Citibank 2008 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

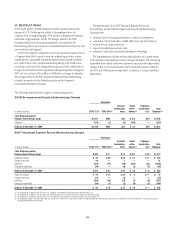

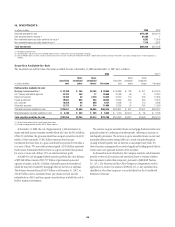

10. RESTRUCTURING

In the fourth quarter of 2008, Citigroup recorded a pretax restructuring

expense of $1.797 billion pre-tax related to the implementation of a

Company-wide re-engineering plan. This initiative will generate headcount

reductions of approximately 20,600. The charges related to the 2008

Re-engineering Projects Restructuring Initiative are reported in the

Restructuring line on the Company’s Consolidated Statement of Income and

are recorded in each segment.

In 2007, the Company completed a review of its structural expense base in

a Company-wide effort to create a more streamlined organization, reduce

expense growth, and provide investment funds for future growth initiatives.

As a result of this review, a pretax restructuring charge of $1.4 billion was

recorded in Corporate/Other during the first quarter of 2007. Additional net

charges of $151 million were recognized in subsequent quarters throughout

2007 and a net release of $31 million in 2008 due to a change in estimates.

The charges related to the 2007 Structural Expense Review Restructuring

Initiative are reported in the Restructuring line on the Company’s

Consolidated Statement of Income.

The primary goals of the 2007 Structural Expense Review and

Restructuring, and the 2008 Re-engineering Projects and Restructuring

Initiatives were:

• eliminate layers of management/improve workforce management;

• consolidate certain back-office, middle-office and corporate functions;

• increase the use of shared services;

• expand centralized procurement; and

• continue to rationalize operational spending on technology.

The implementation of these restructuring initiatives also caused certain

related premises and equipment assets to become redundant. The remaining

depreciable lives of these assets were shortened, and accelerated depreciation

charges began in the second quarter of 2007 and fourth quarter of 2008 for

the 2007 and 2008 initiatives, respectively, in addition to normal scheduled

depreciation.

The following tables detail the Company’s restructuring reserves.

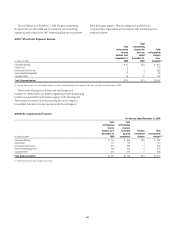

2008 Re-engineering Projects Restructuring Charges

Severance

In millions of dollars SFAS 112 (1) SFAS 146 (2)

Contract

termination

costs

Asset

write-

downs (3)

Employee

termination

cost

Total

Citigroup (4)

Total Citigroup (pretax)

Original restructuring charge $1,254 $295 $55 $ 123 $19 $1,746

Utilization (114) (3) (2) (100) — (219)

Balance at December 31, 2008 $1,140 $292 $53 $ 23 $19 $1,527

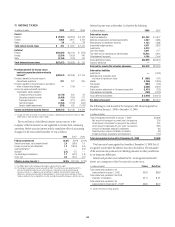

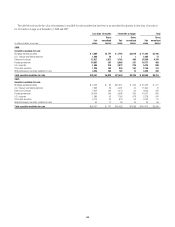

2007 Structural Expense Review Restructuring Charges

Severance

In millions of dollars SFAS 112 (1) SFAS 146 (2)

Contract

termination

costs

Asset

write-

downs (3)

Employee

termination

cost

Total

Citigroup

Total Citigroup (pretax)

Original restructuring charge $ 950 $ 11 $ 25 $ 352 $ 39 $1,377

Additional charge $ 42 $ 96 $ 29 $ 27 $ 11 $ 205

Foreign exchange 19 — 2 — — 21

Utilization (547) (75) (28) (363) (33) (1,046)

Changes in estimates (39) — (6) (1) (8) (54)

Balance at December 31, 2007 $ 425 $ 32 $ 22 $ 15 $ 9 $ 503

Additional charge $ 10 $ 14 $ 43 $ 6 $ — $ 73

Foreign exchange (11) — (4) — — (15)

Utilization (288) (34) (22) (7) (6) (357)

Changes in estimates (93) (2) (2) (4) (3) (104)

Balance at December 31, 2008 $ 43 $ 10 $ 37 $ 10 $ — $ 100

(1) Accounted for in accordance with SFAS No. 112, Employer’s Accounting for Post Employment Benefits (SFAS 112).

(2) Accounted for in accordance with SFAS No. 146, Accounting for Costs Associated with Exit or Disposal Activities (SFAS 146).

(3) Accounted for in accordance with SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets (SFAS 144).

(4) Total Citigroup charge in the table above does not include a $51 million one-time pension curtailment charge related to this restructuring initiative, which is recorded as part of the Company’s Restructuring charge in

the Consolidated Statement of Income.

150