Citibank 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

employees. As explained below, pursuant to SFAS 123(R), the charge to

income for awards made to retirement-eligible employees is accelerated

based on the dates the retirement rules are met.

CAP and certain other awards provide that participants who meet certain

age and years of service conditions may continue to vest in all or a portion of

the award without remaining employed by the Company during the entire

vesting period, so long as they do not compete with Citigroup during that

time. Beginning in 2006, awards to these retirement-eligible employees are

recognized in the year prior to the grant in the same manner as cash

incentive compensation is accrued. However, awards granted in January

2006 were required to be expensed in their entirety at the date of grant. Prior

to 2006, all awards were recognized ratably over the stated vesting period. See

Note 1 to the Consolidated Financial Statements on page 122 for the impact

of adopting SFAS 123(R).

From 2003 to 2007, Citigroup granted restricted or deferred shares

annually under the Citigroup Ownership Program (COP) to eligible

employees. This program replaced the WealthBuilder, CitiBuilder and

Citigroup Ownership stock option programs. Under COP, eligible employees

received either restricted or deferred shares of Citigroup common stock that

vest after three years. The last award under this program was in 2007.

Unearned compensation expense associated with the stock grants represents

the market value of Citigroup common stock at the date of grant and is

recognized as a charge to income ratably over the vesting period, except for

those awards granted to retirement-eligible employees. The charge to income

for awards made to retirement-eligible employees is accelerated based on the

dates the retirement rules are met.

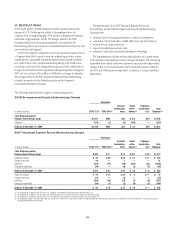

On July 17, 2007, the Personnel and Compensation Committee of

Citigroup’s Board of Directors approved the Management Committee Long-

Term Incentive Plan (MC LTIP), under the terms of the shareholder-

approved 1999 Stock Incentive Plan. The MC LTIP provides members of the

Citigroup Management Committee, including the CEO, CFO and the named

executive officers in the Citigroup Proxy Statement, an opportunity to earn

stock awards based on Citigroup’s performance. Each participant received an

equity award that will be earned based on Citigroup’s performance for the

period from July 1, 2007 to December 31, 2009. Three periods will be

measured for performance (July 1, 2007 to December 31, 2007, full year

2008 and full year 2009). The ultimate value of the award will be based on

Citigroup’s performance in each of these periods with respect to (1) total

shareholder return versus Citigroup’s current key competitors and

(2) publicly stated return on equity (ROE) targets measured at the end of

each calendar year. If, in any of the three performance periods, Citigroup’s

total shareholder return does not exceed the median performance of the peer

group, the participants will not receive award shares for that period. The

awards will generally vest after 30 months. In order to receive the shares, a

participant generally must be a Citigroup employee on January 5, 2010. The

final expense for each of the three calendar years will be adjusted based on

the results of the ROE tests. No awards were earned for 2008 or 2007 because

performance targets were not met. No new awards were made under the MC

LTIP since the initial award in July 2007.

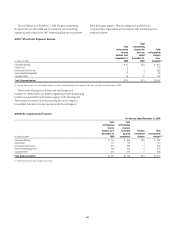

On January 22, 2008, special retention stock awards were made to key

senior executive officers and certain other members of senior management.

The awards vest ratably over two- or four-year periods. Executives must

remain employed through the vesting dates to receive the shares awarded,

except in cases of death, disability, or involuntary termination other than for

gross misconduct. Unlike CAP, post-employment vesting is not provided for

participants who meet specified age and years of service conditions. Shares

subject to some of the awards are exempted from the stock ownership

commitment.

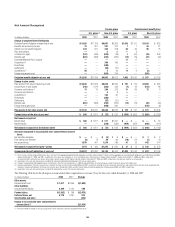

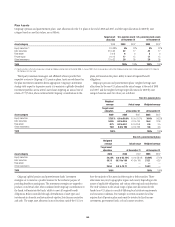

A summary of the status of Citigroup’s unvested stock awards as of

December 31, 2008, and changes during the 12 months ended December 31,

2008, is presented below:

Unvested stock awards Shares

Weighted average

grant date

fair value

Unvested at January 1, 2008 153,207,132 $50.70

Awards 149,140,314 $26.04

Cancellations (20,945,018) $42.92

Deletions (1,968,824) $25.94

Vestings (1) (53,222,745) $47.06

Unvested at December 31, 2008 226,210,859 $36.23

(1) The weighted average market value of the vestings during 2008 was approximately $22.31 per share.

As of December 31, 2008, there was $3.3 billion of total unrecognized

compensation cost related to unvested stock awards net of the forfeiture

provision. That cost is expected to be recognized over a weighted-average

period of 2.6 years.

141