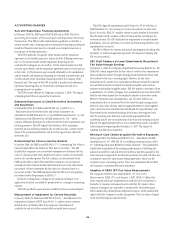

Trading Account Assets and Liabilities

Trading account assets include debt and marketable equity securities,

derivatives in a receivable position, residual interests in securitizations and

physical commodities inventory. In addition (as set out in Note 27 on page

202), certain assets that Citigroup has elected to carry at fair value under

SFAS 159, such as loans and purchased guarantees, are also included in

Trading account assets.

Trading account liabilities include securities sold, not yet purchased

(short positions), and derivatives in a net payable position, as well as certain

liabilities that Citigroup has elected to carry at fair value under SFAS 159 or

SFAS 155, Accounting for Certain Hybrid Financial Instruments (SFAS

155) as set out in Note 27 on page 202.

Other than physical commodities inventory, all trading account assets and

liabilities are carried at fair value. Revenues generated from trading assets and

trading liabilities are generally reported in Principal transactions and include

realized gains and losses as well as unrealized gains and losses resulting from

changes in the fair value of such instruments. Interest income on trading assets

is recorded in Interest revenue reduced by interest expense on trading liabilities.

Physical commodities inventory is carried at the lower of cost or market

(LOCOM) with related gains or losses reported in Principal transactions.

Realized gains and losses on sales of commodities inventory are included in

Principal transactions on a “first in, first out” basis.

Derivatives used for trading purposes include interest rate, currency,

equity, credit, and commodity swap agreements, options, caps and floors,

warrants, and financial and commodity futures and forward contracts.

Derivative asset and liability positions are presented net by counterparty on

the Consolidated Balance Sheet when a valid master netting agreement exists

and the other conditions set out in FASB Interpretation No. 39, “Offsetting of

Amounts Related to Certain Contracts” (FIN 39) are met.

The Company uses a number of techniques to determine the fair value of

trading assets and liabilities, all of which are described in Note 26 on

page 192.

Securities Borrowed and Securities Loaned

Securities borrowing and lending transactions generally do not constitute a

sale of the underlying securities for accounting purposes, and so are treated

as collateralized financing transactions when the transaction involves the

exchange of cash. Such transactions are recorded at the amount of cash

advanced or received plus accrued interest. As set out in Note 27 on page 202,

the Company has elected under SFAS 159 to apply fair value accounting to a

number of securities borrowing and lending transactions. Irrespective of

whether the Company has elected fair-value accounting, fees paid or received

for all securities lending and borrowing transactions are recorded in Interest

expense or Interest revenue at the contractually specified rate.

Where the conditions of FIN 39 are met, amounts recognized in respect of

securities borrowed and securities loaned are presented net on the

Consolidated Balance Sheet.

With respect to securities borrowed or loaned, the Company pays or

receives cash collateral in an amount in excess of the market value of

securities borrowed or loaned. The Company monitors the market value of

securities borrowed and loaned on a daily basis with additional collateral

received or paid as necessary.

As described in Note 26 on page 192, the Company uses a discounted

cash-flow technique to determine the fair value of securities lending and

borrowing transactions.

Repurchase and Resale Agreements

Securities sold under agreements to repurchase (repos) and securities

purchased under agreements to resell (reverse repos) generally do not

constitute a sale for accounting purposes of the underlying securities, and so

are treated as collateralized financing transactions. As set out in Note 27 on

page 202, the Company has elected to apply fair-value accounting to a

majority of such transactions, with changes in fair-value reported in

earnings. Any transactions for which fair-value accounting has not been

elected are recorded at the amount of cash advanced or received plus accrued

interest. Irrespective of whether the Company has elected fair-value

accounting, interest paid or received on all repo and reverse repo

transactions is recorded in Interest expense or Interest revenue at the

contractually specified rate.

Where the conditions of FASB Interpretation No. 41, “Offsetting of

Amounts Related to Certain Repurchase and Reverse Repurchase

Agreements” (FIN 41), are met, repos and reverse repos are presented net on

the Consolidated Balance Sheet.

The Company’s policy is to take possession of securities purchased under

agreements to resell. The market value of securities to be repurchased and

resold is monitored, and additional collateral is obtained where appropriate

to protect against credit exposure.

As described in Note 26 on page 192, the Company uses a discounted cash

flow technique to determine the fair value of repo and reverse repo

transactions.

Loans

Loans are reported at their outstanding principal balances net of any

unearned income and unamortized deferred fees and costs. Loan origination

123