Citibank 2008 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

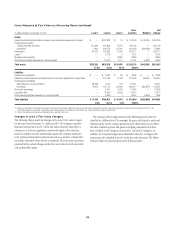

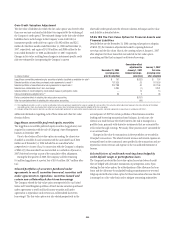

Own-Credit Valuation Adjustment

The fair value of liabilities for which the fair-value option was elected (other

than non-recourse and similar liabilities) was impacted by the widening of

the Company’s credit spread. The estimated change in the fair value of these

liabilities due to such changes in the Company’s own credit risk (or

instrument-specific credit risk) was a gain of $1,982 million and $212

million for the three months ended December 31, 2008 and December 31,

2007, respectively, and a gain of $4,558 million and $888 million for the

years ended December 31, 2008 and December 31, 2007, respectively.

Changes in fair value resulting from changes in instrument-specific credit

risk were estimated by incorporating the Company’s current

observable credit spreads into the relevant valuation technique used to value

each liability as described above.

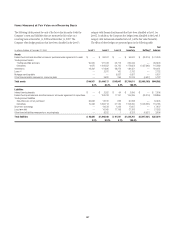

SFAS 159 The Fair-Value Option for Financial Assets and

Financial Liabilities

Detailed below are the December 31, 2006 carrying values prior to adoption

of SFAS 159, the transition adjustments booked to opening Retained

earnings and the fair values (that is, the carrying values at January 1, 2007

after adoption) for those items that were selected for fair-value option

accounting and that had an impact on Retained earnings:

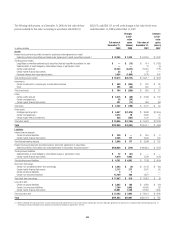

In millions of dollars

December 31, 2006

(carrying value

prior to adoption)

Cumulative-effect

adjustment to

January 1, 2007

retained earnings–

gain (loss)

January 1, 2007

fair value

(carrying value

after adoption)

Legg Mason convertible preferred equity securities originally classified as available-for-sale(1) $ 797 $(232) $ 797

Selected portfolios of securities purchased under agreements to resell (2) 167,525 25 167,550

Selected portfolios of securities sold under agreements to repurchase (2) 237,788 40 237,748

Selected non-collateralized short-term borrowings 3,284 (7) 3,291

Selected letters of credit hedged by credit default swaps or participation notes — 14 14

Various miscellaneous eligible items (1) 96 3 96

Pretax cumulative effect of adopting fair-value option accounting $(157)

After-tax cumulative effect of adopting fair-value option accounting (99)

(1) The Legg Mason securities as well as several miscellaneous items were previously reported at fair value in available-for-sale securities. The cumulative-effect adjustment represents the reclassification of the related

unrealized gain/loss from Accumulated other comprehensive income (loss) to Retained earnings upon the adoption of the fair value option.

(2) Excludes netting of the amounts due from securities purchased under agreements to resell and the amounts owed under securities sold under agreements to repurchase in accordance with FIN 41.

Additional information regarding each of these items and other fair-value

elections follows.

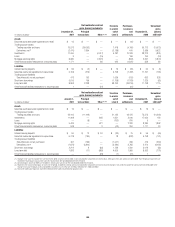

Legg Mason convertible preferred equity securities

The Legg Mason convertible preferred equity securities (Legg shares) were

acquired in connection with the sale of Citigroup’s Asset Management

business in December 2005.

Prior to the election of fair-value option accounting, the shares were

classified as available-for-sale securities with the unrealized loss of $232

million as of December 31, 2006 included in Accumulated other

comprehensive income (loss). In connection with the Company’s adoption

of SFAS 159, this unrealized loss was recorded as a reduction of January 1,

2007 Retained earnings as part of the cumulative-effect adjustment.

During the first quarter of 2008, the Company sold the remaining

8.4 million Legg shares at a pretax loss of $10.3 million ($6.7 million after-

tax).

Selected portfolios of securities purchased under

agreements to resell, securities borrowed, securities sold

under agreements to repurchase, securities loaned and

certain non-collateralized short-term borrowings

The Company elected the fair-value option retrospectively for our United

States and United Kingdom portfolios of fixed-income securities purchased

under agreements to resell and fixed-income securities sold under

agreements to repurchase (and certain non-collateralized short-term

borrowings). The fair-value option was also elected prospectively in the

second quarter of 2007 for certain portfolios of fixed-income securities

lending and borrowing transactions based in Japan. In each case, the

election was made because the related interest-rate risk is managed on a

portfolio basis, primarily with derivative instruments that are accounted for

at fair value through earnings. Previously, these positions were accounted for

on an accrual basis.

Changes in fair value for transactions in these portfolios are recorded in

Principal transactions. The related interest revenue and interest expense are

measured based on the contractual rates specified in the transactions and are

reported as interest revenue and expense in the Consolidated Statement of

Income.

Selected letters of credit and revolving loans hedged by

credit default swaps or participation notes

The Company has elected the fair-value option for certain letters of credit

that are hedged with derivative instruments or participation notes. Upon

electing the fair-value option, the related portions of the allowance for loan

losses and the allowance for unfunded lending commitments were reversed.

Citigroup elected the fair-value option for these transactions because the risk

is managed on a fair-value basis and to mitigate accounting mismatches.

204