Citibank 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

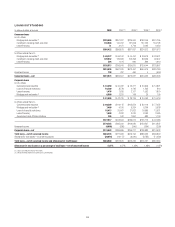

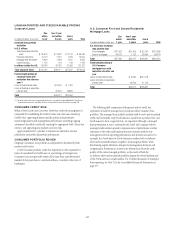

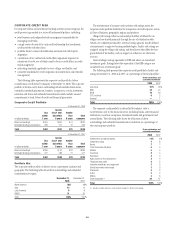

There is no industry-wide definition of non-performing assets. As such,

analysis against the industry is not always comparable. The table below

represents the Company’s view of non-performing assets. As a general rule,

consumer loans are charged off at 120 days past due and credit card loans

are charged off at 180 days contractually past due. Consumer loans secured

with non-real-estate collateral are written down to the estimated value of

the collateral, less costs to sell, at 120 days past due. Consumer real-estate

secured loans are written down to the estimated value of the property, less

costs to sell, when they are 180 days contractually past due. Impaired

corporate loans and leases are written down to the extent that principal is

judged to be uncollectible.

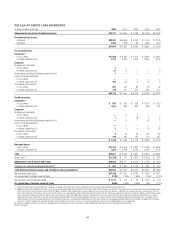

Non-performing assets 2008 2007 2006 2005 2004

Corporate non-accrual loans $ 9,569 $ 1,758 $ 535 $1,004 $1,906

Consumer non-accrual loans 12,728 7,210 4,512 4,020 5,463

Non-accrual loans (NAL) $22,297 $ 8,968 $5,047 $5,024 $7,369

OREO $ 1,433 $ 1,228 $ 701 $ 429 $ 446

Other repossessed assets 78 99 75 62 93

Non-performing assets (NPA) $23,808 $10,295 $5,823 $5,515 $7,908

NAL as a % of total loans 3.21% 1.15% 0.74% 0.86% 1.34%

NPA as a % of total assets 1.22% 0.47% 0.31% 0.37% 0.53%

Allowance for loan losses as a % of NAL(1) 133% 180% 177% 195% 153%

(1) The $6.403 billion of non-accrual loans transferred from the held-for-sale portfolio to the held-for-investment portfolio during the fourth quarter of 2008 were marked-to-market at the transfer date and therefore no

allowance was necessary at the time of the transfer. $2.426 billion of the par value of the loans reclassified was written off prior to transfer.

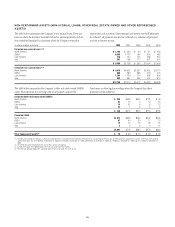

RENEGOTIATED LOANS

In millions of dollars at year end 2008 2007 2006

Renegotiated loans(1)(2)

In U.S. offices $10,031 $5,540 $3,992

In offices outside the U.S. 1,755 1,176 534

$11,786 $6,716 $4,526

(1) Smaller-balance, homogeneous renegotiated loans were derived from our risk management systems.

(2) Also includes Corporate and Commercial Business loans.

FOREGONE INTEREST REVENUE ON LOANS (1)

In millions of dollars

In U.S.

offices

In non-

U.S.

offices

2008

total

Interest revenue that would have been accrued at

original contractual rates (2) $1,245 $827 $2,072

Amount recognized as interest revenue (2) 295 258 553

Foregone interest revenue $ 950 $569 $1,519

(1) Relates to corporate non-accrual, renegotiated loans and consumer loans on which accrual of interest

had been suspended.

(2) Interest revenue in offices outside the U.S. may reflect prevailing local interest rates, including the

effects of inflation and monetary correction in certain countries.

56