Citibank 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.equipment, end-user derivatives in a net receivable position, repossessed

assets, and other receivables.

Other liabilities includes, among other items, accrued expenses and other

payables, deferred tax liabilities, minority interest, end-user derivatives in a

net payable position, and reserves for legal, taxes, restructuring, unfunded

lending commitments, and other matters.

Repossessed Assets

Upon repossession, loans are adjusted, if necessary, to the estimated fair

value of the underlying collateral and transferred to repossessed assets. This

is reported in Other assets, net of a valuation allowance for selling costs and

net declines in value as appropriate.

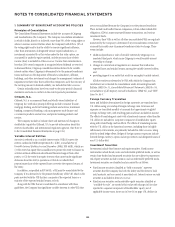

Securitizations

The Company primarily securitizes credit card receivables and mortgages.

Other types of securitized assets include corporate debt instruments (in cash

and synthetic form) and student loans.

There are two key accounting determinations that must be made relating

to securitizations. First, in the case where Citigroup originated or owned the

financial assets transferred to the securitization entity, a decision must be

made as to whether that transfer is considered a sale under U.S. Generally

Accepted Accounting Principles (GAAP). If it is a sale, the transferred assets

are removed from the Company’s Consolidated Balance Sheet with a gain or

loss recognized. Alternatively, when the transfer would be considered to be a

financing rather than a sale, the assets will remain on the Company’s

Consolidated Balance Sheet with an offsetting liability recognized in the

amount of proceeds received.

Second, a determination must be made as to whether the securitization

entity would be included in the Company’s Consolidated Financial

Statements. For each securitization entity with which it is involved, the

Company makes a determination of whether the entity should be considered

a subsidiary of the Company and be included in its Consolidated Financial

Statements or whether the entity is sufficiently independent that it does not

need to be consolidated. If the securitization entity’s activities are sufficiently

restricted to meet accounting requirements to be a qualifying special purpose

entity (QSPE), the securitization entity is not consolidated by the seller of the

transferred assets. If the securitization entity is determined to be a VIE, the

Company consolidates the VIE if it is the primary beneficiary.

For all other securitization entities determined not to be VIEs in which

Citigroup participates, a consolidation decision is made by evaluating several

factors, including how much of the entity’s ownership is in the hands of

third-party investors, who controls the securitization entity, and who reaps

the rewards and bears the risks of the entity. Only securitization entities

controlled by Citigroup are consolidated.

Interests in the securitized and sold assets may be retained in the form of

subordinated interest-only strips, subordinated tranches, spread accounts,

and servicing rights. In credit card securitizations, the Company retains a

seller’s interest in the credit card receivables transferred to the trusts, which is

not in securitized form. Accordingly, the seller’s interest is carried on a

historical cost basis and classified as Consumer loans. Retained interests in

securitized mortgage loans and student loans are classified as Trading

account assets, as is a majority of the retained interests in securitized credit

card receivables. Certain other retained interests are recorded as

available-for-sale investments, but servicing rights are included in

Intangible assets. However, since January 1, 2006, servicing rights are

initially recorded at fair value. Gains or losses on securitization and sale

depend in part on the previous carrying amount of the loans involved in the

transfer and, prior to January 1, 2006, were allocated between the loans sold

and the retained interests based on their relative fair values at the date of

sale. Gains are recognized at the time of securitization and are reported in

Other revenue.

The Company values its securitized retained interests at fair value using

quoted market prices, if such positions are actively traded, or financial

models that incorporate observable and unobservable inputs. More

specifically, these models estimate the fair value of these retained interests by

determining the present value of expected future cash flows, using modeling

techniques that incorporate management’s best estimates of key

assumptions, including prepayment speeds, credit losses and discount rates,

when observable inputs are not available. In addition, internally calculated

fair values of retained interests are compared to recent sales of similar assets,

if available.

Additional information on the Company’s securitization activities can be

found in Note 23 to the Consolidated Financial Statements on page 175.

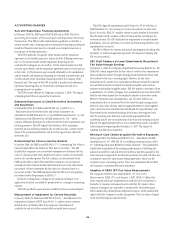

Transfers of Financial Assets

For a transfer of financial assets to be considered a sale, the assets must have

been isolated from the Company, even in bankruptcy or other receivership;

the purchaser must have the right to sell the assets transferred or the

purchaser must be a QSPE; and the Company may not have an option or any

obligation to reacquire the assets. If these sale requirements are met, the

assets are removed from the Company’s Consolidated Balance Sheet. If the

conditions for sale are not met, the transfer is considered to be a secured

borrowing, the assets remain on the Consolidated Balance Sheet, and the

sale proceeds are recognized as the Company’s liability. A legal opinion on a

sale is generally obtained for complex transactions or where the Company

has continuing involvement with assets transferred or with the securitization

entity. For a transfer to be eligible for sale accounting, those opinions must

state that the asset transfer is considered a sale and that the assets transferred

would not be consolidated with the Company’s other assets in the event of

the Company’s insolvency.

See Note 23 to the Consolidated Financial Statements on page 175.

Risk Management Activities—Derivatives Used for

Non-Trading Purposes

The Company manages its exposures to market rate movements outside its

trading activities by modifying the asset and liability mix, either directly or

through the use of derivative financial products, including interest rate

swaps, futures, forwards, and purchased option positions, as well as foreign-

exchange contracts. These end-user derivatives are carried at fair value in

Other assets or Other liabilities.

To qualify as a hedge, a derivative must be highly effective in offsetting

the risk designated as being hedged. The hedge relationship must be

formally documented at inception, detailing the particular risk management

objective and strategy for the hedge, which includes the item and risk that is

being hedged and the derivative that is being used, as well as how

effectiveness will be assessed and ineffectiveness measured. The effectiveness

of these hedging relationships is evaluated on a retrospective and prospective

basis, typically using quantitative measures of correlation with hedge

ineffectiveness measured and recorded in current earnings. If a hedge

relationship is found to be ineffective, it no longer qualifies as a hedge and

126