Citibank 2008 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

recorded in the cumulative translation adjustment account and the

ineffective portion, if any, is immediately recorded in earnings.

For derivatives used in net investment hedges, Citigroup follows the

forward-rate method from FASB Derivative Implementation Group Issue H8.

According to that method, all changes in fair value, including changes

related to the forward-rate component of the foreign-currency forward

contracts and the time-value of foreign-currency options, are recorded in the

cumulative translation adjustment account. For foreign-currency-

denominated debt instruments that are designated as hedges of net

investments, the translation gain or loss that is recorded in the cumulative

translation adjustment account is based on the spot exchange rate between

the functional currency of the respective subsidiary and the U.S. dollar,

which is the functional currency of Citigroup. To the extent the notional

amount of the hedging instrument exactly matches the hedged net

investment and the underlying exchange rate of the derivative hedging

instrument relates to the exchange rate between the functional currency of

the net investment and Citigroup’s functional currency (or, in the case of the

non-derivative debt instrument, such instrument is denominated in the

functional currency of the net investment), no ineffectiveness is recorded in

earnings.

Hedge effectiveness

Key aspects of achieving SFAS 133 hedge accounting are documentation of

hedging strategy and hedge effectiveness at the hedge inception and

substantiating hedge effectiveness on an ongoing basis. A derivative must be

highly effective in accomplishing the hedge objective of offsetting either

changes in the fair value or cash flows of the hedged item for the risk being

hedged. Any ineffectiveness in the hedge relationship is recognized in current

earnings. The assessment of effectiveness excludes changes in the value of

the hedged item that are unrelated to the risks being hedged. Similarly, the

assessment of effectiveness may exclude changes in the fair value of a

derivative related to time value that, if excluded, are recognized in current

earnings.

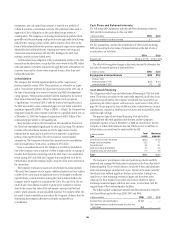

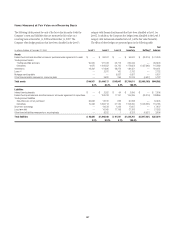

The following table summarizes certain information related to the

Company’s hedging activities for the years ended December 31, 2008, 2007

and 2006:

In millions of dollars 2008 2007 2006

Fair value hedges

Hedge ineffectiveness recognized in earnings $ (559) $ 91 $ 245

Net gain excluded from assessment of

effectiveness 178 420 302

Cash flow hedges

Hedge ineffectiveness recognized in earnings (27) — (18)

Net gain (loss) excluded from assessment of

effectiveness (17) ——

Net investment hedges

Net gain (loss) included in foreign currency

translation adjustment in accumulated other

comprehensive income $2,811 $(1,051) $(569)

For cash flow hedges, any changes in the fair value of the end-user

derivative remaining in Accumulated other comprehensive income (loss)

on the Consolidated Balance Sheet will be included in earnings of future

periods to offset the variability of the hedged cash flows when such cash flows

affect earnings. The net loss associated with cash flow hedges expected to be

reclassified from Accumulated other comprehensive income within 12

months of December 31, 2008 is approximately $1.9 billion.

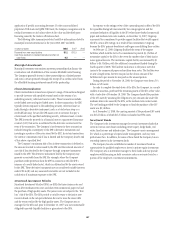

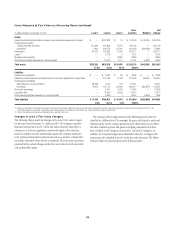

The change in Accumulated other comprehensive income (loss) from

cash flow hedges for the years ended December 31, 2008, 2007 and 2006 can

be summarized as follows (after-tax):

In millions of dollars 2008 2007 2006

Beginning balance $(3,163) $ (61) $ 612

Net gain (loss) from cash flow hedges (2,738) (2,932) (29)

Net amounts reclassified to earnings 712 (170) (644)

Ending balance $(5,189) $(3,163) $ (61)

191