Citibank 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

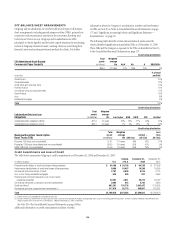

OFF-BALANCE-SHEET ARRANGEMENTS

Citigroup and its subsidiaries are involved with several types of off-balance

sheet arrangements, including special purpose entities (SPEs), primarily in

connection with securitization activities in the Consumer Banking and

Institutional Clients Group. Citigroup and its subsidiaries use SPEs

principally to obtain liquidity and favorable capital treatment by securitizing

certain of Citigroup’s financial assets, assisting clients in securitizing their

financial assets and creating investment products for clients. For further

information about the Company’s securitization activities and involvement

in SPEs, see Note 23 to Notes to Consolidated Financial Statements on page

175 and “Significant Accounting Policies and Significant Estimates—

Securitizations” on page 18.

The following tables describe certain characteristics of assets owned by

certain identified significant unconsolidated VIEs as of December 31, 2008.

These VIEs and the Company’s exposure to the VIEs are described in Note 23

to the Consolidated Financial Statements on page 175.

Credit rating distribution

Citi-Administered Asset-Backed

Commercial Paper Conduits

Total

assets

(in billions)

Weighted

average

life AAA AA A BBB/BBB+

$59.6 4.2 years 41% 45% 10% 4%

Asset class

% of total

portfolio

Student loans 24%

Trade receivables 13%

Credit cards and consumer loans 10%

Portfolio finance 12%

Commercial loans and corporate credit 17%

Export finance 13%

Auto 8%

Residential mortgage 3%

Total 100%

Credit rating distribution

Collateralized Debt and Loan

Obligations

Total

assets

(in billions)

Weighted

average

life A or higher BBB BB/B CCC Unrated

Collateralized debt obligations (CDOs) $17.6 4.5 years 23% 13% 11% 34% 19%

Collateralized loan obligations (CLOs) $20.1 5.9 years 1% 3% 45% 1% 50%

Credit rating distribution

Municipal Securities Tender Option

Bond Trusts (TOB)

Total

assets

(in billions)

Weighted

average

life AAA/Aaa

AA/Aa1 –

AA-/Aa3

Less

than

AA-/Aa3

Customer TOB trusts (not consolidated) $ 8.1 11.4 years 48% 42% 10%

Proprietary TOB trusts (consolidated and non-consolidated) $15.5 19.0 years 50% 41% 9%

QSPE TOB trusts (not consolidated) $ 6.5 9.0 years 62% 29% 9%

Credit Commitments and Lines of Credit

The table below summarizes Citigroup’s credit commitments as of December 31, 2008 and December 31, 2007:

In millions of dollars U.S.

Outside

of U.S.

December 31,

2008

December 31,

2007

Financial standby letters of credit and foreign office guarantees $ 68,100 $ 26,136 $ 94,236 $ 87,066

Performance standby letters of credit and foreign office guarantees 5,809 10,487 16,296 18,055

Commercial and similar letters of credit 2,187 6,028 8,215 9,175

One- to four-family residential mortgages 628 309 937 4,587

Revolving open-end loans secured by one- to four-family

residential properties 22,591 2,621 25,212 35,187

Commercial real estate, construction and land development 2,084 618 2,702 4,834

Credit card lines (1) 867,261 135,176 1,002,437 1,103,535

Commercial and other consumer loan commitments (2) 217,818 92,179 309,997 473,631

Total $1,186,478 $273,554 $1,460,032 $1,736,070

(1) Credit card lines are unconditionally cancelable by the issuer.

(2) Includes commercial commitments to make or purchase loans, to purchase third-party receivables, and to provide note issuance or revolving underwriting facilities. Amounts include $140 billion and $259 billion with

original maturity of less than one year at December 31, 2008 and December 31, 2007, respectively.

See Note 29 to the Consolidated Financial Statements on page 208 for

additional information on credit commitments and lines of credit.

104