Citibank 2008 Annual Report Download - page 202

Download and view the complete annual report

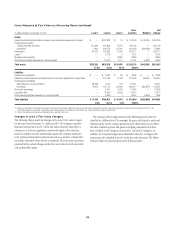

Please find page 202 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Commercial Real Estate Exposure

Citigroup reports a number of different exposures linked to commercial real

estate at fair value with changes in fair value reported in earnings, including

securities, loans and investments in entities that hold commercial real estate

loans or commercial real estate directly. The Company also reports securities

backed by commercial real estate as Available-for-sale investments, which

are carried at fair value with changes in fair-value reported in AOCI.

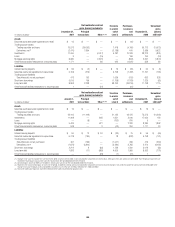

Similar to the valuation methodologies used for other trading securities

and trading loans, the Company generally determines the fair value of

securities and loans linked to commercial real estate utilizing internal

valuation techniques. Fair-value estimates from internal valuation

techniques are verified, where possible, to prices obtained from independent

vendors. Vendors compile prices from various sources. Where available, the

Company may also make use of quoted prices for recent trading activity in

securities or loans with the same or similar characteristics to that being

valued. Securities and loans linked to commercial real estate valued using

these methodologies are generally classified as Level 3 as a result of the

reduced liquidity currently in the market for such exposures.

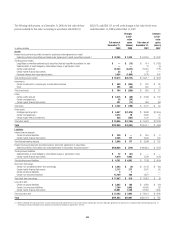

The fair value of investments in entities that hold commercial real estate

loans or commercial real estate directly is determined using a similar

methodology to that used for other non-public investments in real estate

held by the S&B business. The Company uses an established process for

determining the fair value of such securities, using commonly accepted

valuation techniques, including the use of earnings multiples based on

comparable public securities, industry-specific non-earnings-based multiples

and discounted cash flow models. In determining the fair value of such

investments, the Company also considers events, such as a proposed sale of

the investee company, initial public offerings, equity issuances, or other

observable transactions. Such investments are generally classified in Level 3

of the fair-value hierarchy.

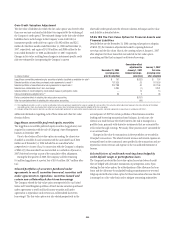

Highly Leveraged Financing Commitments

The Company reports a number of highly leveraged loans as held for sale,

which are measured on a LOCOM basis. The fair value of such exposures is

determined, where possible, using quoted secondary-market prices and

classified in Level 2 of the fair-value hierarchy if there is a sufficient level of

activity in the market and quotes or traded prices are available with suitable

frequency.

However, due to the dislocation of the credit markets and the reduced

market interest in higher risk/higher yield instruments since the latter half

of 2007, liquidity in the market for highly leveraged financings has been

limited. Therefore, a majority of such exposures are classified in Level 3 as

quoted secondary market prices do not generally exist. The fair value for

such exposures is determined using quoted prices for a similar asset or assets,

adjusted for the specific attributes of the loan being valued.

196