Citibank 2008 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

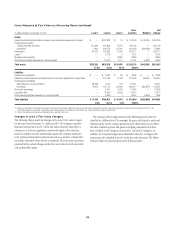

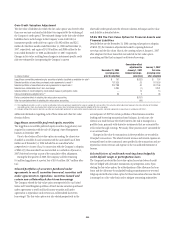

- The increase in Level 3 Short-term borrowings and Long-term debt

of $2.8 billion and $7.3 billion, respectively, resulted from transfers

in of Level 2 positions as prices and other valuation inputs became

unobservable, plus the additions of new issuances for fair value

accounting was elected.

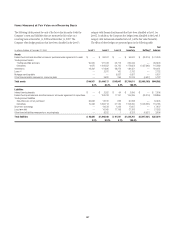

Items Measured at Fair Value on a Nonrecurring Basis

Certain assets and liabilities are measured at fair value on a nonrecurring

basis and therefore are not included in the tables above. These include assets

measured at cost that have been written down to fair value during the

periods as a result of an impairment. In addition, assets such as loans held

for sale that are measured at the lower of cost or market (LOCOM) that were

recognized at fair value below cost at the end of the period.

The Company recorded goodwill impairment charges of $9.6 billion as of

December 31, 2008, as determined based on Level 3 inputs. The primary

cause of goodwill impairment was the overall weak industry outlook and

continuing operating losses. These factors contributed to the overall decline

in the stock price and the related market capitalization of Citigroup. See Note

19, “Goodwill and Intangible Assets” on page 166, for additional

information on goodwill impairment.

The Company performed an impairment analysis of intangible assets

related to the Old Lane multi-strategy hedge fund during the first quarter of

2008. As a result, a pre-tax write-down of $202 million, representing the

remaining unamortized balance of the intangible assets, was recorded

during the first quarter of 2008. The measurement of fair value was

determined using Level 3 input factors along with a discounted cash flow

approach.

During the fourth quarter of 2008, the Company performed an

impairment analysis of Japan's Nikko Asset Management fund contracts

which represent the rights to manage and collect fees on investor assets and

are accounted for as indefinite-lived intangible assets. As a result, an

impairment loss of $937 million pre-tax was recorded. The related fair value

was determined using an income approach which relies on key drivers and

future expectations of the business that are considered Level 3 input factors.

The fair value of loans measured on a LOCOM basis is determined where

possible using quoted secondary-market prices. Such loans are generally

classified in Level 2 of the fair-value hierarchy given the level of activity in

the market and the frequency of available quotes. If no such quoted price

exists, the fair value of a loan is determined using quoted prices for a similar

asset or assets, adjusted for the specific attributes of that loan.

The following table presents all loans held-for-sale that are carried at

LOCOM as of December 31, 2008 and December 31, 2007 (in billions):

Aggregate cost Fair value Level 2 Level 3

December 31, 2008 $ 3.1 $ 2.1 $0.8 $ 1.3

December 31, 2007 33.6 31.9 5.1 26.8

Loans held-for-sale that are carried at LOCOM as of December 31, 2008

significantly declined compared to December 31, 2007 because most of these

loans were either sold or reclassified to held-for-investment category.

201