Citibank 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

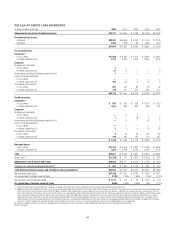

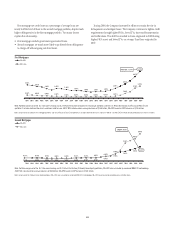

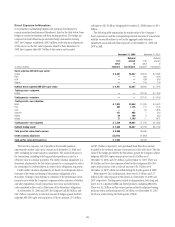

By State

Approximately half of the Company’s U.S. Consumer mortgage portfolio

remains concentrated in five states: California, New York, Florida, Illinois,

and Texas. Those states represent 49% of first mortgages and 57% of second

mortgages.

During 2008, unemployment was the key driver of delinquencies: despite

sharp differences in the quality of their portfolio, California and Florida

experienced above average rises in 90+DPD. California, which has only 3%

of its first mortgage portfolio originated in the FICO<620 band, experienced

a 2.7 times rise in delinquencies, to 4.13%. Florida, which has 21% of its

loans in that FICO band, also suffered a similar rise in delinquencies, albeit

to a much higher rate of 12.24%. Texas, despite having 34% of its portfolio

originated with FICO<620, experienced a relatively mild rise in

delinquencies, a consequence of its below average increase in unemployment

rate.

First Mortgages: December 31, 2008

CALIFORNIA

STATES

(in billions of dollars)

NEW YORK

ILLINOIS

FLORIDA

90+DPD FIRST MORTGAGES

FICO<620

$1.2

$1.0

$1.6

$1.0

STATE

% TOTAL

FIRST

MORTGAGES

$36.1

$9.5

$7.8

$5.8

TEXAS

TOTAL

OTHERS

5.66%

$1.8

$15.7

$22.4100.0%

$5.3

$69.5

26.9%

7.1%

5.8%

4.3%

4.0%

51.9%

4.13%

3.90%

12.24%

6.04%

5.44%

5.94%

$133.9

Note: Data at origination. $134 billion portfolio excludes Canada and Puerto Rico, First Collateral Services

(commercial portfolio), deferred fees/costs, loans held for sale and loans sold with recourse. Excluding

Government insured loans, 90+DPD for the first mortgage portfolio is 5.13%.

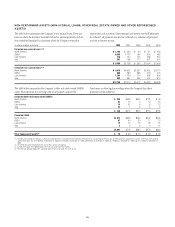

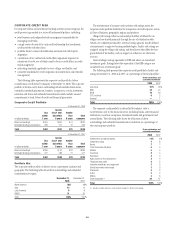

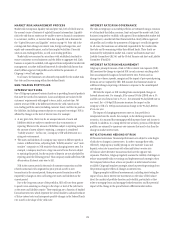

In the second mortgage portfolio, Florida and California maintained

above-average delinquencies, with approximately 18% and 22% of their

loans originated in the LTV ≥90% band.

Second Mortgages: December 31, 2008

CALIFORNIA

STATES

(in billions of dollars)

NEW YORK

ILLINOIS

FLORIDA

90+DPD SECOND MORTGAGES

LTV ≥ 90%

$3.0

$0.9

$1.0

$0.8

STATE

% TOTAL

SECOND

MORTGAGES

$16.6

$8.2

$4.3

$2.4

TEXAS

TOTAL

OTHERS

2.39%

$1.1

$10.4

$17.2100.0%

$1.8

$25.6

28.1%

14.0%

7.3%

4.0%

3.1%

43.4%

3.17%

1.11%

4.72%

1.75%

0.70%

2.08%

$59.0

Note: Data at origination. Second mortgage 90+DPD rate calculated by OTS methodology.

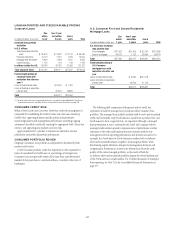

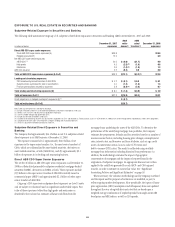

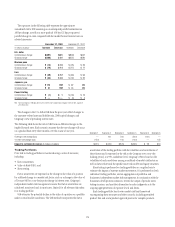

By Vintage

Approximately half of the Company’s U.S. Consumer mortgage portfolio

consisted of 2006 and 2007 vintages, which demonstrated above average

delinquencies. In first mortgages, approximately 45% of the portfolio is of

2006 and 2007 vintages, which on aggregate have a 90+DPD of 8.15%, well

above the 5.66% of the overall portfolio. Approximately 43% is pre-2005

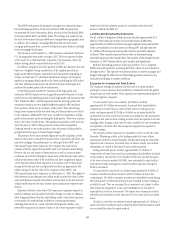

vintage, with an aggregated delinquency of 4.28%. In second mortgages,

slightly over 61% of the portfolio is of 2006 and 2007 vintages and

approximately 33% is pre-2005 vintage.

First Mortgages: December 31, 2008

2008

VINTAGES

(in billions of dollars)

2007

2005

2006

90+DPD FIRST MORTGAGES

FICO<620

$2.5

$6.7

$3.6

$2.4

VINTAGE

% TOTAL

FIRST

MORTGAGES

$16.9

$34.8

$25.2

$23.5

2004

TOTAL

2003

5.66%

$1.8

$5.3

$22.4100.0%

$13.5

$20.0

12.6%

26.0%

18.9%

17.5%

10.1%

15.0%

1.46%

8.39%

7.82%

3.55%

3.68%

5.52%

$133.9

Note: Data at origination. $134 billion portfolio excludes Canada and Puerto Rico, First Collateral Services

(commercial portfolio), deferred fees/costs, loans held for sale and loans sold with recourse. Excluding

Government insured loans, 90+DPD for the first mortgage portfolio is 5.13%.

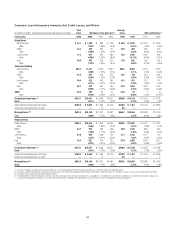

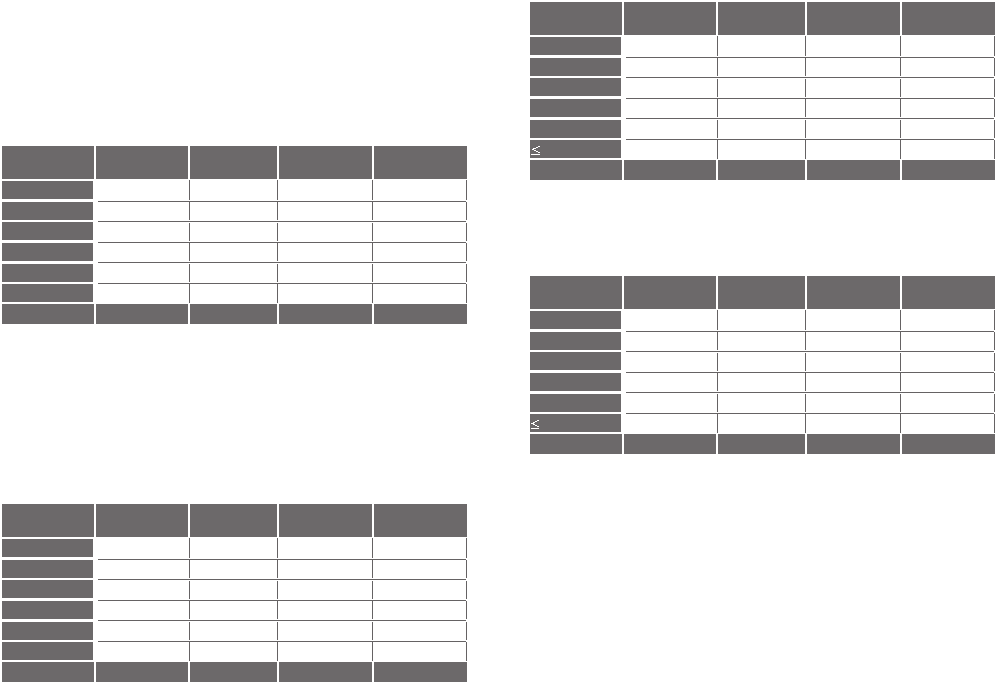

Second Mortgages: December 31, 2008

2008

VINTAGES

(in billions of dollars)

2007

2005

2006

90+DPD

$0.1

$3.5

$7.6

$4.5

VINTAGE

% TOTAL

SECOND

MORTGAGES

$3.2

$14.5

$21.7

$12.8

2004

TOTAL 2.39%

$1.2

$0.4

$17.2100.0%

$3.9

$2.9

5.4%

24.6%

36.8%

21.7%

6.6%

4.9%

0.13%

1.92%

3.33%

2.51%

1.32%

0.98%

$59.0

SECOND MORTGAGES

LTV ≥ 90%

2003

Note: Data at origination. Second mortgage 90+DPD rate calculated by OTS methodology.

64