Citibank 2008 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

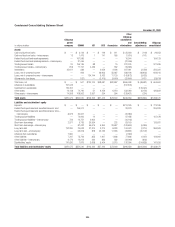

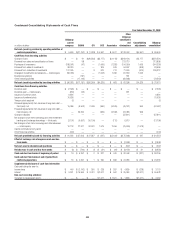

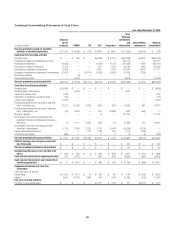

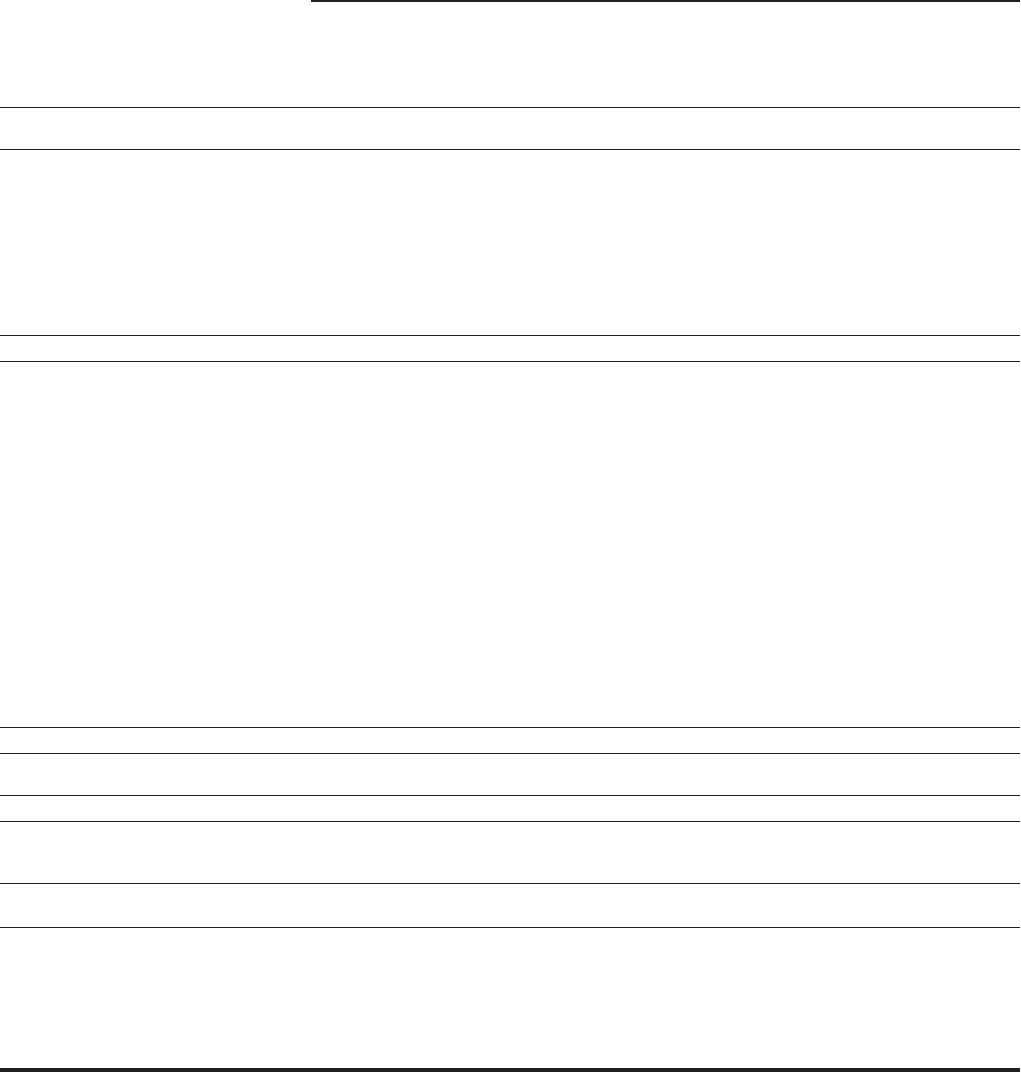

Condensed Consolidating Statements of Cash Flows

Year ended December 31, 2006

In millions of dollars

Citigroup

parent

company CGMHI CFI CCC Associates

Other

Citigroup

subsidiaries

and

eliminations

Consolidating

adjustments

Citigroup

consolidated

Net cash provided by (used in) operating

activities of continuing operations $ 17,391 $ (6,938) $ (142) $ 3,646 $ 3,849 $ (14,325) $(3,646) $ (165)

Cash flows from investing activities

Change in loans $ — $ 188 $ — $(5,805) $ (6,011) $(350,239) $ 5,805 $(356,062)

Proceeds from sales and securitizations of loans — — — — — 253,176 — 253,176

Purchases of investments (15,998) — — (4,239) (6,103) (274,023) 4,239 (296,124)

Proceeds from sales of investments 4,700 — — 957 1,703 80,596 (957) 86,999

Proceeds from maturities of investments 10,623 — — 3,451 4,797 105,691 (3,451) 121,111

Changes in investments and advances—intercompany (21,542) — (36,114) (2,058) (2,653) 60,309 2,058 —

Business acquisitions — (9) — — — 9 — —

Other investing activities — (4,427) — — — (8,879) — (13,306)

Net cash provided by investing activities $(22,217) $ (4,248) $(36,114) $(7,694) $ (8,267) $(133,360) $ 7,694 $(204,206)

Cash flows from financing activities

Dividends paid $ (9,826) $ — $ — $ — $ — $ — $ — $ (9,826)

Dividends paid—intercompany — (4,644) — — — 4,644 — —

Issuance of common stock 1,798 — — — — — — 1,798

Redemption or retirement of preferred stock (125) — — — — — — (125)

Treasury stock acquired (7,000) — — — — — — (7,000)

Proceeds/(repayments) from issuance of long-term

debt—third-party, net 22,202 (11,353) 14,522 (881) (810) 42,658 881 67,219

Proceeds/(repayments) from issuance of long-term

debt—intercompany, net (52) 6,382 — 961 (10,862) 4,532 (961) —

Change in deposits — — — (1) — 121,203 1 121,203

Net change in short-term borrowings and other

investment banking and brokerage borrowings—

third-party (2) 3,711 8,334 (320) 34 21,826 320 33,903

Net change in short-term borrowings and other

advances—intercompany (1,710) 17,598 12,224 3,750 15,446 (43,558) (3,750) —

Capital contributions from parent — — 1,175 238 235 (1,410) (238) —

Other financing activities (685) — — 2 2 (2) (2) (685)

Net cash provided by financing activities $ 4,600 $ 11,694 $ 36,255 $ 3,749 $ 4,045 $ 149,893 $(3,749) $ 206,487

Effect of exchange rate changes on cash and

due from banks $—$—$—$— $— $645 $— $645

Net cash provided by discontinued operations $—$—$—$— $— $121 $— $121

Net (decrease)/increase in cash and due from

banks $ (226) $ 508 $ (1) $ (299) $ (373) $ 2,974 $ 299 $ 2,882

Cash and due from banks at beginning of period 247 3,913 1 687 876 18,595 (687) 23,632

Cash and due from banks at end of period from

continuing operations $ 21 $ 4,421 $ — $ 388 $ 503 $ 21,569 $ (388) $ 26,514

Supplemental disclosure of cash flow

information

Cash paid during the year for:

Income taxes $ (1,021) $ 2,372 $ 49 $ 593 $ 86 $ 7,744 $ (593) $ 9,230

Interest 5,492 20,720 2,893 156 483 21,884 (156) 51,472

Non-cash investing activities:

Transfers to repossessed assets $ — $ — $ — $ 1,077 $ 1,103 $ 311 $(1,077) $ 1,414

224