Citibank 2008 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

instruments. Any cash raised from investors is invested in a portfolio of

collateral securities or investment contracts. The collateral is then used to

support the CDO’s obligations on the credit default swaps written to

counterparties. The Company’s continuing involvement in synthetic CDOs

generally includes purchasing credit protection through credit default swaps

with the CDO, owning a portion of the capital structure of the CDO, in the

form of both unfunded derivative positions (primarily super senior exposures

discussed below) and funded notes, entering into interest-rate swap and

total-return swap transactions with the CDO, lending to the CDO, and

making a market in those funded notes.

A collateralized loan obligation (CLO) is substantially similar to the CDO

transactions described above, except that the assets owned by the SPE (either

cash instruments or synthetic exposures through derivative instruments) are

corporate loans and to a lesser extent corporate bonds, rather than asset-

backed debt securities.

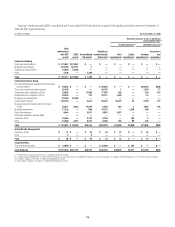

Consolidation

The Company has retained significant portions of the “super senior”

positions issued by certain CDOs. These positions are referred to as “super

senior” because they represent the most senior positions in the CDO and, at

the time of structuring, were senior to tranches rated AAA by independent

rating agencies. These positions include facilities structured in the form of

short-term commercial paper, where the Company wrote put options

(“liquidity puts”) to certain CDOs. Under the terms of the liquidity puts, if

the CDO was unable to issue commercial paper at a rate below a specified

maximum (generally LIBOR + 35bps to LIBOR + 40 bps), the Company was

obligated to fund the senior tranche of the CDO at a specified interest rate. As

of December 31, 2008, the Company had purchased all $25 billion of the

commercial paper subject to the liquidity puts.

Since inception of many CDO transactions, the subordinate tranches of

the CDOs have diminished significantly in value and in rating. The declines

in value of the subordinate tranches and in the super senior tranches

indicate that the super senior tranches are now exposed to a significant

portion of the expected losses of the CDOs, based on current market

assumptions. The Company evaluates these transactions for consolidation

when reconsideration events occur, as defined in FIN 46(R).

Upon a reconsideration event, the Company is at risk for consolidation

only if the Company owns a majority of either a single tranche or a group of

tranches that absorb the remaining risk of the CDO. Due to reconsideration

events during 2007 and 2008, the Company has consolidated 34 of the 46

CDOs/CLOs in which the Company holds a majority of the senior interests of

the transaction.

The Company continues to monitor its involvement in unconsolidated

VIEs and if the Company were to acquire additional interests in these vehicles

or if the CDOs’ contractual arrangements were to be changed to reallocate

expected losses or residual returns among the various interest holders, the

Company may be required to consolidate the CDOs. For cash CDOs, the net

result of such consolidation would be to gross up the Company’s balance

sheet by the current fair value of the subordinate securities held by third

parties, which amounts are not considered material. For synthetic CDOs, the

net result of such consolidation may reduce the Company’s balance sheet by

eliminating intercompany derivative receivables and payables in

consolidation.

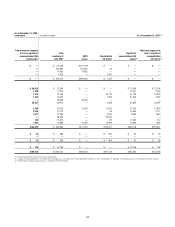

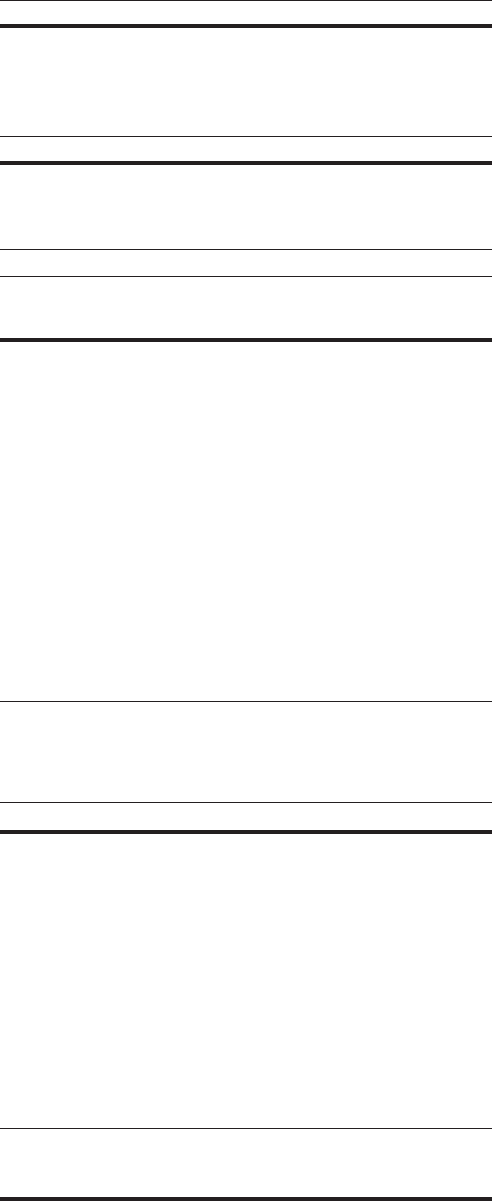

Cash Flows and Retained Interests

The following tables summarize selected cash flow information related to

CDO and CLO securitizations for the year 2008:

In billions of dollars CDOs CLOs

Cash flows received on retained interests 0.1 —

The key assumptions, used for the securitization of CDOs and CLOs during

2008 in measuring the fair value of retained interests at the date of sale or

securitization, are as follows:

CDOs CLOs

Discount rate 28.5% to 31.2% 4.7% to 5.2%

The effect of two negative changes in discount rates used to determine the

fair value of retained interests is disclosed below.

In millions of dollars CDOs CLOs

Carrying value of retained interests $928 $763

Discount rates

Adverse change of 10% $(21) $ (11)

Adverse change of 20% (41) (23)

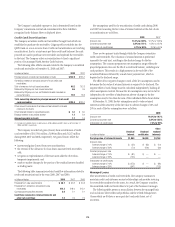

Asset-Based Financing

The Company provides loans and other forms of financing to VIEs that hold

assets. Those loans are subject to the same credit approvals as all other loans

originated or purchased by the Company and related loan loss reserves are

reported as part of the Company’s Allowance for credit losses in Note 18 on

page 165. Financings in the form of debt securities or derivatives are, in most

circumstances, reported in Trading account assets and accounted for at fair

value through earnings.

The primary types of asset-based financing, total assets of the

unconsolidated VIEs with significant involvement and the Company’s

maximum exposure to loss at December 31, 2008 are shown below. For the

Company to realize that maximum loss, the VIE (borrower) would have to

default with no recovery from the assets held by the VIE.

In billions of dollars

Type

Total

assets

Maximum

exposure

Commercial and other real estate $46.9 $ 9.3

Hedge funds and equities 28.2 7.1

Corporate loans 9.5 8.1

Asset purchasing vehicles/SIVs 2.4 0.5

Airplanes, ships and other assets 11.3 3.2

Total $98.3 $28.2

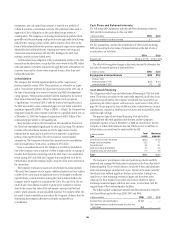

The Company’s involvement in the asset purchasing vehicles and SIVs

sponsored and managed by third parties is primarily in the form of provided

backstop liquidity. Those vehicles finance a majority of their asset purchases

with commercial paper and short-term notes. Certain of the assets owned by

the vehicles have suffered significant declines in fair value, leading to an

inability to re-issue maturing commercial paper and short-term notes.

Citigroup has been required to provide loans to those vehicles to replace

maturing commercial paper and short-term notes, in accordance with the

original terms of the backstop liquidity facilities.

The following table summarizes selected cash flow information related to

asset-based financing for the years 2008, 2007 and 2006:

In billions of dollars 2008 2007 2006

Proceeds from new securitizations $ 1.7 ——

Cash flows received on retained interests and other net

cash flows 0.4 ——

185