Citibank 2008 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

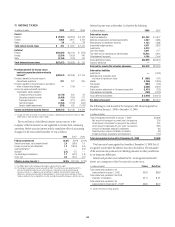

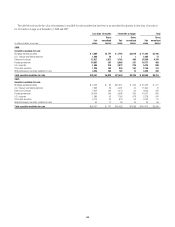

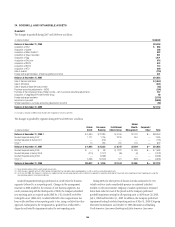

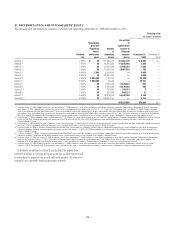

The following table presents the carrying value and fair value of debt

securities held-to-maturity by contractual maturity dates as of December 31,

2008:

In millions of dollars

Carrying

value Fair value

Mortgage-backed securities

Due within 1 year $ 73 $ 50

After 1 but within 5 years 102 101

After 5 but within 10 years 32 32

After 10 years (1) 30,531 27,568

Total $30,738 $27,751

State and municipal

Due within 1 year $ 138 $ 138

After 1 but within 5 years 137 137

After 5 but within 10 years 105 100

After 10 years (1) 5,321 4,992

Total $ 5,701 $ 5,367

All other (2)

Due within 1 year $ 4,448 $ 4,471

After 1 but within 5 years 11,142 10,862

After 5 but within 10 years 6,821 6,604

After 10 years (1) 5,609 5,322

Total $28,020 $27,259

Total debt securities held-to-maturity $64,459 $60,377

(1) Investments with no stated maturities are included as contractual maturities of greater than 10 years.

Actual maturities may differ due to call or prepayment rights.

(2) Includes asset-backed securities and all other debt securities.

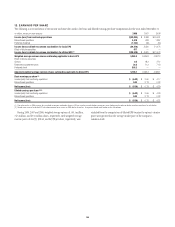

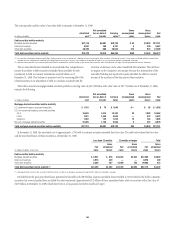

Evaluating Investments for Other-than-Temporary

Impairments

The Company conducts periodic reviews to identify and evaluate each

investment that has an unrealized loss, in accordance with FASB Staff

Position No. 115-1, The Meaning of Other-Than-Temporary Impairment

and Its Application to Certain Investments (FSP FAS 115-1). An unrealized

loss exists when the current fair value of an individual security is less than its

amortized cost basis. Unrealized losses that are determined to be temporary

in nature are recorded, net of tax, in Accumulated other comprehensive

income (AOCI) for available-for-sale securities, while such losses related to

held-to-maturity securities are not recorded, as these investments are carried

at their amortized cost (less any permanent impairment). For securities

transferred to held-to-maturity from Trading account assets, amortized cost

is defined as the fair value amount of the securities at the date of transfer.

For securities transferred to held-to-maturity from available-for-sale,

amortized cost is defined as the original purchase cost, plus or minus any

accretion or amortization of interest, less any impairment recognized in

earnings.

Regardless of the classification of the securities as available-for-sale or

held-to-maturity, the Company has assessed each position for credit

impairment.

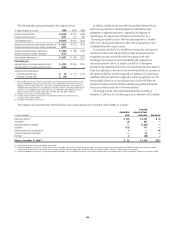

Factors considered in determining whether a loss is temporary include:

• the length of time and the extent to which fair value has been below cost;

• the severity of the impairment;

• the cause of the impairment and the financial condition and near-term

prospects of the issuer;

• activity in the market of the issuer which may indicate adverse credit

conditions; and

• the Company’s ability and intent to hold the investment for a period of

time sufficient to allow for any anticipated recovery.

The Company’s review for impairment generally entails:

• identification and evaluation of investments that have indications of

possible impairment;

• analysis of individual investments that have fair values less than

amortized cost, including consideration of the length of time the

investment has been in an unrealized loss position and the expected

recovery period;

• discussion of evidential matter, including an evaluation of factors or

triggers that could cause individual investments to qualify as having

other-than-temporary impairment and those that would not support

other-than-temporary impairment; and

• documentation of the results of these analyses, as required under business

policies.

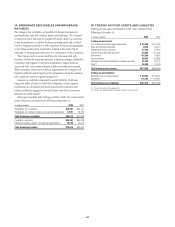

The extent of the Company’s analysis regarding credit quality and the

stress on assumptions used in the analysis have been refined for securities

where the current fair value or other characteristics of the security warrant.

For example, given the declines in fair values of mortgage-backed securities,

general concerns regarding housing prices and the delinquency and default

rates on the mortgage loans underlying these securities, the Company’s

analysis for identifying securities for which it is not probable that all

principal and interest contractually due will be recovered have been refined.

More specifically, for U.S. mortgage-backed securities (and in particular

for Alt-A and other mortgage-backed securities that have significant

unrealized losses as a percentage of amortized cost), credit impairment is

assessed using a cash flow model that estimates the cash flows on the

underlying mortgages, using the security-specific collateral and transaction

structure. The model estimates cash flows from the underlying mortgage

loans and distributes those cash flows to various tranches of securities,

considering the transaction structure and any subordination and credit

enhancements that exist in that structure. The cash flow model incorporates

actual cash flows on the mortgage-backed securities through the current

period and then projects the remaining cash flows using a number of

assumptions, including default rates, prepayment rates, and recovery rates

(on foreclosed properties).

162