Citibank 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIGROUP’S 2008 ANNUAL REPORT ON FORM 10-K

THE COMPANY 2

Citigroup Segments 3

Citigroup Regions 3

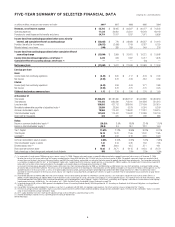

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL

DATA 4

MANAGEMENT’S DISCUSSION AND ANALYSIS 6

2008 in Summary 6

Outlook for 2009 7

Events in 2008 9

Events in 2007 15

SIGNIFICANT ACCOUNTING POLICIES AND

SIGNIFICANT ESTIMATES 18

SEGMENT AND REGIONAL—NET INCOME (LOSS) AND

REVENUES 25

Citigroup Net Income (Loss)—Segment View 25

Citigroup Net Income (Loss)—Regional View 26

Citigroup Revenues—Segment View 27

Citigroup Revenues—Regional View 28

GLOBAL CARDS 29

Global Cards Outlook 30

CONSUMER BANKING 31

Consumer Banking Outlook 33

INSTITUTIONAL CLIENTS GROUP (ICG) 34

Institutional Clients Group Outlook 35

GLOBAL WEALTH MANAGEMENT 36

Global Wealth Management Outlook 37

CORPORATE/OTHER 38

REGIONAL DISCUSSIONS 39

North America 39

EMEA 40

Latin America 41

Asia 42

TARP AND OTHER REGULATORY PROGRAMS 44

RISK FACTORS 47

MANAGING GLOBAL RISK 51

Risk Management 51

Risk Aggregation and Stress Testing 51

Risk Capital 52

Credit Risk Management Process 52

Loans Outstanding 53

Details of Credit Loss Experience 54

Non-Performing Assets 55

Renegotiated Loans 56

Foregone Interest Revenue on Loans 56

Loan Maturities and Fixed/Variable Pricing 57

Consumer Credit Risk 57

Consumer Portfolio Review 57

Corporate Credit Risk 65

Global Corporate Portfolio Review 67

Exposure to U.S. Real Estate in Securities and Banking 68

Market Risk Management Process 72

Operational Risk Management Process 76

Country and FFIEC Cross-Border Risk Management Process 77

BALANCE SHEET REVIEW 78

Segment Balance Sheet at December 31, 2008 81

Average Balances and Interest Rates—Assets 83

Average Balances and Interest Rates—Liabilities and Equity, and

Net Interest Revenue 84

Analysis of Changes in Interest Revenue 85

Analysis of Changes in Interest Expense and Net Interest Revenue 86

Reclassification of Financial Assets 87

DERIVATIVES 90

CAPITAL RESOURCES AND LIQUIDITY 94

Capital Resources 94

Funding 98

Liquidity 102

Off-Balance-Sheet Arrangements 104

Pension and Postretirement Plans 106

FAIR VALUATION 107

CORPORATE GOVERNANCE AND CONTROLS AND

PROCEDURES 108

FORWARD-LOOKING STATEMENTS 108

GLOSSARY OF TERMS 109

MANAGEMENT’S REPORT ON INTERNAL CONTROL

OVER FINANCIAL REPORTING 112

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM—INTERNAL CONTROL OVER

FINANCIAL REPORTING 113

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM—CONSOLIDATED FINANCIAL

STATEMENTS 114

FINANCIAL STATEMENTS AND NOTES TABLE OF

CONTENTS 115

CONSOLIDATED FINANCIAL STATEMENTS 116

NOTES TO CONSOLIDATED FINANCIAL

STATEMENTS 122

FINANCIAL DATA SUPPLEMENT (Unaudited) 226

Ratios 226

Average Deposit Liabilities in Offices Outside the U.S. 226

Maturity Profile of Time Deposits ($100,000 or more) in U.S. Offices 226

Short-Term and Other Borrowings 226

LEGAL AND REGULATORY REQUIREMENTS 227

Securities Regulation 228

Capital Requirements 228

General Business Factors 229

Properties 229

Legal Proceedings 229

Unregistered Sales of Equity Securities and Use of Proceeds 236

10-K CROSS-REFERENCE INDEX 239

CORPORATE INFORMATION 240

Exhibits and Financial Statement Schedules 240

CITIGROUP BOARD OF DIRECTORS 242

1