Citibank 2008 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

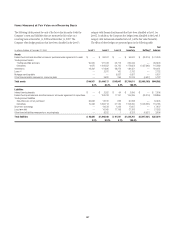

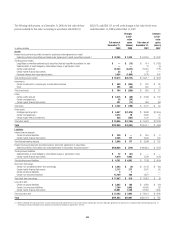

The following table presents, as of December 31, 2008, the fair value of those

positions selected for fair-value accounting in accordance with SFAS 159,

SFAS 156, and SFAS 155, as well as the changes in fair value for the years

ended December 31, 2008 and December 31, 2007.

In millions of dollars

Fair value at

December 31,

2008

Changes

in fair-

value

gains

(losses)

2008

Fair value at

December 31,

2007

Changes

in fair-

value

gains

(losses)

2007

Assets

Federal funds sold and securities borrowed or purchased under agreements to resell

Selected portfolios of securities purchased under agreements to resell, securities borrowed (1) $ 70,305 $ 2,438 $ 84,305 $ 1,462

Trading account assets:

Legg Mason convertible preferred equity securities originally classified as available-for-sale $ — $ (13) $ 614 $ (183)

Selected letters of credit hedged by credit default swaps or participation notes —— 10 (4)

Certain credit products 16,254 (6,272) 26,020 (778)

Certain hybrid financial instruments 33 3 97 —

Retained interests from asset securitizations 3,026 (1,890) 2,476 343

Total trading account assets $ 19,313 $ (8,172) $ 29,217 $ (622)

Investments:

Certain investments in private equity and real estate ventures $ 469 $ (254) $ 539 $ 58

Other 295 (35) 320 9

Total investments $ 764 $ (289) $ 859 $ 67

Loans:

Certain credit products $ 2,315 $ (59) $ 3,038 $ 102

Certain mortgage loans 36 (34) ——

Certain hybrid financial instruments 381 (13) 689 (63)

Total loans $ 2,732 $ (106) $ 3,727 $ 39

Other assets:

Mortgage servicing rights $ 5,657 $ (1,870) $ 8,380 $(1,554)

Certain mortgage loans 4,273 78 6,392 74

Certain equity method investments 936 (362) 1,131 45

Total other assets $ 10,866 $ (2,154) $ 15,903 $(1,435)

Total $103,980 $ (8,283) $134,011 $ (489)

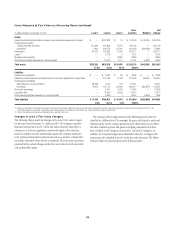

Liabilities

Interest-bearing deposits:

Certain structured liabilities $ 320 $ — $ 264 $ 3

Certain hybrid financial instruments 2,286 177 3,334 129

Total interest-bearing deposits $ 2,606 $ 177 $ 3,598 $ 132

Federal funds purchased and securities loaned or sold under agreements to repurchase

Selected portfolios of securities sold under agreements to repurchase, securities loaned (1) $138,866 $ (319) $199,854 $ (225)

Trading account liabilities:

Selected letters of credit hedged by credit default swaps or participation notes $ 72 $ (81) $— $—

Certain hybrid financial instruments 4,679 4,663 7,228 (409)

Total trading account liabilities $ 4,751 $ 4,582 $ 7,228 $ (409)

Short-term borrowings:

Certain non-collateralized short-term borrowings $ 2,303 $ (9) $ 5,105 $ (64)

Certain hybrid financial instruments 2,112 277 3,561 56

Certain structured liabilities 31 ——

Certain non-structured liabilities 13,189 250 4,821 —

Total short-term borrowings $ 17,607 $ 519 $ 13,487 $ (8)

Long-term debt:

Certain structured liabilities $ 3,083 $ 160 $ 2,952 $ (40)

Certain non-structured liabilities 7,189 3,802 49,095 99

Certain hybrid financial instruments 16,991 3,730 27,265 1,233

Total long-term debt $ 27,263 $ 7,692 $ 79,312 $ 1,292

Total $191,093 $12,651 $303,479 $ 782

(1) Reflects netting of the amounts due from securities purchased under agreements to resell and the amounts owed under securities sold under agreements to repurchase in accordance with FASB Interpretation No. 41,

“Offsetting of Amounts Related to Certain Repurchase and Reverse Repurchase Agreements” (FIN 41).

203