Citibank 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Level 1–Quoted prices for identical instruments in active markets.

• Level 2–Quoted prices for similar instruments in active markets; quoted

prices for identical or similar instruments in markets that are not active;

and model derived valuations in which all significant inputs and

significant value drivers are observable in active markets.

• Level 3–Valuations derived from valuation techniques in which one or

more significant inputs or significant value drivers are unobservable.

This hierarchy requires the Company to use observable market data,

when available, and to minimize the use of unobservable inputs when

determining fair value. For some products or in certain market conditions,

observable inputs may not always be available. For example, during the

market dislocations that started in the second half of 2007, certain markets

became illiquid, and some key observable inputs used in valuing certain

exposures were unavailable. When and if these markets become liquid, the

valuation of these exposures will use the related observable inputs available

at that time from these markets.

Under SFAS 157, Citigroup is required to take into account its own credit

risk when measuring the fair value of derivative positions as well as the other

liabilities for which fair value accounting has been elected under SFAS 155,

Accounting for Certain Hybrid Financial Instruments and SFAS 159, The

Fair Value Option for Financial Assets and Financial Liabilities. The

adoption of SFAS 157 has also resulted in some other changes to the

valuation techniques used by Citigroup when determining fair value, most

notably the changes to the way that the probability of default of a

counterparty is factored in and the elimination of a derivative valuation

adjustment which is no longer necessary under SFAS 157. The cumulative

effect at January 1, 2007 of making these changes was a gain of $250 million

after-tax ($402 million pretax), or $0.05 per diluted share, which was

recorded in the first quarter of 2007 earnings within the S&B business.

SFAS 157 also precludes the use of block discounts for instruments traded

in an active market, which were previously applied to large holdings of

publicly traded equity securities, and requires the recognition of trade-date

gains after consideration of all appropriate valuation adjustments related to

certain derivative trades that use unobservable inputs in determining their

fair value. Previous accounting guidance allowed the use of block discounts

in certain circumstances and prohibited the recognition of day-one gains on

certain derivative trades when determining the fair value of instruments not

traded in an active market. The cumulative effect of these changes resulted

in an increase to January 1, 2007 retained earnings of $75 million.

Fair Value Option (SFAS 159)

In conjunction with the adoption of SFAS 157, the Company early-adopted

SFAS 159, The Fair Value Option for Financial Assets and Financial

Liabilities (SFAS 159), as of January 1, 2007. SFAS 159 provides an option on

an instrument-by-instrument basis for most financial assets and liabilities to

be reported at fair value with changes in fair value reported in earnings. After

the initial adoption, the election is made at the acquisition of a financial

asset, a financial liability, or a firm commitment and it may not be revoked.

SFAS 159 provides an opportunity to mitigate volatility in reported earnings

that resulted prior to its adoption from being required to apply fair value

accounting to certain economic hedges (e.g., derivatives) while having to

measure the assets and liabilities being economically hedged using an

accounting method other than fair value.

Under the SFAS 159 transition provisions, the Company elected to apply

fair value accounting to certain financial instruments held at January 1,

2007 with future changes in value reported in earnings. The adoption of

SFAS 159 resulted in a decrease to January 1, 2007 retained earnings of $99

million.

Leveraged Leases

On January 1, 2007, the Company adopted FSP FAS 13-2, “Accounting for a

Change or Projected Change in the Timing of Cash Flows Relating to

Income Taxes Generated by a Leverage Lease Transaction” (FSP 13-2),

which provides guidance regarding changes or projected changes in the

timing of cash flows relating to income taxes generated by a leveraged lease

transaction.

Leveraged leases can provide significant tax benefits to the lessor,

primarily as a result of the timing of tax payments. Since changes in the

timing and/or amount of these tax benefits may have a significant effect on

the cash flows of a lease transaction, a lessor, in accordance with FSP 13-2,

will be required to perform a recalculation of a leveraged lease when there is

a change or projected change in the timing of the realization of tax benefits

generated by that lease. Previously, Citigroup did not recalculate the tax

benefits if only the timing of cash flows had changed.

The adoption of FSP 13-2 resulted in a decrease to January 1, 2007

retained earnings of $148 million. This decrease to retained earnings will be

recognized in earnings over the remaining lives of the leases as tax benefits

are realized.

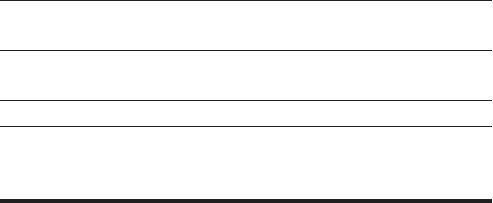

Accounting for Defined Benefit Pensions and Other

Postretirement Benefits

As of December 31, 2006, the Company adopted SFAS No. 158, Employer’s

Accounting for Defined Benefit Pensions and Other Postretirement

Benefits (SFAS 158). In accordance with this standard, Citigroup recorded

the funded status of each of its defined benefit pension and postretirement

plans as an asset or liability on its Consolidated Balance Sheet with a

corresponding offset, net of taxes, recorded in Accumulated other

comprehensive income (loss) within Stockholders’ equity, resulting in an

after-tax decrease in equity of $1.647 billion. See Note 9 on page 144.

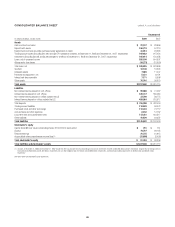

The following table shows the effects of adopting SFAS 158 at

December 31, 2006 on individual line items in the Consolidated Balance

Sheet at December 31, 2006:

In millions of dollars

Before

application

of

SFAS 158 Adjustments

After

application

of

SFAS 158

Other assets

Prepaid benefit cost $ 2,620 $ (534) $ 2,086

Other liabilities

Accrued benefit liability $ — $ 2,147 $ 2,147

Deferred taxes, net $ 3,653 $ 1,034 $ 4,687

Accumulated other

comprehensive income (loss) $ (2,053) $(1,647) (1) $ (3,700)

Total stockholders’ equity $121,430 $(1,647) (1) $119,783

(1) Adjustment to initially apply SFAS 158, net of taxes.

130