Citibank 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

related loss reserve. Once a loss is recognized under the agreement, the

aggregate amount of qualifying losses across the portfolio in a particular

period is netted against all recoveries and gains across the portfolio, all on a

pretax basis. The resulting net loss amount on the portfolio is the basis of the

loss-sharing arrangements between Citigroup and the USG. Citigroup will

bear the first $39.5 billion of such net losses, which amount was determined

using (i) an agreed-upon $29 billion of first losses, (ii) Citigroup’s then-

existing reserve with respect to the portfolio of approximately $9.5 billion,

and (iii) an additional $1.0 billion as an agreed-upon amount in exchange

for excluding the effects of certain hedge positions from the portfolio. Net

losses, if any, on the portfolio after Citigroup’s first-loss position will be borne

90% by the USG and 10% by Citigroup in the following manner:

•first, until the UST has paid $5 billion in aggregate, 90% by the UST and

10% by Citigroup;

•second, until the FDIC has paid $10 billion in aggregate, 90% by the

FDIC and 10% by Citigroup; and

•third, by the Federal Reserve Bank of New York.

The Company recognized approximately $900 million of qualifying losses

related to the portfolio (excluding replacement assets, as discussed in the

note to the table below) from November 21, 2008 through December 31,

2008. These losses will count towards Citi’s $39.5 billion first-loss position.

The Federal Reserve Bank of New York will implement its loss-sharing

obligations under the agreement by making a loan, after Citigroup’s first-

loss position and the obligations of the UST and FDIC have been exhausted,

in an amount equal to the then aggregate value of the remaining covered

asset pool (after reductions for charge-offs, pay-downs and realized losses) as

determined in accordance with the agreement. Following the loan, as losses

are incurred on the remaining covered asset pool, Citigroup will be required

to immediately repay 10% of such losses to the Federal Reserve Bank of New

York. The loan is non-recourse to Citigroup, other than with respect to the

repayment obligation in the preceding sentence and interest on the loan. The

loan is recourse only to the remaining covered asset pool, which is the sole

collateral to secure the loan. The loan will bear interest at the overnight

index swap rate plus 300 basis points.

The covered asset pool includes U.S.-based exposures and transactions

that were originated prior to March 14, 2008. Pursuant to the terms of the

agreement, the composition of the covered asset pool, amount of Citigroup’s

first-loss position and premium paid for loss coverage are subject to final

confirmation by the USG of, among other things, the qualification of assets

under the asset eligibility criteria, expected losses and reserves. This

confirmation process is to be completed no later than April 15, 2009.

The agreement includes guidelines for governance and asset

management with respect to the covered asset pool, including reporting

requirements and notice and approval rights of the USG at certain

thresholds. If covered losses exceed $27 billion, the USG has the right to

change the asset manager for the covered asset pool.

The covered assets are risk-weighted at 20% for purposes of calculating

the Tier 1 Capital ratio at December 31, 2008. This lower risk weighting

added approximately 150 basis points to Citigroup’s Tier 1 Capital ratio at

December 31, 2008.

The following table summarizes the assets that were part of the covered

asset pool agreed to between Citigroup and the USG as of January 15, 2009,

with their values as of November 21, 2008:

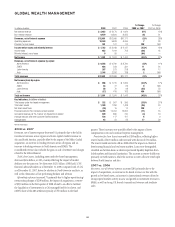

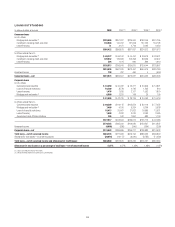

Assets (1)

In billions of dollars

November 21,

2008

Loans:

First mortgages $ 98.9

Second mortgages 55.2

Retail auto loans 16.2

Other consumer loans 21.3

Total consumer loans $191.6

CRE loans $ 12.4

Leveraged finance loans 2.3

Other corporate loans 11.1

Total corporate loans $ 25.8

Securities:

Alt-A $ 11.4

SIVs 6.4

CRE 2.1

Other 12.0

Total securities $ 31.9

Unfunded Lending Commitments (ULC)

Second mortgages $ 22.4

Other consumer loans 5.2

Leveraged finance 0.2

CRE 5.4

Other commitments 18.3

Total ULC $ 51.5

Total covered assets $300.8

(1) As a result of the initial confirmation process (conducted between November 21, 2008 and

January 15, 2009), the covered asset pool includes approximately $96 billion of assets considered

“replacement” assets (assets that were added to the pool to replace assets that were in the pool as of

November 21, 2008 but were later determined not to qualify). Loss-sharing on qualifying losses

incurred on these replacement assets was effective beginning January 15, 2009, instead of

November 21, 2008.

Exchange Offer and U.S. Government Exchange

On February 27, 2009, the Company announced an exchange offer of its

common stock for up to $27.5 billion of its existing preferred securities and

trust preferred securities at a conversion price of $3.25 per share. The U.S.

government will match this exchange up to a maximum of $25 billion of its

preferred stock at the same conversion price. See “Outlook for 2009” on

page 7.

45