Citibank 2008 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

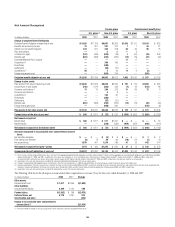

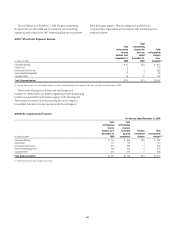

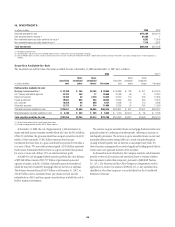

11. INCOME TAXES

In millions of dollars 2008 2007 2006

Current

Federal $ (4,582) $(2,260) $ 3,703

Foreign 4,968 3,615 3,766

State 29 75 178

Total current income taxes $ 415 $ 1,430 $ 7,647

Deferred

Federal $(16,585) $(2,113) $ (552)

Foreign (2,284) (1,039) 490

State (2,158) (776) 164

Total deferred income taxes $(21,027) $(3,928) $ 102

Provision (benefit) for income tax on

continuing operations before minority

interest (1) $(20,612) $(2,498) $ 7,749

Provision (benefit) for income taxes on

discontinued operations 207 297 306

Provision (benefit) for income taxes on cumulative

effect of accounting changes —(109) —

Income tax expense (benefit) reported in

stockholders’ equity related to:

Foreign currency translation (2,116) 565 52

Securities available-for-sale (5,468) (759) 271

Employee stock plans 449 (410) (607)

Cash flow hedges (1,354) (1,705) (406)

Pension liability adjustments (918) 426 (1,033)

Income taxes before minority interest $(29,812) $(4,193) $ 6,332

(1) Includes the effect of securities transactions resulting in a (benefit) provision of $(721) million in 2008,

$409 million in 2007 and $627 million in 2006.

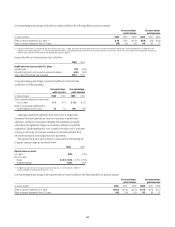

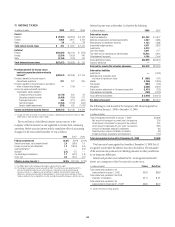

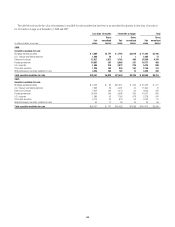

The reconciliation of the federal statutory income tax rate to the

Company’s effective income tax rate applicable to income from continuing

operations (before minority interest and the cumulative effect of accounting

changes) for the years ended December 31 was as follows:

2008 2007 2006

Federal statutory rate 35.0% 35.0% 35.0%

State income taxes, net of federal benefit 2.6 (58.6) 1.6

Foreign income tax rate differential 1.2 (180.8) (4.3)

Audit settlements (1) —— (2.9)

Goodwill (2.2) 0.5 —

Tax advantaged investments 1.7 (84.0) (1.8)

Other, net 0.6 (34.0) (0.4)

Effective income tax rate (2) 38.9% (321.9)% 27.2%

(1) For 2006, relates to the resolution of the Federal and New York tax audits.

(2) The Company recorded an income tax benefit for 2007. The effective tax rate (benefit) of (322)%

primarily resulted from pretax losses in the Company’s ICG and N.A. and Consumer Banking

businesses (the U.S. is a higher tax rate jurisdiction). In addition, the tax benefits of permanent

differences, including the tax benefit for not providing U.S. income taxes on the earnings of certain

foreign subsidiaries that are indefinitely invested, favorably impacted the Company’s effective tax rate.

Deferred income taxes at December 31 related to the following:

In millions of dollars 2008 2007

Deferred tax assets

Credit loss deduction $11,242 $ 5,977

Deferred compensation and employee benefits 4,367 2,686

Restructuring and settlement reserves 1,134 2,388

Unremitted foreign earnings 4,371 2,833

Investments 5,312 —

Cash flow hedges 3,071 1,717

Tax credit and net operating loss carryforwards 18,424 4,644

Other deferred tax assets 4,158 2,404

Gross deferred tax assets $52,079 $22,649

Valuation allowance ——

Deferred tax assets after valuation allowance $52,079 $22,649

Deferred tax liabilities

Investments —(1,023)

Deferred policy acquisition costs

and value of insurance in force $ (805) (761)

Leases (1,255) (1,865)

Fixed assets (954) (765)

Intangibles (2,365) (2,361)

Credit valuation adjustment on Company-issued debt (1,473) (222)

Other deferred tax liabilities (758) (2,075)

Gross deferred tax liabilities $ (7,610) $ (9,072)

Net deferred tax asset $44,469 $13,577

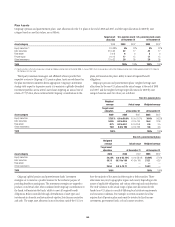

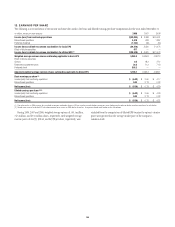

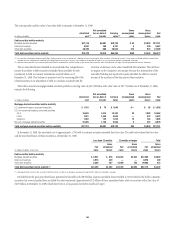

The following is a roll-forward of the Company’s FIN 48 unrecognized tax

benefits from January 1, 2008 to December 31, 2008.

In millions of dollars

Total unrecognized tax benefits at January 1, 2008 $3,698

Net amount of increases for current year’s tax positions 254

Gross amount of increases for prior years’ tax positions 252

Gross amount of decreases for prior years’ tax positions (581)

Amounts of decreases relating to settlements (21)

Reductions due to lapse of statutes of limitation (30)

Foreign exchange, acquisitions and dispositions (104)

Total unrecognized tax benefits at December 31, 2008 $3,468

Total amount of unrecognized tax benefits at December 31, 2008 that, if

recognized, would affect the effective tax rate is $2.4 billion. The remainder

of the uncertain tax positions have offsetting amounts in other jurisdictions

or are temporary differences.

Interest and penalties (not included in the “unrecognized tax benefits”

above) are a component of the Provision for income taxes.

In millions of dollars Pretax Net of tax

Total interest and penalties in the

balance sheet at January 1, 2008 $618 $389

Total interest and penalties in the 2008

statement of operations $114 $ 81

Total interest and penalties in the

balance sheet at December 31, 2008(1) $663 $420

(1) Includes $9 million for foreign penalties.

152