Citibank 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

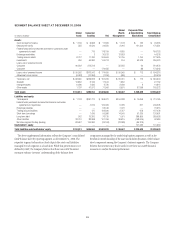

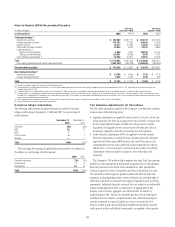

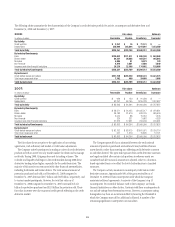

Mark-to-Market (MTM) Receivables/Payables

In millions of dollars

Derivatives

receivables—MTM

Derivatives

payables—MTM

As of December 31 2008 2007 (6) 2008 2007 (6)

Trading derivatives (2)

Interest rate contracts $ 667,597 $ 237,711 $ 654,178 $ 237,903

Foreign exchange contracts 153,197 77,937 160,628 71,980

Equity contracts 35,717 27,381 57,292 66,916

Commodity and other contracts 23,924 8,540 22,473 8,887

Credit derivatives: (4)

Citigroup as the Guarantor 5,890 4,967 198,233 73,103

Citigroup as the Beneficiary 222,461 78,426 5,476 11,191

Cash collateral paid/received (3) 63,866 32,247 65,010 19,437

Total $ 1,172,652 $ 467,209 $ 1,163,290 $ 489,417

Less: Netting agreements and market value adjustments (1,057,363) (390,328) (1,046,505) (385,876)

Net receivables/payables $ 115,289 $ 76,881 $ 116,785 $ 103,541

Non-trading derivatives (5)

Interest rate contracts $ 14,755 $ 8,529 $ 7,742 $ 7,176

Foreign exchange contracts 2,408 1,634 3,746 972

Total $ 17,163 $ 10,163 $ 11,488 $ 8,148

(1) Includes the notional amounts for long and short derivative positions.

(2) Trading derivatives include proprietary positions, as well as certain hedging derivatives instruments that qualify for hedge accounting in accordance with SFAS No. 133, Accounting for Derivative Instruments and

Hedging Activities (SFAS 133).

(3) In addition to the cash collateral paid or received, as of December 31, 2008 the Company has provided $7.9 billion and received $6.8 billion of marketable securities as collateral under derivative contracts.

(4) Credit derivatives are arrangements designed to allow one party (the “beneficiary”) to transfer the credit risk of a “reference asset” to another party (the “guarantor”). These arrangements allow a guarantor to assume

the credit risk associated with the reference asset without directly purchasing it. The Company has entered into credit derivatives positions for purposes such as risk management, yield enhancement, reduction of credit

concentrations and diversification of overall risk.

(5) Non-trading derivatives include only those end-user derivative instruments where the changes in market value are recorded in Other assets or Other liabilities.

(6) Reclassified to conform to the current period’s presentation.

Derivative Obligor Information

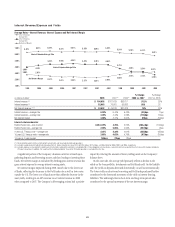

The following table presents the global derivatives portfolio by internal

obligor credit rating at December 31, 2008 and 2007, as a percentage of

credit exposure:

December 31,

2008

December 31,

2007

AAA/AA/A 68% 80%

BBB 20 11

BB/B 77

CCC or below 51

Unrated —1

Total 100% 100%

The following table presents the global derivatives portfolio by industry of

the obligor as a percentage of credit exposure:

2008 2007

Financial institutions 73% 75%

Governments 76

Corporations 20 19

Total 100% 100%

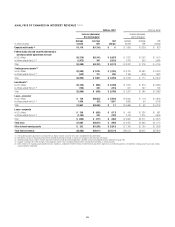

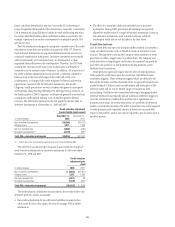

Fair Valuation Adjustments for Derivatives

The fair value adjustments applied by the Company to its derivative carrying

values consist of the following items:

• Liquidity adjustments are applied to items in Level 2 or Level 3 of the fair-

value hierarchy (see Note 26 on page 192 for more details) to ensure that

the fair value reflects the price at which the entire position could be

liquidated. The liquidity reserve is based on the bid/offer spread for an

instrument, adjusted to take into account the size of the position.

• Credit valuation adjustments (CVA) are applied to over-the-counter

derivative instruments, in which the base valuation generally discounts

expected cash flows using LIBOR interest rate curves. Because not all

counterparties have the same credit risk as that implied by the relevant

LIBOR curve, a CVA is necessary to incorporate the market view of both

counterparty credit risk and the Company’s own credit risk in the

valuation.

The Company’s CVA methodology comprises two steps. First, the exposure

profile for each counterparty is determined using the terms of all individual

derivative positions and a Monte Carlo simulation or other quantitative

analysis to generate a series of expected cash flows at future points in time.

The calculation of this exposure profile considers the effect of credit risk

mitigants, including pledged cash or other collateral and any legal right of

offset that exists with a counterparty through arrangements such as netting

agreements. Individual derivative contracts that are subject to an enforceable

master netting agreement with a counterparty are aggregated for this

purpose, since it is those aggregate net cash flows that are subject to

nonperformance risk. This process identifies specific, point in time future

cash flows that are subject to nonperformance risk, rather than using the

current recognized net asset or liability as a basis to measure the CVA.

Second, market-based views of default probabilities derived from observed

credit spreads in the credit default swap market, are applied to the expected

91