Citibank 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

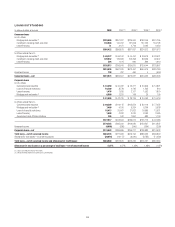

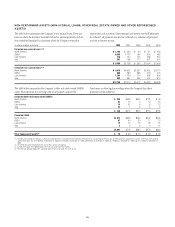

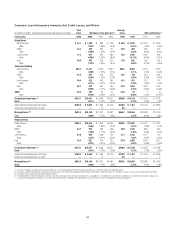

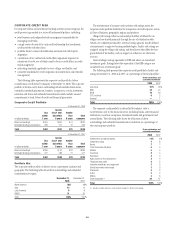

Consumer Loan Balances, Net of Unearned Income

End of period Average

In billions of dollars 2008 2007 2006 2008 2007 2006

On-balance-sheet (1) $515.7 $557.8 $478.2 $548.8 $516.4 $446.2

Securitized receivables (all in NA Cards) 105.9 108.1 99.6 106.9 98.9 96.4

Credit card receivables held-for-sale (2) —1.0 — 0.5 3.0 0.3

Total managed (3) $621.6 $666.9 $577.8 $656.2 $618.3 $542.9

(1) Total loans and total average loans exclude certain interest and fees on credit cards of approximately $3 billion and $2 billion, respectively, for 2008, $3 billion and $2 billion, respectively, for 2007, and $2 billion and

$3 billion, respectively, for 2006, which are included in Consumer loans on the Consolidated Balance Sheet.

(2) Included in Other assets on the Consolidated Balance Sheet.

(3) This table presents loan information on a held basis and shows the impact of securitization to reconcile to a managed basis. Managed-basis reporting is a non-GAAP measure. Held-basis reporting is the related GAAP

measure. See a discussion of managed-basis reporting on page 57.

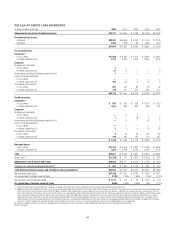

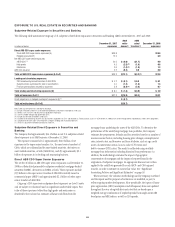

Citigroup’s total allowance for loans, leases and unfunded lending

commitments of $30.503 billion is available to absorb probable credit losses

inherent in the entire portfolio. For analytical purposes only, the portion of

Citigroup’s allowance for loan losses attributed to the Consumer portfolio

was $22.366 billion at December 31, 2008, $12.393 billion at December 31,

2007 and $6.006 billion at December 31, 2006. The increase in the

allowance for loan losses from December 31, 2007 of $9.973 billion

included net builds of $11.034 billion.

The builds consisted of $10.785 billion in Global Cards and Consumer

Banking ($8.216 billion in North America and $2.569 billion in regions

outside North America), and $249 million in Global Wealth Management.

The build of $8.216 billion in North America primarily reflected an

increase in the estimate of losses across all portfolios based on weakening

leading credit indicators, including increased delinquencies on first and

second mortgages, unsecured personal loans, credit cards and auto loans.

The build also reflected trends in the U.S. macroeconomic environment,

including the housing market downturn, rising unemployment and

portfolio growth. The build of $2.569 billion in regions outside North

America primarily reflected portfolio growth the impact of recent

acquisitions, and credit deterioration in Mexico, Brazil, the U.K., Spain,

Greece, India and Colombia.

On-balance-sheet consumer loans of $515.7 billion decreased $42.1

billion, or 8%, from December 31, 2007, primarily driven by a decrease in

residential real estate lending in North America Consumer Banking as well

as the impact of foreign currency translation across Global Cards,

Consumer Banking and GWM.

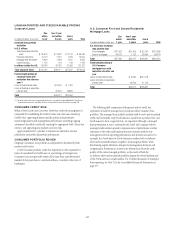

Citigroup Mortgage Foreclosure Moratoriums

On February 13, 2009, Citigroup announced the initiation of a foreclosure

moratorium on all Citigroup-owned first mortgage loans that are the

principal residence of the owner as well as all loans serviced by the

Company where the Company has reached an understanding with the

owner. The moratorium was effective February 12, 2009, and will extend

until the earlier of the U.S. government’s loan modification program

(described below) or March 12, 2009. The Company will not initiate or

complete any new foreclosures on eligible owners during this time.

The above foreclosure moratorium expands on the Company’s current

foreclosure moratorium pursuant to which Citigroup will not initiate or

complete a foreclosure sale on any eligible owner where Citigroup owns the

mortgage and the owner is seeking to stay in the home (which is the

owner’s primary residence), is working in good faith with the Company and

has sufficient income for affordable mortgage payments. Since the start of

the housing crisis in 2007, Citigroup has worked successfully with

approximately 440,000 homeowners to avoid potential foreclosure on

combined mortgages totaling approximately $43 billion.

Proposed U.S. Mortgage Modification Legislation

In January 2009, both the U.S. Senate and House of Representatives

introduced legislation (the Legislation) that would give bankruptcy courts

the authority to modify mortgage loans originated on borrowers’ principal

residences in Chapter 13 bankruptcy. Support for some version of this

Legislation has been endorsed by the Obama Administration. The

modification provisions of the Legislation require that the mortgage loan to

be modified be originated prior to the effective date of the Legislation, and

that the debtor receive a notice of foreclosure and attempt to contact the

mortgage lender/servicer regarding modification of the loan.

It is difficult to project the impact the Legislation may have on the

Company’s consumer secured and unsecured lending portfolio and capital

market positions. Any impact will be dependent on numerous factors,

including the final form of the Legislation, the implementation guidelines

for the Administration’s housing plan, the number of borrowers who file for

bankruptcy after enactment of the Legislation and the response of the

markets and credit rating agencies.

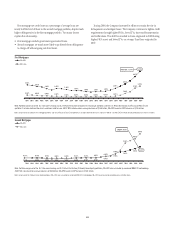

Consumer Credit Outlook

Consumer credit losses in 2009 are expected to increase from prior-year

levels due to the following:

• Continued deterioration in the U.S. housing and labor markets and

higher levels of bankruptcy filings are expected to drive higher losses in

both the secured and unsecured portfolios.

• Negative economic outlook around the globe, most notably in EMEA,

will continue to lead to higher credit costs in Global Cards and

Consumer Banking.

59