Citibank 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

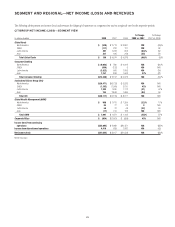

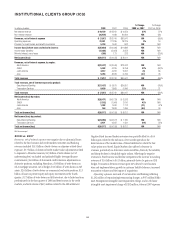

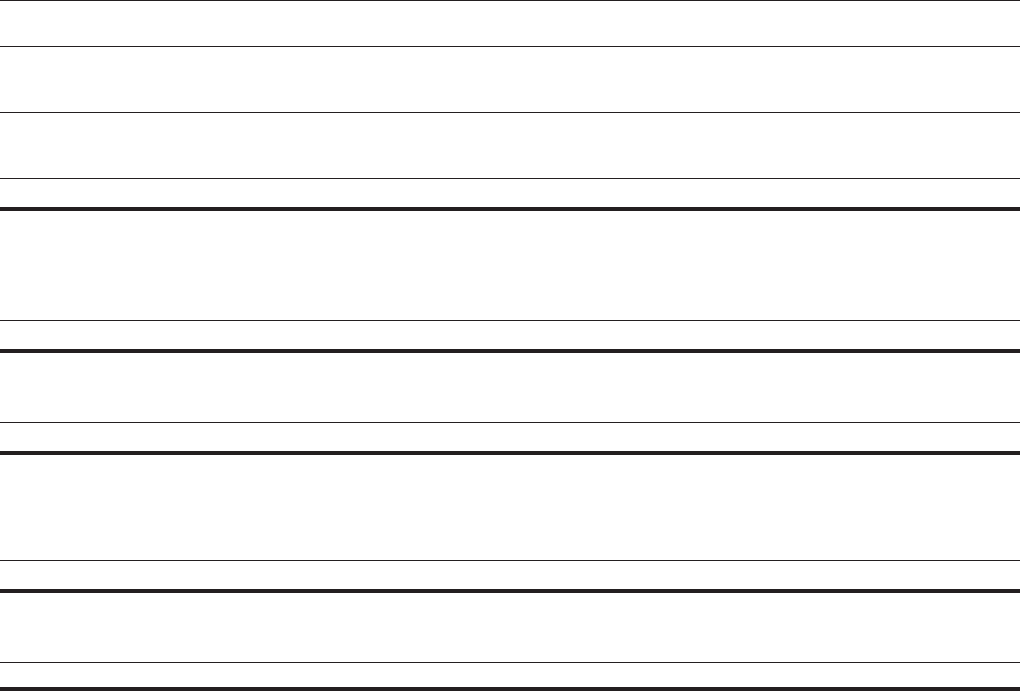

INSTITUTIONAL CLIENTS GROUP (ICG)

In millions of dollars 2008 2007 2006

% Change

2008 vs. 2007

% Change

2007 vs. 2006

Net interest revenue $ 19,159 $12,242 $ 9,653 57% 27%

Non-interest revenue (26,976) 1,498 20,994 NM (93)

Revenues, net of interest expense $ (7,817) $13,740 $30,647 NM (55)%

Operating expenses 22,851 21,236 18,229 8% 16

Provision for credit losses and benefits and claims 5,234 1,540 532 NM NM

Income (loss) before taxes and minority interest $(35,902) $ (9,036) $11,886 NM NM

Income taxes (benefits) (15,405) (5,054) 3,052 NM NM

Minority interest, net of taxes (380) 173 223 NM (22)%

Net income (loss) $(20,117) $ (4,155) $ 8,611 NM NM

Revenues, net of interest expense, by region:

North America $(22,477) $ (3,040) $13,032 NM NM

EMEA 5,592 4,235 8,758 32% (52)%

Latin America 3,812 4,206 3,091 (9) 36

Asia 5,256 8,339 5,766 (37) 45

Total revenues $ (7,817) $13,740 $30,647 NM (55)%

Total revenues, net of interest expense by product:

Securities and Banking $(17,437) $ 5,875 $24,651 NM (76)%

Transaction Services 9,620 7,865 5,996 22% 31

Total revenues $ (7,817) $13,740 $30,647 NM (55)%

Net income (loss) by region:

North America $(20,471) $ (6,733) $ 3,533 NM NM

EMEA (1,102) (1,900) 2,010 42% NM

Latin America 1,292 1,630 1,112 (21) 47%

Asia 164 2,848 1,956 (94) 46

Total net income (loss) $(20,117) $ (4,155) $ 8,611 NM NM

Net income (loss) by product:

Securities and Banking $(23,088) $ (6,377) $ 7,180 NM NM

Transaction Services 2,971 2,222 1,431 34% 55%

Total net income (loss) $(20,117) $ (4,155) $ 8,611 NM NM

NM Not meaningful.

2008 vs. 2007

Revenues, net of interest expense were negative due to substantial losses

related to the fixed income and credit markets. Securities and Banking

revenues included $14.3 billion of write-downs on subprime-related direct

exposure, $5.7 billion of downward credit market value adjustments related

to exposure to Monoline insurers, $4.9 billion of write-downs (net of

underwriting fees) on funded and unfunded highly leveraged finance

commitments, $4.4 billion of downward credit valuation adjustments on

derivative positions, excluding Monolines, $3.8 billion of write-downs on

Alt-A mortgage securities, net of hedges, $3.3 billion of write-downs on SIV

assets, $2.6 billion of write-downs on commercial real estate positions, $2.5

billion of losses in private equity and equity investments in the fourth

quarter, $1.7 billion of write-downs on ARS inventory, due to failed auctions

predominately in the first quarter of 2008 and deterioration in the credit

markets, and write-downs of $413 million related to the ARS settlement.

Negative Fixed Income Markets revenues were partially offset by a $4.6

billion gain related to the inclusion of Citi’s credit spreads in the

determination of the market value of those liabilities for which the fair-

value option was elected. Equity Markets also suffered a decrease in

revenues, particularly in derivatives and convertibles, driven by the volatility

and sharp declines in the global equity indices. Offsetting the negative

revenues in Fixed Income and decline in Equities is the increase in Lending

revenues of $1.6 billion to $4.1 billion, primarily driven by gains on CDS

hedges. Transaction Services revenues grew 22% driven by new business

wins and implementations, growth in customer liability balances, increased

transaction volumes and the impact of acquisitions.

Operating expenses increased 4% in Securities and Banking reflecting

$1,242 million of repositioning/restructuring charges, a $937 million Nikko

Asset Management intangible asset impairment charge, and an Old Lane

intangible asset impairment charge of $202 million, whereas 2007 expenses

34