Citibank 2008 Annual Report Download - page 41

Download and view the complete annual report

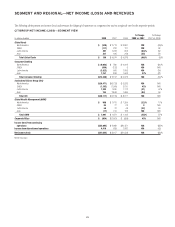

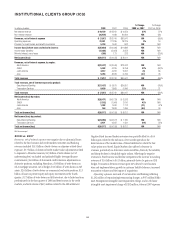

Please find page 41 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.included $370 million of repositioning/restructuring charges, partially offset

by a $300 million release of litigation reserves. Expenses increased 11% in

Transaction Services due to higher expenses driven by organic business

growth, higher variable expenses related to sales and revenue growth, and

the Bisys Group acquisition.

Provisions for credit losses and for benefits and claims in Securities

and Banking increased, primarily from an incremental net charge to

increase loan loss reserves of $2.5 billion, reflecting loan loss reserves for

specific counterparties, as well as a weakening in credit quality in the

corporate credit environment and a $1.1 billion increase in net credit losses

mainly associated with loan sales. Transaction Services credit costs

increased, primarily due to a charge to increase loan loss reserves, mainly

from the commercial banking portfolio in the emerging markets.

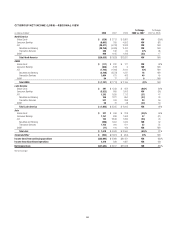

2007 vs. 2006

Revenues, net of interest expense decreased 55% driven by $20.7 billion of

pretax write-downs and losses related to deterioration in the mortgage-

backed and credit markets. The losses consisted primarily of approximately

$18.3 billion related to direct subprime-related exposures and write-downs of

approximately $1.5 billion pretax, net of underwriting fees, on funded and

unfunded highly leveraged finance commitments. Of this amount,

approximately $1.3 billion of impairment was recognized for transactions

that had been funded as of December 31, 2007, and $0.2 billion of

impairment was recognized on transactions that were unfunded as of

December 31, 2007. Securities and Banking’s remaining $37.3 billion in U.S.

subprime net direct exposure as of December 31, 2007 consisted of

(a) approximately $8.0 billion of subprime-related exposures in its lending

and structuring business and (b) approximately $29.3 billion of net

exposures to the super senior tranches of CDOs which are collateralized by

asset-backed securities, derivatives on asset-backed securities, or both. The

decreases were offset partially by increased revenues in Equity Markets from

cash trading and strong growth in equity finance, in Advisory from strong

deal volumes, in Equity Underwriting and in Lending. Transaction Services

revenues increased 31% reflecting growth in liability balances, transaction

volumes and assets under custody mainly in Cash Management and

Securities and Funds Services. Average liability balances grew 30% to $247

billion in 2007 as compared to 2006 due to growth across all regions,

reflecting positive flow from new and existing customers.

Operating expenses increased 16% due to higher business volumes,

higher non-incentive compensation staff expenses and increased costs driven

by the Bisys Group, Nikko Cordial, Grupo Cuscatlán, Old Lane and ATD

acquisitions. Operating expenses also increased driven by the

implementation of a headcount reduction plan to reduce ongoing expenses.

This resulted in a $438 million pretax charge to compensation and benefits

in connection with headcount reductions. Expense growth in 2007 was

favorably affected by the absence of a $354 million charge related to the

initial adoption of SFAS 123(R) in 2006 and a $300 million pretax release of

litigation reserves in 2007.

Provisions for credit losses and for benefits and claims increased

approximately $1.0 billion, driven by higher net credit losses, mainly from

loans with subprime-related direct exposure, and a higher net charge to

increase loan loss and unfunded lending commitment reserves reflecting a

slight weakening in overall portfolio credit quality, as well as loan loss

reserves for specific counterparties. Subprime-related loans accounted for

approximately $860 million of credit costs in 2007, of which $704 million

was recorded in the fourth quarter.

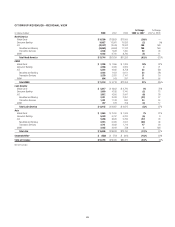

OUTLOOK FOR 2009

During 2009, the Company’s Securities and Banking businesses will

continue to be significantly affected by the levels of and volatility in the

global capital markets and economic and political developments, in the U.S.

and globally. Default rates are expected to be at historic highs by the end of

2009 and could negatively impact the cost of credit. Growth in the

transaction services business could be offset by lower interest rates and

continued potential pressure on asset values. See “Outlook for 2009” on

page 7 and “Risk Factors” on page 47.

The Company intends to continue to manage down legacy positions that

have proven illiquid to reduce future losses. The Company’s global

Transaction Services business will continue to focus on generating earnings

growth, leveraging its strong global platform and its ability to innovatively

serve large multinational clients seeking to optimize their working capital.

In addition, Citigroup’s management and reporting realignment will

result in the restructuring of the Securities and Banking businesses, effective

for reporting purposes in the second quarter of 2009, resulting in a focus on

the Company’s core assets, such as its global Transaction Services and

investment banking business, and managing and maximizing the value of

its other legacy assets.

35