Citibank 2008 Annual Report Download - page 199

Download and view the complete annual report

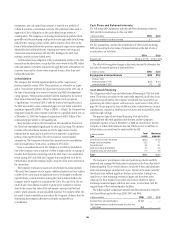

Please find page 199 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for Servicing of Financial Assets (SFAS 156), or whether they were

previously carried at fair value.

When available, the Company generally uses quoted market prices to

determine fair value and classifies such items in Level 1. In some cases where

a market price is available, the Company will make use of acceptable

practical expedients (such as matrix pricing) to calculate fair value, in

which case the items are classified in Level 2.

If quoted market prices are not available, fair value is based upon

internally developed valuation techniques that use, where possible, current

market-based or independently sourced market parameters, such as interest

rates, currency rates, option volatilities, etc. Items valued using such

internally generated valuation techniques are classified according to the

lowest level input or value driver that is significant to the valuation. Thus, an

item may be classified in Level 3 even though there may be some significant

inputs that are readily observable.

Where available, the Company may also make use of quoted prices for

recent trading activity in positions with the same or similar characteristics to

that being valued. The frequency and size of transactions and the amount of

the bid-ask spread are among the factors considered in determining the

liquidity of markets and the relevance of observed prices from those markets.

If relevant and observable prices are available, those valuations would be

classified as Level 2. If prices are not available, other valuation techniques

would be used and the item would be classified as Level 3.

Fair-value estimates from internal valuation techniques are verified,

where possible, to prices obtained from independent vendors or brokers.

Vendors and brokers’ valuations may be based on a variety of inputs ranging

from observed prices to proprietary valuation models.

The following section describes the valuation methodologies used by the

Company to measure various financial instruments at fair value, including

an indication of the level in the fair-value hierarchy in which each

instrument is generally classified. Where appropriate, the description

includes details of the valuation models, the key inputs to those models as

well as any significant assumptions.

Securities purchased under agreements to resell and

securities sold under agreements to repurchase

No quoted prices exist for such instruments and so fair value is determined

using a discounted cash-flow technique. Cash flows are estimated based on

the terms of the contract, taking into account any embedded derivative or

other features. Expected cash flows are discounted using market rates

appropriate to the maturity of the instrument as well as the nature and

amount of collateral taken or received. Generally, such instruments are

classified within Level 2 of the fair-value hierarchy as the inputs used in the

fair valuation are readily observable.

Trading Account Assets and Liabilities—Trading Securities

and Trading Loans

When available, the Company uses quoted market prices to determine the

fair value of trading securities; such items are classified in Level 1 of the fair-

value hierarchy. Examples include some government securities and

exchange-traded equity securities.

For bonds and secondary market loans traded over the counter, the

Company generally determines fair value utilizing internal valuation

techniques. Fair-value estimates from internal valuation techniques are

verified, where possible, to prices obtained from independent vendors.

Vendors compile prices from various sources and may apply matrix pricing

for similar bonds or loans where no price is observable. If available, the

Company may also use quoted prices for recent trading activity of assets with

similar characteristics to the bond or loan being valued. Trading securities

and loans priced using such methods are generally classified as Level 2.

However, when less liquidity exists for a security or loan, a quoted price is

stale or prices from independent sources vary, a loan or security is generally

classified as Level 3.

Where the Company’s principal market for a portfolio of loans is the

securitization market, the Company uses the securitization price to

determine the fair value of the portfolio. The securitization price is

determined from the assumed proceeds of a hypothetical securitization in the

current market, adjusted for transformation costs (i.e., direct costs other than

transaction costs) and securitization uncertainties such as market conditions

and liquidity. As a result of the severe reduction in the level of activity in

certain securitization markets since the second half of 2007, observable

securitization prices for certain directly comparable portfolios of loans have

not been readily available. Therefore, such portfolios of loans are generally

classified in Level 3 of the fair-value hierarchy. However, for other loan

securitization markets, such as those related to conforming prime fixed-rate

and conforming adjustable-rate mortgage loans, pricing verification of the

hypothetical securitizations has been possible, since these markets have

remained active. Accordingly, these loan portfolios are classified as Level 2 in

the fair-value hierarchy.

Trading Account Assets and Liabilities—Derivatives

Exchange-traded derivatives are generally fair valued using quoted market

(i.e., exchange) prices and so are classified in Level 1 of the fair-value

hierarchy.

The majority of derivatives entered into by the Company are executed over

the counter and so are valued using internal valuation techniques as no

quoted market prices exist for such instruments. The valuation techniques

and inputs depend on the type of derivative and the nature of the underlying

instrument. The principal techniques used to value these instruments are

discounted cash flows, Black-Scholes and Monte Carlo simulation. The fair

values of derivative contracts reflect cash the Company has paid or received

(for example, option premiums paid and received).

The key inputs depend upon the type of derivative and the nature of the

underlying instrument and include interest rate yield curves, foreign-

exchange rates, the spot price of the underlying volatility and correlation.

The item is placed in either Level 2 or Level 3 depending on the observability

of the significant inputs to the model. Correlation and items with longer

tenors are generally less observable.

Subprime-Related Direct Exposures in CDOs

The Company accounts for its CDO super senior subprime direct exposures

and the underlying securities on a fair-value basis with all changes in fair

value recorded in earnings. Citigroup’s CDO super senior subprime direct

exposures are not subject to valuation based on observable transactions.

Accordingly, the fair value of these exposures is based on management’s best

estimates based on facts and circumstances as of the date of these

Consolidated Financial Statements.

Citigroup’s CDO super senior subprime direct exposures are Level 3 assets

and are subject to valuation based on significant unobservable inputs. Fair

193