Citibank 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RECLASSIFICATION OF FINANCIAL ASSETS

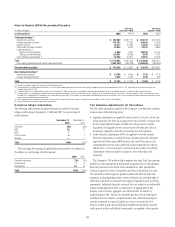

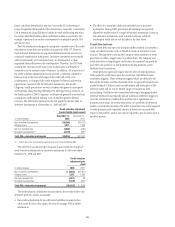

The Company reviewed portfolios of debt securities and loans throughout the

fourth quarter of 2008 and identified positions where there has been a

change of intent to hold the debt securities or loans for periods of time much

longer than those originally anticipated. The Company believes that the

expected cash flows to be generated from holding the assets significantly

exceed their current fair value which has been significantly adversely

impacted by the reduced liquidity in the global financial markets. As such,

the Company anticipates returns on these assets will be optimized by holding

them for extended periods or until maturity, rather than through an exit

strategy in the short term. During the fourth quarter of 2008, the Company

reclassified certain debt securities and loans into accounting categories with

measurement based on amortized cost to align the accounting treatment

with the revised asset holding periods.

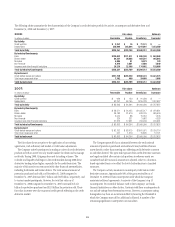

Debt Securities Reclassified to Available for Sale and

Held to Maturity

FASB Statement No. 115, Accounting for Certain Investments in Debt and

Equity Securities (SFAS 115), requires that, at acquisition, an enterprise

classify debt securities into one of three categories: trading, available for sale

(AFS) or held to maturity (HTM). Trading securities are carried at fair value

on the balance sheet with unrealized holding gains and losses recognized in

earnings currently. AFS securities are carried at fair value on the balance

sheet, and unrealized holding gains and losses are excluded from earnings

and recognized as a separate component of equity in Accumulated other

comprehensive income (AOCI). HTM debt securities are measured at

amortized cost. Both AFS and HTM are subject to review for other-than-

temporary impairment (see discussion on page 129).

SFAS 115 states that transfers of securities out of the trading category are

expected to be rare. During the fourth quarter of 2008, Citigroup made a

number of transfers out of the trading category in order to better reflect the

revised intentions of the Company in response to the significant deterioration

in market conditions, which was especially acute during the fourth quarter.

These market conditions were not foreseen at the initial purchase date of the

securities. Most of the debt securities previously classified as trading were

bought and held principally for the purpose of selling them in the short

term, many in the context of Citigroup’s acting as a market maker. At the

date of acquisition, most of these positions were liquid and the Company

expected active and frequent buying and selling with the objective of

generating profits on short-term differences in price. However, subsequent

declines in value of these securities are primarily related to the ongoing

widening of market credit spreads reflecting increased risk and liquidity

premiums that buyers are currently demanding. As market liquidity has

decreased, the primary buyers for these securities have typically demanded a

return on investment that is significantly higher than previously

experienced.

Despite depressed market prices, the Company determined through credit

analysis that the cash recovery levels of these securities is expected to be

significantly higher than current market prices might indicate.

87