Citibank 2008 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

application of specific accounting literature. For the nonconsolidated

proprietary TOB trusts and QSPE TOB trusts, the Company recognizes only its

residual investment on its balance sheet at fair value and the third-party

financing raised by the trusts is off-balance sheet.

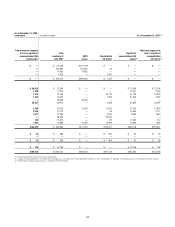

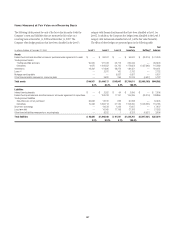

The following table summarizes selected cash flow information related to

municipal bond securitizations for the years 2008, 2007 and 2006:

In billions of dollars 2008 2007 2006

Proceeds from new securitizations $1.2 $10.5 —

Cash flows received on retained interests and other net

cash flows 0.5 ——

Municipal Investments

Municipal investment transactions represent partnerships that finance the

construction and rehabilitation of low-income affordable rental housing.

The Company generally invests in these partnerships as a limited partner

and earns a return primarily through the receipt of tax credits earned from

the affordable housing investments made by the partnership.

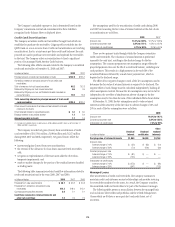

Client Intermediation

Client intermediation transactions represent a range of transactions designed

to provide investors with specified returns based on the returns of an

underlying security, referenced asset or index. These transactions include

credit-linked notes and equity-linked notes. In these transactions, the SPE

typically obtains exposure to the underlying security, referenced asset or

index through a derivative instrument, such as a total-return swap or a

credit-default swap. In turn the SPE issues notes to investors that pay a

return based on the specified underlying security, referenced asset or index.

The SPE invests the proceeds in a financial asset or a guaranteed insurance

contract (GIC) that serves as collateral for the derivative contract over the

term of the transaction. The Company’s involvement in these transactions

includes being the counterparty to the SPE’s derivative instruments and

investing in a portion of the notes issued by the SPE. In certain transactions,

the investor’s maximum risk of loss is limited and the Company absorbs risk

of loss above a specified level.

The Company’s maximum risk of loss in these transactions is defined as

the amount invested in notes issued by the SPE and the notional amount of

any risk of loss absorbed by the Company through a separate instrument

issued by the SPE. The derivative instrument held by the Company may

generate a receivable from the SPE (for example, where the Company

purchases credit protection from the SPE in connection with the SPE’s

issuance of a credit-linked note), which is collateralized by the assets owned

by the SPE. These derivative instruments are not considered variable interests

under FIN 46(R) and any associated receivables are not included in the

calculation of maximum exposure to the SPE.

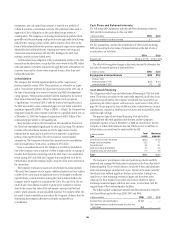

Structured Investment Vehicles

Structured Investment Vehicles (SIVs) are SPEs that issue junior notes and

senior debt (medium-term notes and short-term commercial paper) to fund

the purchase of high quality assets. The junior notes are subject to the “first

loss” risk of the SIVs. The SIVs provide a variable return to the junior note

investors based on the net spread between the cost to issue the senior debt

and the return realized by the high quality assets. The Company acts as

manager for the SIVs and, prior to December 13, 2007, was not contractually

obligated to provide liquidity facilities or guarantees to the SIVs.

In response to the ratings review of the outstanding senior debt of the SIVs

for a possible downgrade announced by two ratings agencies and the

continued reduction of liquidity in the SIV-related asset-backed commercial

paper and medium-term note markets, on December 13, 2007, Citigroup

announced its commitment to provide support facilities that would support

the SIVs’ senior debt ratings. As a result of this commitment, Citigroup

became the SIVs’ primary beneficiary and began consolidating these entities.

On February 12, 2008, Citigroup finalized the terms of the support

facilities, which took the form of a commitment to provide $3.5 billion of

mezzanine capital to the SIVs in the event the market value of their junior

notes approaches zero. The mezzanine capital facility was increased by $1

billion to $4.5 billion, with the additional commitment funded during the

fourth quarter of 2008. The facilities rank senior to the junior notes but

junior to the commercial paper and medium-term notes. The facilities were

at arm’s-length terms. Interest was paid on the drawn amount of the

facilities and a per annum fee was paid on the unused portion.

During the period to November 18, 2008, the Company wrote down $3.3

billion on SIV assets.

In order to complete the wind-down of the SIVs, the Company, in a nearly

cashless transaction, purchased the remaining assets of the SIVs at fair value,

with a trade date of November 18, 2008. The Company funded the purchase

of the SIV assets by assuming the obligation to pay amounts due under the

medium-term notes issued by the SIVs, as the medium-term notes mature.

The net funding provided by the Company to fund the purchase of the SIV

assets was $0.3 billion.

As of December 31, 2008, the carrying amount of the purchased SIV assets

was $16.6 billion, of which $16.5 billion is classified as HTM assets.

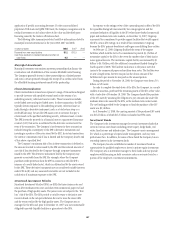

Investment Funds

The Company is the investment manager for certain investment funds that

invest in various asset classes including private equity, hedge funds, real

estate, fixed income and infrastructure. The Company earns a management

fee, which is a percentage of capital under management, and may earn

performance fees. In addition, for some of these funds the Company has an

ownership interest in the investment funds.

The Company has also established a number of investment funds as

opportunities for qualified employees to invest in private equity investments.

The Company acts as investment manager to these funds and may provide

employees with financing on both a recourse and non-recourse basis for a

portion of the employees’ investment commitments.

187