Citibank 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The 2008 fourth quarter housing-price changes were estimated using a

forward-looking projection. In the second half of 2008, this projection

incorporated the Loan Performance Index, whereas in the first half of 2008,

it incorporated the S&P Case Shiller Index. This change was made because

the Loan Performance Index provided more comprehensive geographic data.

In addition, the Company’s mortgage default model also uses recent

mortgage performance data, a period of sharp home price declines and high

levels of mortgage foreclosures.

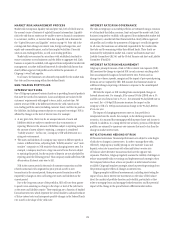

The valuation as of December 31, 2008, assumes a cumulative decline in

U.S. housing prices from peak to trough of 33%. This rate assumes declines

of 16% and 13% in 2008 and 2009, respectively, the remainder of the 33%

decline having already occurred before the end of 2007.

In addition, during the last three quarters of 2008, the discount rates were

based on a weighted average combination of the implied spreads from

single-name ABS bond prices, ABX indices and CLO spreads, depending on

vintage and asset types. To determine the discount margin, the Company

applies the mortgage default model to the bonds underlying the ABX indices

and other referenced cash bonds and solves for the discount margin that

produces the market prices of those instruments.

In the third quarter of 2008, the valuation of the high-grade and

mezzanine ABS CDO positions was changed from model valuation to trader

prices based on the underlying assets of each high-grade and mezzanine ABS

CDO. Unlike the ABCP- and CDO-squared positions, the high-grade and

mezzanine positions are now largely hedged through the ABX and bond

short positions, which are, by necessity, trader priced. Thus, this change

brings closer symmetry in the way these long and short positions are valued

by the Company. Additionally, there were a number of liquidations of high-

grade and mezzanine positions during the third quarter. These were at prices

close to the value of trader prices. The liquidation proceeds in total were also

above the June 30, 2008 carrying amount of the positions liquidated.

Citigroup intends to use trader marks to value this portion of the portfolio

going forward so long as it remains largely hedged.

The primary drivers that currently impact the model valuations are the

discount rates used to calculate the present value of projected cash flows and

projected mortgage loan performance. In valuing its direct ABCP- and

CDO-squared super senior exposures, the Company has made its best

estimate of the key inputs that should be used in its valuation methodology.

However, the size and nature of these positions as well as current market

conditions are such that changes in inputs such as the discount rates used to

calculate the present value of the cash flows can have a significant impact

on the reported value of these exposures. For instance, each 10 basis point

change in the discount rate used generally results in an approximate $32

million change in the fair value of the Company’s direct ABCP- and

CDO-squared super senior exposures as of December 31, 2008. This applies to

both decreases in the discount rate (which would increase the value of these

assets and decrease reported write-downs) and increases in the discount rate

(which would decrease the value of these assets and increase reported write-

downs).

Estimates of the fair value of the CDO super senior exposures depend on

market conditions and are subject to further change over time. In addition,

while Citigroup believes that the methodology used to value these exposures

is reasonable, the methodology is subject to continuing refinement,

including those made as a result of market developments. Further, any

observable transactions in respect of some or all of these exposures could be

employed in the fair valuation process in accordance with and in the

manner called for by SFAS 157.

Lending and Structuring Exposures

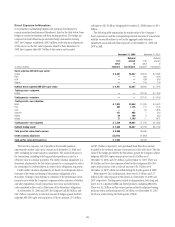

The $2.1 billion of subprime-related exposures includes approximately $0.1

billion of CDO warehouse inventory and unsold tranches of ABS CDOs,

approximately $1.3 billion of actively managed subprime loans purchased for

resale or securitization at a discount to par during 2007 and approximately

$1.3 billion of financing transactions with customers secured by subprime

collateral. These amounts represent the fair value as determined using

observable inputs and other market data. The majority of the change from the

December 31, 2007 balances reflects sales, transfers and liquidations.

S&B also has trading positions, both long and short, in U.S. subprime

RMBS and related products, including ABS CDOs, which are not included in

the figures above. The exposure from these positions is actively managed and

hedged, although the effectiveness of the hedging products used may vary

with material changes in market conditions.

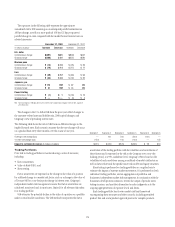

Exposure to Commercial Real Estate

The Company, through its business activities and as a capital markets

participant, incurs exposures that are directly or indirectly tied to the global

commercial real estate market. These exposures are represented primarily by

the following three categories:

(1) Assets held at fair value include:$5.8 billion, of which

approximately $3.5 billion are securities, loans and other items linked to

commercial real estate that are carried at fair value as trading account

assets, and approximately $2.3 billion of which are securities backed by

commercial real estate carried at fair value as available-for-sale investments.

Changes in fair value for these trading account assets are reported in current

earnings, while changes in fair value for these available-for-sale investments

are reported in OCI with other-than-temporary impairments reported in

current earnings.

The majority of these exposures are classified as Level 3 in the fair-value

hierarchy. Weakening activity in the trading markets for some of these

instruments resulted in reduced liquidity, thereby decreasing the observable

inputs for such valuations, and could have an adverse impact on how these

instruments are valued in the future if such conditions persist.

During the fourth quarter of 2008, approximately $3.3 billion of

commercial real estate loans and loan commitments that had been included

in this category, because they were classified as held-for-sale and measured

at the lower-of-cost-or-market (LOCOM), were reclassified to assets held at

amortized cost since management’s intent for these exposures changed to

held for investment.

(2) Assets held at amortized cost include approximately $2.0 billion of

securities classified as held-to-maturity and $24.9 billion of loans and

commitments. The held-to-maturity securities were classified as such during

the fourth quarter of 2008 and were previously classified as either trading or

available for sale. They are accounted for at amortized cost, subject to other-

than-temporary impairment. Loans and commitments are recorded at

amortized cost, less loan loss reserves. The impact from changes in credit is

reflected in the calculation of the allowance for loan losses and in net credit

losses.

(3) Equity and other investments include approximately $4.7 billion of

equity and other investments such as limited partner fund investments which

are accounted for under the equity method.

69