Citibank 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

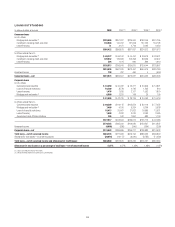

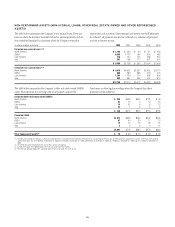

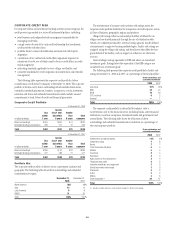

LOAN MATURITIES AND FIXED/VARIABLE PRICING

Corporate Loans

In millions of dollars at year end

Due

within

1 year

Over 1 year

but within

5 years

Over 5

years Total

Corporate loan portfolio

maturities

In U.S. offices:

Commercial and industrial

loans $ 25,913 $ 3,827 $ 3,710 $ 33,450

Financial institutions 8,110 1,061 1,029 10,200

Mortgage and real estate 3,690 1,609 1,261 6,560

Lease financing 1,173 154 149 1,476

In offices outside the U.S. 63,249 42,760 21,508 127,517

Total corporate loans $102,135 $49,411 $27,657 $179,203

Fixed/variable pricing of

corporate loans with

maturities due after one

year (1)

Loans at fixed interest rates $ 6,904 $ 7,764

Loans at floating or adjustable

interest rates 42,507 19,893

Total $49,411 $27,657

(1) Based on contractual terms. Repricing characteristics may effectively be modified from time to time

using derivative contracts. See Note 24 to the Consolidated Financial Statements on page 189.

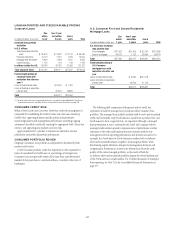

U.S. Consumer First and Second Residential

Mortgage Loans

In millions of dollars at year end

Due

within

1 year

Over 1 year

but within

5 years

Over 5

years Total

U.S. Consumer mortgage

loan portfolio type

First mortgages $17,423 $51,495 $ 92,167 $161,085

Second mortgages 30,073 1,752 36,654 68,479

Total $47,496 $53,247 $128,821 $229,564

Fixed/variable pricing of

U.S. Consumer

mortgage loans with

maturities due after one

year

Loans at fixed interest rates $ 6,984 $107,078

Loans at floating or adjustable

interest rates 46,263 21,743

Total $53,247 $128,821

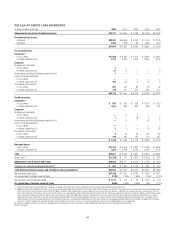

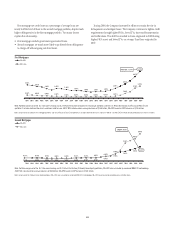

CONSUMER CREDIT RISK

Within Global Cards and Consumer Banking, credit risk management is

responsible for establishing the Global Cards and Consumer Banking

Credit Policy, approving business-specific policies and procedures,

monitoring business risk management performance, providing ongoing

assessment of portfolio credit risk, ensuring the appropriate level of loan loss

reserves, and approving new products and new risks.

Approval policies for a product or business are tailored to internal

profitability and credit risk portfolio performance.

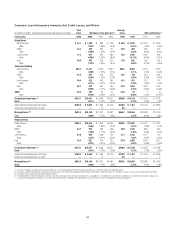

CONSUMER PORTFOLIO REVIEW

Citigroup’s consumer loan portfolio is comparatively diversified by both

product and location.

In the Consumer portfolio, credit loss experience is often expressed in

terms of annualized net credit losses as a percentage of average loans.

Consumer loans are generally written off no later than a predetermined

number of days past due on a contractual basis, or earlier in the event of

bankruptcy.

The following table summarizes delinquency and net credit loss

experience in both the managed and on-balance-sheet consumer loan

portfolios. The managed loan portfolio includes held-for-sale and securitized

credit card receivables. Only North America Cards from a product view, and

North America from a regional view, are impacted. Although a managed

basis presentation is not in conformity with GAAP, the Company believes

managed credit statistics provide a representation of performance and key

indicators of the credit card business that are consistent with the way

management reviews operating performance and allocates resources. For

example, the North America Cards business considers both on-balance-

sheet and securitized balances (together, its managed portfolio) when

determining capital allocation and general management decisions and

compensation. Furthermore, investors use information about the credit

quality of the entire managed portfolio, as the results of both the

on-balance-sheet and securitized portfolios impact the overall performance

of the North America Cards business. For a further discussion of managed-

basis reporting, see Note 23 to the Consolidated Financial Statements on

page 175.

57