Citibank 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

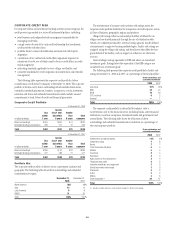

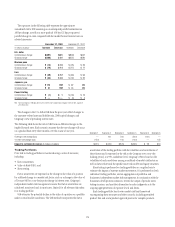

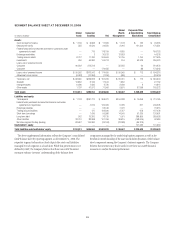

The exposures in the following table represent the approximate

annualized risk to NIR assuming an unanticipated parallel instantaneous

100 bps change, as well as a more gradual 100 bps (25 bps per quarter)

parallel change in rates compared with the market forward interest rates in

selected currencies.

December 31, 2008 December 31, 2007

In millions of dollars Increase Decrease Increase Decrease

U.S. dollar

Instantaneous change $(801) $391 $(940) $837

Gradual change $(456) $ 81 $(527) $540

Mexican peso

Instantaneous change $ (18) $ 18 $ (25) $ 25

Gradual change $ (14) $ 14 $ (17) $ 17

Euro

Instantaneous change $ (56) $ 57 $ (63) $ 63

Gradual change $ (43) $ 43 $ (32) $ 32

Japanese yen

Instantaneous change $ 172 NM $67 NM

Gradual change $51 NM $43 NM

Pound sterling

Instantaneous change $ (1) $ 1 $ (16) $ 16

Gradual change $— $— $ (4) $ 4

NM Not meaningful. A 100 bps decrease in interest rates would imply negative rates for the Japanese

yen yield curve.

The changes in the U.S. dollar IRE from the prior year reflect changes in

the customer-related asset and liability mix, 2008 capital changes, and

Citigroup’s view of prevailing interest rates.

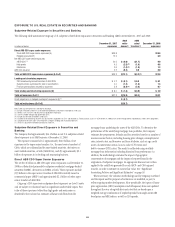

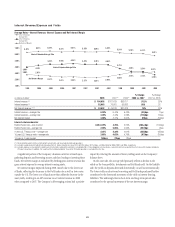

The following table shows the risk to NIR from six different changes in the

implied forward rates. Each scenario assumes that the rate change will occur

on a gradual basis every three months over the course of one year. Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6

Overnight rate change (bps) — 100 200 (200) (100) —

10-year rate change (bps) (100) — 100 (100) — 100

Impact to net interest revenue (in millions of dollars) $(424) $(435) $(576) $(333) $ 28 $30

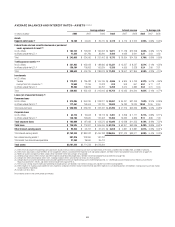

Trading Portfolios

Price risk in trading portfolios is monitored using a series of measures,

including:

• factor sensitivities;

• Value-at-Risk (VAR); and

• Stress testing.

Factor sensitivities are expressed as the change in the value of a position

for a defined change in a market risk factor, such as a change in the value of

a Treasury bill for a one-basis-point change in interest rates. Citigroup’s

independent market risk management ensures that factor sensitivities are

calculated, monitored and, in most cases, limited, for all relevant risks taken

in a trading portfolio.

VAR estimates the potential decline in the value of a position or a portfolio

under normal market conditions. The VAR method incorporates the factor

sensitivities of the trading portfolio with the volatilities and correlations of

those factors and is expressed as the risk to the Company over a one-day

holding period, at a 99% confidence level. Citigroup’s VAR is based on the

volatilities of and correlations among a multitude of market risk factors as

well as factors that track the specific issuer risk in debt and equity securities.

Stress testing is performed on trading portfolios on a regular basis to

estimate the impact of extreme market movements. It is performed on both

individual trading portfolios, and on aggregations of portfolios and

businesses. Independent market risk management, in conjunction with the

businesses, develops stress scenarios, reviews the output of periodic stress

testing exercises, and uses the information to make judgments as to the

ongoing appropriateness of exposure levels and limits.

Each trading portfolio has its own market risk limit framework

encompassing these measures and other controls, including permitted

product lists and a new product approval process for complex products.

73