Citibank 2008 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

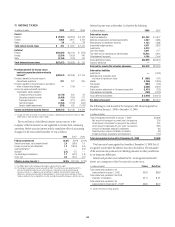

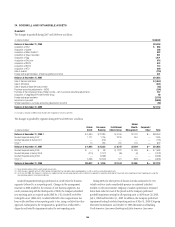

13. FEDERAL FUNDS, SECURITIES BORROWED,

LOANED, AND SUBJECT TO REPURCHASE

AGREEMENTS

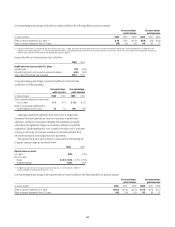

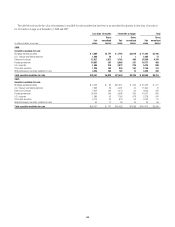

Federal funds sold and securities borrowed or purchased under agreements

to resell, at their respective fair values, consisted of the following at

December 31:

In millions of dollars at year end 2008 2007

Federal funds sold $—$ 196

Securities purchased under agreements to resell 78,701 98,258

Deposits paid for securities borrowed 105,432 175,612

Total $184,133 $274,066

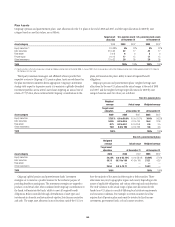

Federal funds purchased and securities loaned or sold under agreements

to repurchase, at their respective fair values, consisted of the following at

December 31:

In millions of dollars at year end 2008 2007

Federal funds purchased $ 5,755 $ 6,279

Securities sold under agreements to repurchase 177,585 230,880

Deposits received for securities loaned 21,953 67,084

Total $205,293 $304,243

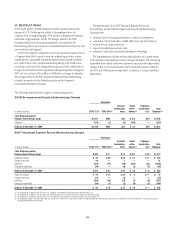

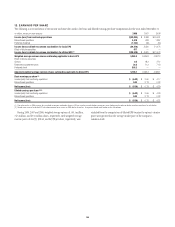

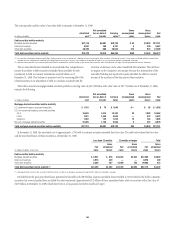

The resale and repurchase agreements represent collateralized financing

transactions used to generate net interest income and facilitate trading

activity. These instruments are collateralized principally by government and

government agency securities and generally have terms ranging from

overnight to up to a year.

It is the Company’s policy to take possession of the underlying collateral,

monitor its market value relative to the amounts due under the agreements

and, when necessary, require prompt transfer of additional collateral or

reduction in the balance in order to maintain contractual margin

protection. In the event of counterparty default, the financing agreement

provides the Company with the right to liquidate the collateral held. As

disclosed in Note 27 on page 202, effective January 1, 2007, the Company

elected fair value option accounting in accordance with SFAS 159 for the

majority of the resale and repurchase agreements. The remaining portion is

carried at the amount of cash initially advanced or received, plus accrued

interest, as specified in the respective agreements. Resale agreements and

repurchase agreements are reported net by counterparty, when applicable,

pursuant to FIN 41. Excluding the impact of FIN 41, resale agreements

totaled $114.0 billion and $151.0 billion at December 31, 2008 and 2007,

respectively.

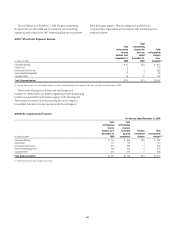

A majority of the deposits paid for securities borrowed and deposits

received for securities loaned are recorded at the amount of cash advanced or

received and are collateralized principally by government and government

agency securities and corporate debt and equity securities. The remaining

portion is recorded at fair value as the Company elected fair value option for

certain securities borrowed and loaned portfolios in accordance with SFAS

159. This election was made effective in the second quarter of 2007.

Securities borrowed transactions require the Company to deposit cash with

the lender. With respect to securities loaned, the Company receives cash

collateral in an amount generally in excess of the market value of securities

loaned. The Company monitors the market value of securities borrowed and

securities loaned daily, and additional collateral is obtained as necessary.

Securities borrowed and securities loaned are reported net by counterparty,

when applicable, pursuant to FIN 39.

156