Citibank 2008 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

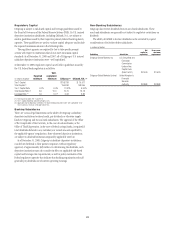

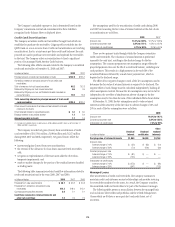

On-Balance Sheet Securitizations

The Company engages in on-balance sheet securitizations. These are

securitizations that do not qualify for sales treatment; thus, the assets remain

on the Company’s balance sheet. The following table presents the carrying

amounts and classification of consolidated assets and liabilities transferred

in transactions from the consumer credit card, student loan, mortgage and

auto businesses, accounted for as secured borrowings:

In billions of dollars

December 31,

2008

December 31,

2007

Cash $ 0.3 $ 0.1

Available-for-sale securities 0.1 0.2

Loans 7.5 7.4

Allowance for loan losses (0.1) (0.1)

Total assets $ 7.8 $ 7.6

Long-term debt $ 6.3 $ 5.8

Other liabilities 0.3 0.4

Total liabilities $ 6.6 $ 6.2

All assets are restricted from being sold or pledged as collateral. The cash

flows from these assets are the only source used to pay down the associated

liabilities, which are non-recourse to the Company’s general assets.

Citi-Administered Asset-Backed Commercial Paper Conduits

The Company is active in the asset-backed commercial paper conduit

business as administrator of several multi-seller commercial paper conduits,

and also as a service provider to single-seller and other commercial paper

conduits sponsored by third parties.

The multi-seller commercial paper conduits are designed to provide the

Company’s customers access to low-cost funding in the commercial paper

markets. The conduits purchase assets from or provide financing facilities to

customers and are funded by issuing commercial paper to third-party

investors. The conduits generally do not purchase assets originated by the

Company. The funding of the conduit is facilitated by the liquidity support

and credit enhancements provided by the Company and by certain third

parties. As administrator to the conduits, the Company is responsible for

selecting and structuring of assets purchased or financed by the conduits,

making decisions regarding the funding of the conduits, including

determining the tenor and other features of the commercial paper issued,

monitoring the quality and performance of the conduits’ assets, and

facilitating the operations and cash flows of the conduits. In return, the

Company earns structuring fees from clients for individual transactions and

earns an administration fee from the conduit, which is equal to the income

from client program and liquidity fees of the conduit after payment of

interest costs and other fees. This administration fee is fairly stable, since

most risks and rewards of the underlying assets are passed back to the

customers and, once the asset pricing is negotiated, most ongoing income,

costs and fees are relatively stable as a percentage of the conduit’s size.

The conduits administered by the Company do not generally invest in

liquid securities that are formally rated by third parties. The assets are

privately negotiated and structured transactions that are designed to be held

by the conduit, rather than actively traded and sold. The yield earned by the

conduit on each asset is generally tied to the rate on the commercial paper

issued by the conduit, thus passing interest rate risk to the client. Each asset

purchased by the conduit is structured with transaction-specific credit

enhancement features provided by the third-party seller, including over-

collateralization, cash and excess spread collateral accounts, direct recourse

or third-party guarantees. These credit enhancements are sized with the

objective of approximating a credit rating of A or above, based on the

Company’s internal risk ratings.

Substantially all of the funding of the conduits is in the form of short-

term commercial paper. As of December 31, 2008, the weighted average life

of the commercial paper issued was approximately 37 days. In addition, the

conduits have issued Subordinate Loss Notes and equity with a notional

amount of approximately $80 million and varying remaining tenors

ranging from six months to seven years.

The primary credit enhancement provided to the conduit investors is in

the form of transaction-specific credit enhancement described above. In

addition, there are two additional forms of credit enhancement that protect

the commercial paper investors from defaulting assets. First, the Subordinate

Loss Notes issued by each conduit absorb any credit losses up to their full

notional amount. It is expected that the Subordinate Loss Notes issued by

each conduit are sufficient to absorb a majority of the expected losses from

each conduit, thereby making the single investor in the Subordinate Loss

Note the primary beneficiary under FIN 46(R). Second, each conduit has

obtained a letter of credit from the Company, which is generally 8-10% of the

conduit’s assets. The letters of credit provided by the Company total

approximately $5.8 billion and are included in the Company’s maximum

exposure to loss. The net result across all multi-seller conduits administered

by the Company is that, in the event of defaulted assets in excess of the

transaction-specific credit enhancement described above, any losses in each

conduit are allocated in the following order:

• Subordinate loss note holders

• the Company

• the commercial paper investors

The Company, along with third parties, also provides the conduits with

two forms of liquidity agreements that are used to provide funding to the

conduits in the event of a market disruption, among other events. Each asset

of the conduit is supported by a transaction-specific liquidity facility in the

form of an asset purchase agreement (APA). Under the APA, the Company

has agreed to purchase non-defaulted eligible receivables from the conduit at

par. Any assets purchased under the APA are subject to increased pricing. The

APA is not designed to provide credit support to the conduit, as it generally

does not permit the purchase of defaulted or impaired assets and generally

reprices the assets purchased to consider potential increased credit risk. The

APA covers all assets in the conduits and is considered in the Company’s

maximum exposure to loss. In addition, the Company provides the conduits

with program-wide liquidity in the form of short-term lending

commitments. Under these commitments, the Company has agreed to lend

to the conduits in the event of a short-term disruption in the commercial

paper market, subject to specified conditions. The total notional exposure

under the program-wide liquidity agreement is $11.3 billion and is

considered in the Company’s maximum exposure to loss. The Company

receives fees for providing both types of liquidity agreement and considers

these fees to be on fair market terms.

183