Citibank 2008 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

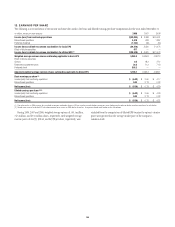

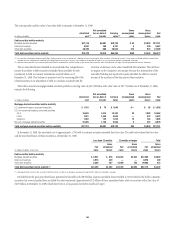

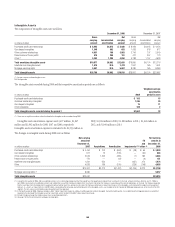

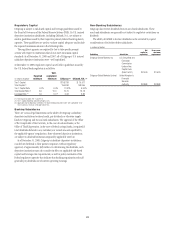

The following table presents information about impaired loans:

In millions of dollars at year end 2008 2007 2006

Impaired corporate loans $ 9,536 $1,735 $458

Impaired consumer loans (1) 9,011 241 360

Total impaired loans (2) $18,547 $1,976 $818

Impaired corporate loans with valuation allowances (3) $ 9,531 $1,724 $439

Impaired consumer loans with valuation allowances 8,573 ——

Impaired corporate valuation allowance (3) $ 2,698 $ 388 $122

Impaired consumer valuation allowance 2,373 ——

Total valuation allowances (3)(4) $ 5,071 $ 388 $122

During the year

Average balance of impaired corporate loans (3) $ 4,163 $1,050 $767

Average balance of impaired consumer loans 5,266 ——

Interest income recognized on

Impaired corporate loans $49$ 101 $ 63

Impaired consumer loans $ 276 ——

(1) Prior to 2008, the Company’s financial accounting systems did not separately track impaired smaller-

balance, homogeneous Consumer loans whose terms were modified due to the borrowers’ financial

difficulties and it was determined that a concession was granted to the borrower. During 2008, such

modified impaired Consumer loans amounted to $8.151 billion. However, information derived from the

Company’s risk management systems indicates that such modifications were approximately $12.3

billion, $7.0 billion and $4.7 billion at December 31, 2008, 2007 and 2006, respectively.

(2) Excludes loans purchased for investment purposes.

(3) Includes amounts related to Consumer loans not separately tracked in the Company financial

accounting systems prior to 2008.

(4) Included in the Allowance for loan losses.

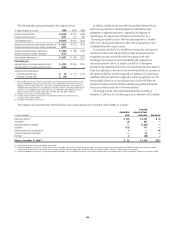

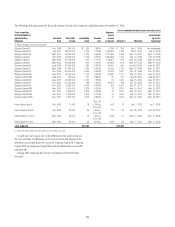

In addition, included in the loan table are purchased distressed loans,

which are loans that have evidenced significant credit deterioration

subsequent to origination but prior to acquisition by Citigroup. In

conforming to the requirements of Statement of Position No. 03-3,

“Accounting for Certain Loans or Debt Securities Acquired in a Transfer”

(SOP 03-3), which became effective in 2005, these purchased loans were

reclassified from Other assets to Loans.

In accordance with SOP 03-3, the difference between the total expected

cash flows for these loans and the initial recorded investments must be

recognized in income over the life of the loans using a level yield.

Accordingly, these loans have been excluded from the impaired loan

information presented above. In addition, per SOP 03-3, subsequent

decreases to the expected cash flows for a purchased distressed loan require a

build of an allowance so the loan retains its level yield. However, increases in

the expected cash flows are first recognized as a reduction of any previously

established allowance and then recognized as income prospectively over the

remaining life of the loan by increasing the loan’s level yield. Where the

expected cash flows cannot be reliably estimated, the purchased distressed

loan is accounted for under the cost recovery method.

The carrying amount of the purchased distressed loan portfolio at

December 31, 2008 was $1,510 million gross of an allowance of $122 million.

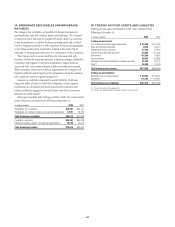

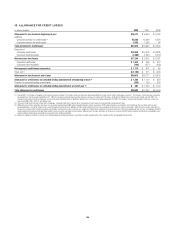

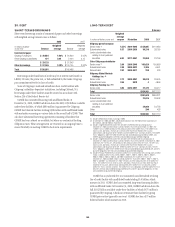

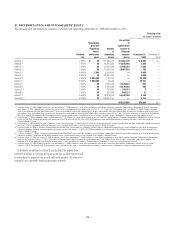

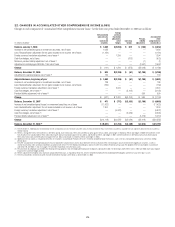

The changes in the accretable yield, related allowance and carrying amount net of accretable yield for 2008 are as follows:

In millions of dollars

Accretable

yield

Carrying

amount of loan

receivable Allowance

Beginning balance (1) $ 219 $ 2,373 $ 76

Purchases (2) 38 407 —

Disposals/payments received — (1,457) —

Accretion (171) 171 —

Builds (reductions) to the allowance 4—46

Increase to expected cash flows —42—

FX/Other 2 (26) —

Balance, December 31, 2008 (3) $ 92 $ 1,510 $122

(1) Reclassified to conform to the current period’s presentation.

(2) The balance reported in the column “Carrying amount of loan receivable” consists of $114 million of purchased loans accounted for under the level-yield method and $293 million under the cost recovery method.

These balances represent the fair value of these loans at their acquisition date. The related total expected cash flows for the level-yield loans were $151 million at their acquisition dates.

(3) The balance reported in the column “Carrying amount of loan receivable” consists of $995 million of loans accounted for under the level-yield method and $515 million accounted for under the cost recovery method.

164