Citibank 2008 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.charge-off to the allowance, and are subsequently accounted for as securities

available-for-sale.

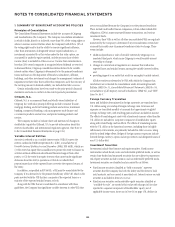

In the Corporate portfolios, larger-balance, non-homogeneous exposures

representing significant individual credit exposures are evaluated based upon

the borrower’s overall financial condition, resources, and payment record,

the prospects for support from any financially responsible guarantors and, if

appropriate, the realizable value of any collateral. Reserves are established

for these loans based upon an estimate of probable losses for the individual

loans deemed to be impaired. This estimate considers all available evidence

including, as appropriate, the present value of the expected future cash flows

discounted at the loan’s contractual effective rate, the secondary market

value of the loan and the fair value of collateral less disposal costs. The

allowance for credit losses attributed to the remaining portfolio is established

via a process that estimates the probable loss inherent in the portfolio based

upon various analyses. These analyses consider historical and project default

rates and loss severities, internal risk ratings, and geographic, industry, and

other environmental factors. Management also considers overall portfolio

indicators, including trends in internally risk-rated exposures, classified

exposures, cash-basis loans, historical and forecasted write-offs, and a review

of industry, geographic, and portfolio concentrations, including current

developments within those segments. In addition, management considers the

current business strategy and credit process, including credit limit setting

and compliance, credit approvals, loan underwriting criteria, and loan

workout procedures.

For Consumer loans, each portfolio of smaller-balance, homogeneous

loans—including consumer mortgage, installment, revolving credit, and

most other consumer loans—is collectively evaluated for impairment. The

allowance for loan losses attributed to these loans is established via a process

that estimates the probable losses inherent in the portfolio based upon

various analyses. These include migration analysis, in which historical

delinquency and credit loss experience is applied to the current aging of the

portfolio, together with analyses that reflect current trends and conditions.

Management also considers overall portfolio indicators, including historical

credit losses, delinquent, non-performing, and classified loans, trends in

volumes and terms of loans, an evaluation of overall credit quality, the credit

process, including lending policies and procedures, and economic,

geographical, product and other environmental factors.

In addition, valuation allowances are determined for impaired smaller-

balance homogenous loans whose terms have been modified due to the

borrowers’ financial difficulties and it was determined that a concession was

granted to the borrower. Such modifications may include interest rate

reductions, principal forgiveness and/or term extensions. These allowances

are determined by comparing estimated cash flows of the loans discounted at

the loans’ original contractual interest rates to the carrying value of the

loans.

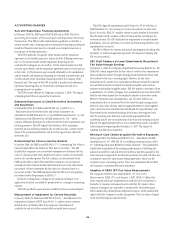

Allowance for Unfunded Lending Commitments

A similar approach to the allowance for loan losses is used for calculating a

reserve for the expected losses related to unfunded loan commitments and

standby letters of credit. This reserve is classified on the balance sheet in

Other liabilities.

Mortgage Servicing Rights (MSRs)

Mortgage servicing rights (MSRs), which are included in Intangible assets

in the Consolidated Balance Sheet, are recognized as assets when purchased

or when the Company sells or securitizes loans acquired through purchase or

origination and retains the right to service the loans.

With the Company’s electing to early-adopt SFAS 156, Accounting for

Servicing of Financial Assets, as of January 1, 2006, MSRs in the U.S.

mortgage and student loan classes of servicing rights are accounted for at

fair value, with changes in value recorded in current earnings. Upon electing

the fair-value method of accounting for its MSRs, the Company discontinued

the application of SFAS 133 fair-value hedge accounting, the calculation of

amortization and the assessment of impairment for the MSRs. The MSR

valuation allowance at the date of adoption of SFAS 156 was written off

against the recorded value of the MSRs.

Prior to 2006, only the portion of the MSR portfolio that was hedged with

instruments qualifying for hedge accounting under SFAS 133 was recorded at

fair value. The remaining portion, which was hedged with instruments that

did not qualify for hedge accounting under SFAS 133, was accounted for at

the lower of cost or market. Servicing rights retained in the securitization of

mortgage loans were measured by allocating the carrying value of the loans

between the assets sold and the interests retained, based on the relative fair

values at the date of securitization. MSRs were amortized using a

proportionate cash flow method over the period of the related net positive

servicing income to be generated from the various portfolios purchased or

loans originated. Impairment of MSRs was evaluated on a disaggregated

basis by type (i.e., fixed rate or adjustable rate) and by interest-rate band,

which were believed to be the predominant risk characteristics of the

Company’s servicing portfolio. Any excess of the carrying value of the

capitalized servicing rights over the fair value by stratum was recognized

through a valuation allowance for each stratum and charged to the

provision for impairment on MSRs.

Additional information on the Company’s MSRs can be found in Note 23

to the Consolidated Financial Statements on page 175.

Goodwill

Goodwill represents an acquired company’s acquisition cost over the fair

value of net tangible and intangible assets acquired. Goodwill is subject to

annual impairment tests, whereby Goodwill is allocated to the Company’s

reporting units and an impairment is deemed to exist if the carrying value of

a reporting unit exceeds its estimated fair value. Furthermore, on any

business dispositions, Goodwill is allocated to the business disposed of based

on the ratio of the fair value of the business disposed of to the fair value of

the reporting unit.

Intangible Assets

Intangible assets—including core deposit intangibles, present value of

future profits, purchased credit card relationships, other customer

relationships, and other intangible assets, but excluding MSRs—are

amortized over their estimated useful lives. Intangible assets deemed to have

indefinite useful lives, primarily certain asset management contracts and

trade names, are not amortized and are subject to annual impairment tests.

An impairment exists if the carrying value of the indefinite-lived intangible

asset exceeds its fair value. For other Intangible assets subject to

amortization, an impairment is recognized if the carrying amount is not

recoverable and exceeds the fair value of the Intangible asset.

Other Assets and Other Liabilities

Other assets includes, among other items, loans held-for-sale, deferred tax

assets, equity-method investments, interest and fees receivable, premises and

125