Citibank 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

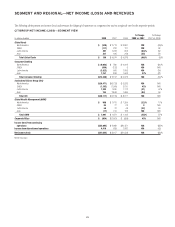

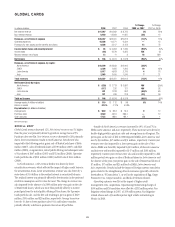

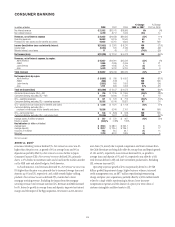

CONSUMER BANKING

In millions of dollars 2008 2007 2006

% Change

2008 vs. 2007

% Change

2007 vs. 2006

Net interest revenue $ 21,932 $20,741 $18,986 6% 9%

Non-interest revenue 6,720 8,717 7,649 (23) 14

Revenues, net of interest expense $ 28,652 $29,458 $26,635 (3)% 11%

Operating expenses 26,653 16,316 14,540 63 12

Provisions for loan losses and for benefits and claims 19,622 10,761 3,825 82 NM

Income (loss) before taxes and minority interest $(17,623) $ 2,381 $ 8,270 NM (71)%

Income taxes (5,354) 181 2,136 NM (92)

Minority interest, net of taxes 11 43 61 (74)% (30)

Net income (loss) $(12,280) $ 2,157 $ 6,073 NM (64)%

Revenues, net of interest expense, by region:

North America $ 16,627 $16,991 $15,526 (2)% 9%

EMEA 2,596 2,485 2,059 421

Latin America 3,959 4,185 3,740 (5) 12

Asia 5,470 5,797 5,310 (6) 9

Total revenues $ 28,652 $29,458 $26,635 (3)% 11%

Net income (loss) by region:

North America $ (9,003) $ 780 $ 4,002 NM (81)%

EMEA (606) (122) 5 NM NM

Latin America (3,822) 660 1,003 NM (34)

Asia 1,151 839 1,063 37% (21)

Total net income (loss) $(12,280) $ 2,157 $ 6,073 NM (64)%

Consumer Finance Japan (CFJ)—NIR $ 726 $ 1,135 $ 1,566 (36)% (28)%

Consumer Banking, excluding CFJ—NIR 21,206 19,606 17,420 813

CFJ—operating expenses $ 371 $ 576 $ 713 (36)% (19)%

Consumer Banking, excluding CFJ—operating expenses 26,282 15,740 13,827 67 14

CFJ—provision for loan losses and for benefits and claims $ 1,336 $ 1,421 $ 1,118 (6)% 27%

Consumer Banking, excluding CFJ—

provision for loan losses and for benefits and claims 18,286 9,340 2,707 96 NM

CFJ—net income (loss) $ 146 $ (520) $ (133) NM NM

Consumer Banking, excluding CFJ—net income (loss) (12,426) 2,677 6,206 NM (57)%

Average assets (in billions of dollars) $ 547 $ 572 $ 467 (4)% 22%

Return on assets (2.24)% 0.38% 1.30%

Key indicators (in billions of dollars)

Average loans $ 395.3 $ 380.0 $ 330.1 415

Average deposits $ 287.7 $ 276.4 $ 236.7 417

Accounts (in millions) 78.5 79.5 69.7 (1) 14

Branches 7,730 8,247 7,826 (6) 5

NM Not meaningful

2008 vs. 2007

Consumer Banking revenue declined 3%. Net interest revenue was 6%

higher than the prior year, as growth of 4% in average loans and 4% in

deposits was partially offset by a Net interest revenue decline in Japan

Consumer Finance (CFJ). Non-interest revenue declined 23%, primarily

due to a 27% decline in investment sales and a loss from the mark-to-market

on the MSR asset and related hedge in North America.

In North America, total revenues decreased 2%. Net interest revenue was

9% higher than the prior year, primarily due to increased average loans and

deposits, up 3% and 2%, respectively, and a shift towards higher yielding

products. Non-interest revenue declined 29%, mainly due to lower

mortgage servicing revenue. Excluding the impact from the mortgage

servicing revenue, total revenues increased 4%. Revenues in EMEA increased

by 4%, driven by growth in average loans and deposits, improved net interest

margin and the impact of the Egg acquisition. Revenues in Latin America

were down 5%, mainly due to spread compression and lower revenues from

the Chile divestiture not being fully offset by average loan and deposit growth

of 14% and 4%, respectively. Asia revenues decreased 6%, as growth in

average loans and deposits of 5% and 4%, respectively, was offset by a 36%

total revenue decline in CFJ and lower investment product sales. Excluding

CFJ, revenues increased 2%.

Operating expenses growth of 63% was primarily driven by a $9.568

billion goodwill impairment charge, higher business volumes, increased

credit management costs, an $877 million repositioning/restructuring

charge and prior-year acquisitions, partially offset by a $221 million benefit

related to a legal vehicle repositioning in Mexico, lower incentive

compensation expenses and the absence of a prior-year write-down of

customer intangibles and fixed assets in CFJ.

31